Diesel Price Bumps Up 2.4¢ to $4.028 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

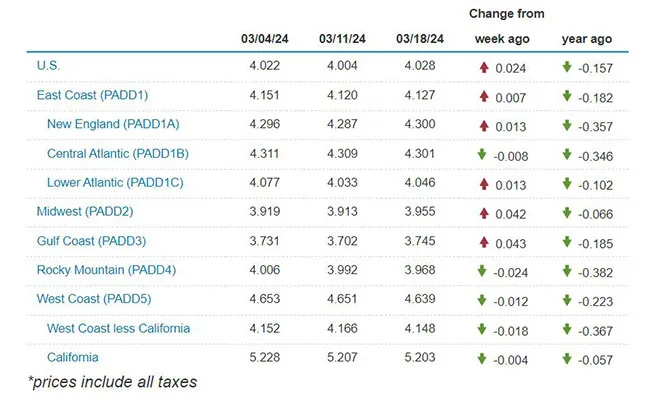

The national average diesel price gained 2.4 cents, the first increase in the past four weeks, to settle at $4.028 a gallon, according to Energy Information Administration data released March 18.

The national average diesel price had dropped 10.5 cents over the past three weeks since remaining unchanged at $4.109 on Feb. 19. A gallon of diesel now costs 15.7 cents less than it did at this time a year ago.

The average price for a gallon of gasoline rose 7.7 cents to $3.453, which is 3.1 cents more than it cost at this time in 2023.

“Diesel prices have stabilized the last few months after a higher and more volatile period of 2022-2023,” Roadrunner CEO Chris Jamroz said. “We’re never sure how they will move going forward, but stability is certainly good for our drivers.”

On-Highway Diesel Fuel Prices

EIA.gov

EIA data shows the average diesel price went up in five of the 10 regions in its weekly survey. The Gulf Coast saw the biggest increase at 4.3 cents to $3.745. The Rocky Mountain area experienced the largest drop at 2.4 cents to $3.968. California has the most expensive diesel prices, but they declined slightly by four-tenths of a cent to f$5.203.

Flynn

“It wasn’t as bullish as the market wanted to see to not worry about what the Fed might do,” said Phil Flynn, senior account executive at The Price Futures Group. “Because of the expectations that exports were going to be up big, we would see a big drop in production. And while we did get a 2 million-barrel drop, people were looking for more. The demand numbers, if you look at the four-week moving average, they’re solid.”

Federal Reserve Chair Jerome Powell on March 20 signaled that he still expects three interest rate cuts this year. Flynn believes the approach taken on interest rates will set the stage on how fuel prices change going forward.

“The concerns about tight supplies of product seemed to ease a bit. That could be reflective in the fact that we’ve got the Whiting Refinery [in Indiana] back online, and it could be reflective of concerns about demand,” Flynn said.

Powell

EIA also found that total products supplied over the past four-week period averaged 20.1 million barrels a day. That’s a 2.2% rise from the same period last year. Its data showed, too, that motor gasoline product supplied averaged 8.8 million barrels a day over the past four weeks.

“It’s one of those things where none of us have control over what goes on relative to fuel pricing,” said Mark Finger, vice president of operations at Transervice Logistics. “Anytime you start to see an upward tick, you start to question is this an indicator of an ongoing rise in fuel. And if it is, it is. We operate equipment, and to do so, we need fuel.”

U.S. average retail prices for March 18, 2024:

Regular grade #gasoline: $3.45/gallon

On-highway #diesel: $4.03/gallon #gaspriceshttps://t.co/dsfxiPA8Wj pic.twitter.com/Ky9HhZvuWI — EIA (@EIAgov) March 18, 2024

Finger noted that market volatility places a greater emphasis on controlling fuel usage. That involves maximizing miles per gallon through equipment spec’ing as well as driver training and monitoring.

“Monitoring our performance on a unit-by-unit basis within each one of our different business units to somewhat have some internal benchmarking of how our guys are performing,” Finger said. “It’s hard; fuel costs are hard to watch go up because it has a direct impact on your bottom line. The biggest thing you have control over is how far can you stretch that fuel.”

Finger also said to what degree fuel surcharges help depends on operating agreements with individual customers. He noted that because there are unknowns and the cost is uncontrollable, his company tries to hedge itself against that in making fuel a variable cost that’s adjusted to customers.

Wagrodzki

“Probably 95% of our freight is contract freight,” Artur Express President Artur Wagrodzki said. “All of our customers really have a fuel surcharge. So it’s definitely something where we are protected by these swings. Obviously, sometimes, the price is going up faster than the fuel surcharge. But, for the most part, we’re pretty well protected with our customers.”

Wagrodzki said the industry is dealing with market pressures besides fuel costs. He noted that it’s challenging for everyone with customers looking to reprice and freight rates already being down for the past year or so.

“I think what we see … the last four or five months maybe, it’s definitely stabilized, we definitely see a bottom,” Wagrodzki said. “It seems like things are changing a little bit for the better. The volume for us is there. The rates are obviously still not where they need to be, but overall, we feel that the market is slowly going the right direction.”

Want more news? Listen to today's daily briefing below or go here for more info: