Staff Reporter

Diesel Price Dips 1.8¢ in Third Straight Decline

[Stay on top of transportation news: Get TTNews in your inbox.]

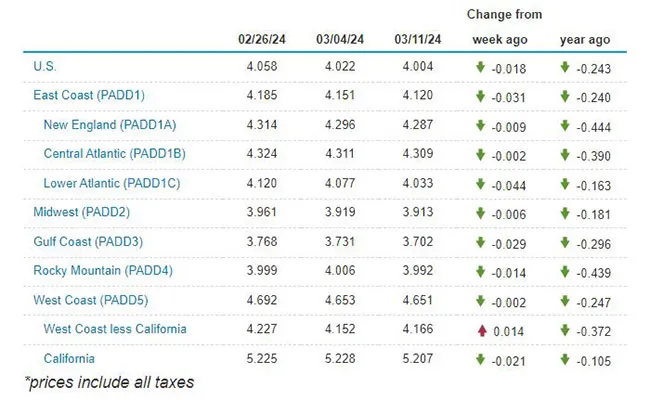

The national average diesel price held just above $4 a gallon after dropping 1.8 cents to settle at $4.004, according to Energy Information Administration data released March 11.

After reaching $4.109 on Feb. 12 and holding there Feb. 19, diesel has shed a total of 10.5 cents a gallon as a result of three straight declines.

A gallon of trucking’s main fuel now costs 24.3 cents a gallon less than it did at this time in 2023.

Diesel’s average price fell in nine of the 10 regions in EIA’s weekly survey, with the exception being a 1.4-cent gain in the West Coast less California. The biggest drop was 4.4 cents in the Lower Atlantic.

U.S. average on-highway #diesel fuel price on March 11, 2024 was $4.004/gallon, DOWN 1.8¢/gallon from 3/04/24, DOWN 24.3¢/gallon from year ago #truckers #shippers #fuelprices https://t.co/lPvRNZG7iO pic.twitter.com/JqL5hawYHz — EIA (@EIAgov) March 12, 2024

Further downside is expected, say analysts.

“Unless we get a bout of really cold weather, then prices are set to decline, as the end of the heating oil demand season has already arrived,” Patrick De Haan, GasBuddy head of petroleum analysis, told Transport Topics in an interview.

In addition, while storage stocks are lower than usual, if carriers look at the United States’ days of supply — calculated using demand and inventory statistics — then the prospects for prices are slightly more bearish, said David Thompson, executive vice president at Washington-based brokerage Powerhouse.

Distillate demand, a proxy for diesel demand, averaged 3.7 million barrels per day over the past four weeks, 0.5% higher than a year earlier, according to EIA data released March 13. Distillate demand averaged 3.375 million barrels per day in the week that ended March 8.

Inventories rose 888,000 barrels week-over-week to 117.9 million barrels, below expectations of 1.05 million barrels, but 7% below the five-year average, EIA data shows.

There is still some underlying support for diesel and other refined products, but below the $4 per gallon level.

U.S. average price for regular-grade #gasoline on March 11, 2024 was $3.376/gal, UP 2.6¢/gallon from 3/04/24, DOWN 0.8¢/gallon from year ago #gasprices https://t.co/jZphFa0hDF pic.twitter.com/WFNrIfuoRl — EIA (@EIAgov) March 12, 2024

The EIA’s forecast for first-quarter diesel prices increased 0.9% from February to $3.97 per gallon from $3.94 per gallon, according to the latest monthly Short-Term Energy Outlook, published March 12. The agency’s outlook for prices in the second quarter was unchanged at $3.92 per gallon.

EIA’s forecast for Q1 distillate fuel oil consumption decreased 3.1% to 3.83 million barrels per day from 3.96 million barrels per day in February.

However, the agency’s forecast for Q2 demand increased 1.1% compared with February’s outlook to 4.01 million barrels per day from 3.96 million barrels per day, a rise matched in percentage terms by the change between February and March’s third-quarter consumption prognostication to 3.93 million barrels per day from 3.89 million barrels per day.

Further support is likely to come from rising crude and gasoline prices.

COMTO's April Rai offers tips to increase workforce diversity and grow profits.. Tune in above or by going to RoadSigns.ttnews.com.

From April onward, there could be a run-up in crude and gasoline prices in the United States as players prepare for the start of the summer driving season, De Haan said.

The price of a gallon of gasoline bumped 2.6 cents higher in the week that ended March 11 to $3.376 a gallon. That’s 8 cents less than it cost at this time a year ago.

EIA is becoming more bullish on crude prices. On March 12, the agency raised its 2024 WTI crude spot price forecast to $82.15 a barrel from $77.68 per barrel a month earlier. The agency also raised its 2024 spot Brent oil forecast to $87 a barrel from $82.42 a barrel.

Part of that is because of falling inventories, but also as a result of an improved forecast for the U.S. economy. EIA raised its U.S. GDP growth forecast to 2.6% in 2024 and 1.7% in 2025, from 1.8% and 1.6%, respectively, in the latest STEO report.

The optimism is reflected in freight volumes, according to at least one observer. February brought more encouraging signs that a freight recovery is beginning, Cass Information Systems said March 11, noting that shipment volumes increased 7.3% compared with January, slightly ahead of month-over-month seasonal expectations.

While shipments were down 4.5% year-on-year, the gap continues to close, as this was the smallest decrease in 10 months, Cass said, adding that if normal seasonality prevails, shipments will be down 1% year-over-year in March and return to the black in May.

“It’s been over two years since the first [year-over-year] decline of this freight recession, and with destocking playing out and goods consumption rising, we see this improvement as an encouraging sign that a recovery is beginning,” Cass said.

Disposable income slowed in the first couple of months of 2024, but goods prices are sliding overall, and with the ongoing strong labor market, freight demand fundamentals are improving, it added.

The Department of Labor reported March 8 that 275,000 jobs were added to employer payrolls in February, the third consecutive month of at least 229,000 additions.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: