Diesel Drops 3.8¢ a Gallon to $3.876

[Stay on top of transportation news: Get TTNews in your inbox.]

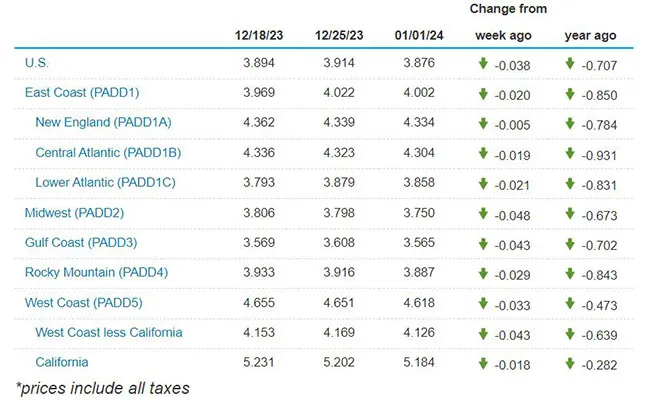

The national average diesel price resumed its decline after a one-week increase, slipping 3.8 cents to $3.876 a gallon, according to Energy Information Administration data released Jan. 1.

The dip arrives after diesel’s average price rose 2 cents Dec. 25 after eight consecutive weekly declines.

A gallon of trucking’s main fuel now costs 70.7 cents less than it did at this time in 2023.

Diesel’s price dropped in all 10 regions in EIA’s weekly survey, with the declines ranging from 4.8 cents in the Midwest to a half-cent in the Central Atlantic.

U.S. average on-highway #diesel fuel price on January 1, 2024 was $3.876/gallon, DOWN 3.8¢/gallon from 12/25/23, DOWN 70.7¢/gallon from year ago #truckers #shippers #fuelprices https://t.co/lPvRNZG7iO pic.twitter.com/BSXmhmPv9O — EIA (@EIAgov) January 3, 2024

On the Gulf Coast, the price averaged $3.565 per gallon, down 4.3 cents compared with a week earlier and some 70.2 cents lower than at the same point in 2023. The Gulf Coast, home to nearly half the nation’s refining capacity, typically sees the cheapest prices in the U.S.

Within the Gulf Coast region, Sherman, Texas, saw the lowest city average nationally at $3.16 per gallon, according to GasBuddy Head of Petroleum Analysis Patrick De Haan.

Conversely, California tends to see the highest prices. In the most recent week, prices in the Golden State averaged $5.184 per gallon, according to the EIA, a week-over-week decrease of 1.8 cents and down 28.2 cents year-over-year.

San Luis Obispo, Calif., posted the highest city average in the nation at $5.82 per gallon, according to De Haan.

The most common U.S. diesel prices across the nation of late were $3.99, $3.89, $3.79, $3.69 and $3.59, he added in a Jan. 3 post on X.

Prices are not expected to climb in the coming weeks, with demand low, weather forecasts mild and wholesale diesel price indicators bearish.

Distillate fuel product supplied — a proxy for diesel consumption across the nation — averaged 3.6 million barrels a day over the past four weeks, down 1.5% compared with the same period last year and a slump of 1.38 million barrels per day week-on-week, according to EIA data published Jan. 4.

U.S. average price for regular-grade #gasoline on January 1, 2024 was $3.089/gal, DOWN 2.7¢/gallon from 12/25/23, DOWN 13.4¢/gallon from year ago #gasprices https://t.co/jZphFa0Ptd pic.twitter.com/sZjDXtZHMf — EIA (@EIAgov) January 3, 2024

However, refiners’ distillate output averaged 5.2 million barrels per day in the week that ended Dec. 29, the EIA data shows. Refineries operated at 93.5% of capacity, the highest level seen since August.

As a result, distillate fuel inventories increased by 10.1 million barrels to 125.9 million barrels last week, and although stocks are about 6% below the five-year average for this time of year, inventories are up 5.98% compared with 118.8 million barrels a year earlier.

The decrease in demand was significant, although a jump in inventories happens routinely at this time of year, said David Thompson, executive vice president at Washington-based brokerage Powerhouse. The big question is how quickly demand returns, Thompson said, adding that consumption took six weeks to climb back to pre-Christmas levels a year ago.

Weather forecasts for the next few weeks are bearish for diesel demand too, with temperatures expected to be above normal along the East Coast and westward to Michigan in the northern tier of the country.

On top of that, underlying diesel futures prices have been trending lower. Diesel futures have failed to break a technical downtrend channel since September, said Powerhouse’s Thompson.

Beyond the outlook for the opening couple of weeks of 2024, prognosticators expect lower and less choppy diesel markets as the year progresses.

In this special year-in-review episode, we delve into the journey and future of alternative fuel trucks. How are they paving the way for a greener 2024? Tune in above or by going to RoadSigns.ttnews.com.

Prices are set to be a little bit lower in 2024, although with not a huge amount of volatility, FTR Transportation Intelligence Chairman of the Board Eric Starks told TT.

American Trucking Associations Chief Economist Bob Costello added that there is unlikely to be a great deal of movement either up or down compared with December levels. That’s because some support is likely from the source of trucking’s main fuel — crude oil. Benchmark West Texas Intermediate crude is expected to average $83 per barrel compared with $78 per barrel in 2023, according to Wood Mackenzie, while Bank of America expects front-month WTI to average $86 per barrel.

There will also be less incentive for refiners to produce diesel in the U.S., Wood Mackenzie Vice President of Refining, Chemicals & Oil Markets Alan Gelder told TT.

Wood Mackenzie expects the U.S. Gulf Coast diesel crack spread — the profitability of producing the fuel — to average around $22 per barrel above Louisiana Light Sweet crude in 2024, compared with $28 per barrel above LLS in 2023 and more than $41 a barrel in 2022.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: