Senior Reporter

National Average Diesel Price Falls 5.1¢ to $4.058 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

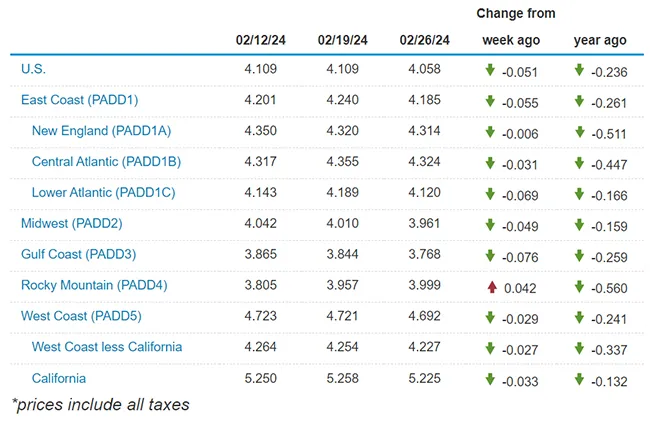

The national average price for a gallon of diesel fell by 5.1 cents the week ending Feb. 26, the largest drop so far this year, according to data released by the Energy Information Administration.

EIA says the national average now sits at $4.058 a gallon. Diesel dropped by 4.8 cents between Jan. 1 and Jan. 8 but since then has risen four weeks, been flat one week and dropped one week by 2.5 cents.

Diesel rose by 4.2 cents in the Rocky Mountain region to $3.999, but fell in every other region.

The biggest drop, 7.6 cents, was seen in the Gulf Coast region, where diesel is the lowest in the nation at $3.768 a gallon.

The national average price of gasoline shed 2 cents to $3.249 a gallon.

U.S. average on-highway #diesel fuel price on February 26, 2024 was $4.058/gallon, DOWN 5.1¢/gallon from 2/19/24, DOWN 23.6¢/gallon from year ago #truckers #shippers #fuelprices https://t.co/lPvRNZG7iO pic.twitter.com/pjHqkdthS6 — EIA (@EIAgov) February 27, 2024

Two things are impacting the price of gasoline and diesel, according to oil industry analyst Phil Flynn. He says it has been a warmer than expected winter and that is lessening demand for diesel fuel, especially in the Mid-Atlantic, Northwest and Midwest where heating oil, which from a molecular standpoint is the same as diesel, has not been needed as much as it is during colder winters.

“It’s been warmer, especially in those areas that usually get cold weather this time of year,” Flynn told Transport Topics. “There is a lack of home heating oil demand. There’s now an expectation they’re going to get through winter.”

This is also the time of year when most of the nation’s refineries switch from making winter-blend gasoline to producing summer-blend gasoline. The winter-blend gasoline contains additional butane in the refining process and in the summer the fuel producers lower the butane and use additional, more expensive additives, which the U.S. Environmental Protection Agency and other state government environmental agencies mandate to lower air pollution levels, especially in states such as California, which has the strictest air quality rules in the nation.

Summer-blend fuels cost more, but analysts say the process to change those refineries over is in full swing and they expect refining capacity to steadily increase in the coming weeks as more facilities come back online.

“There is an expectation that the refinery runs are going to improve a little bit and come back,” Flynn said. “The demand for oil products, gasoline and diesel is hanging in there and I expect we may see some volatility for a while in terms of prices. I wouldn’t read too much into this short-term pullback.”

U.S. average price for regular-grade #gasoline on February 26, 2024 was $3.249/gal, DOWN 2.0¢/gallon from 2/19/24, DOWN 9.3¢/gallon from year ago #gasprices https://t.co/jZphFa0Ptd pic.twitter.com/qgUhb4XyrH — EIA (@EIAgov) February 27, 2024

In its latest report, dated Feb. 23, the EIA said U.S. refining capacity was 81.5%, compared with 85.8% the same time a year ago and down from 93.6% a month earlier.

Meanwhile in London, at the International Energy Week conference, an official with Vitol Group said the slower pace of the shift to renewable energy will push the world’s peak oil demand beyond 2030.

“Oil demand has a good few number of years still to climb ... before it plateaus,” Vitol CEO Russell Hardy said, emphasizing that energy markets have changed as world markets have changed in a post-COVID era. “We agreed with that view 12-24 months ago, but we are of the view now that the pace of change is more challenging so it is likely to drift into the early 2030s.”

Those attending the conference said higher interest rates, supply chain woes and low returns for renewable projects, along with a renewed public pushback against some governments imposing more expensive choices to consumers for their energy supply is causing the new assessment of oil’s long-term strength.

Get the inside scoop on ATA's Technology & Maintenance Council Annual Meeting March 4-7 in New Orleans. Tune in above or by going to RoadSigns.ttnews.com.

While it has an economic interest in oil remaining the predominant global energy source, in its latest World Oil Outlook, OPEC raised its long-term estimate of world oil global demand by 6 million barrels per day in 2045, to nearly 116 million barrels per day.

OPEC says the increase will be steady, with global demand reaching 110.2 million barrels per day in 2028, up nearly 10.6 million from 2022. Much of the growth in oil production is expected to come from non-OPEC members. The United States, Canada, Mexico and China are four of the most prominent members of that non-OPEC group. The United States is now the world’s global leader for oil production at more than 13.3 million barrels per day pumped last week, according to the EIA.

Canada’s oil production is set to jump by about 10% over the next year and become one of the largest sources of increased supply around the world, reaching 5.4 million barrels per day.

China is pumping an estimated 4.3 million barrels of oil a day, making it the world’s fifth-largest producer, only behind the US, Saudi Arabia, Russia and Canada, and ahead of Iraq.

Mexico is the world’s 11th largest producer of oil in the world, at 1.8 million barrels per day.

On-Highway Diesel Fuel Prices

Source: EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: