Staff Reporter

Diesel Price Up Another 13.9¢ to $4.378 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

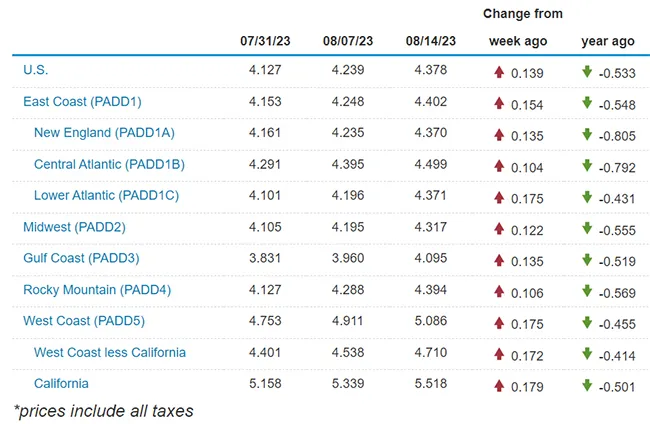

Diesel prices climbed another 13.9 cents a gallon in the most recent week, according to data from the Energy Information Administration on Aug. 14.

After a fourth straight week that saw a jump of a dime or more, the on-highway national average for a gallon of diesel is now $4.378. The average has climbed 57.2 cents a gallon in those four weeks.

Still, the nationwide diesel price is 53.3 cents a gallon cheaper than a year ago.

The average price increased by at least a dime in all 10 regions that EIA surveys.

The smallest increase was 10.4 cents in the Central Atlantic; the largest was 17.9 cents a gallon in California.

U.S. On-Highway Diesel Fuel Prices

Source: Energy Information Administration

Gasoline prices rose too, although not everywhere. The national average was up 2.2 cents a gallon to $3.85, but it was down in four of the nine regions.

Support for retail diesel prices is coming from strength in upstream wholesale energy markets and demand across a number of sectors of the U.S. economy, including freight, according to sources.

Front-month WTI crude futures continue to hover above $80 per barrel, having ended June below $70, with peaks seen above $84 on Aug. 9 and Aug. 10.

Wholesale front-month CME ultra-low-sulfur diesel prices, meanwhile, topped $3.20 a gallon in recent days and remained above $3 per gallon Aug. 15. As recently as the start of July, front-month futures were trading below $2.40 a gallon.

U.S. average retail prices for August 14, 2023:

Regular grade #gasoline: $3.85/gal

On-highway #diesel: $4.38/gal #gaspriceshttps://t.co/dsfxiPA8Wj — EIA (@EIAgov) August 14, 2023

Domestic demand is strong, too ,though, according to S&P Global Commodity Insights Associate Director Christopher Elsner. Consumption from the freight and construction industries is holding up, he told Transport Topics on Aug. 15. The U.S. economy is still proving to be stronger than expected, he added.

Trucking companies are confident this will continue, according to Bank of America Securities.

The Bank of America Truckload Demand Indicator for shippers’ zero- to three-month freight demand outlook rose to 55.2 from 50.0 in the bank’s latest bi-weekly survey, up 10% sequentially, analyst Ken Hoexter said in an Aug. 11 note.

Hoexter

Providing a little more context, Hoexter said the Demand Indicator is up 10% year-over-year, its first year-on-year increase in 36 surveys, with the latest figure the highest since June 2022. Bank of America surveyed 48 shippers.

East Coast retail prices saw the second-largest regional increase behind the West Coast, and analysts say part of this is likely due to the absence of Midwest shipments.

Midwest diesel is remaining in the region because maintenance on locks on the Illinois River, which connects Lake Michigan to the Mississippi River, began in early June and is scheduled to continue through September.

For example, between June 9 and July 14, regional inventories of distillate fuel oil, usually consumed as diesel, increased by 4.7 million barrels (18%), according to EIA.

The U.S. diesel inventory outlook is beginning to look tighter for the second half of summer 2023, EIA said, which is also supporting wholesale and retail prices.

Supplies are tight globally, too, which is offering further backing.

There’s growing concern that if we get a cold winter, we could see diesel prices spiked to all-time highs.

Phil Flynn, Price Futures Group oil trader

Image

“There’s growing concern that if we get a cold winter, we could see diesel prices spiked to all-time highs. Refining margins continue to be strong, and there is a concern among global leaders of potential shortfalls this winter,” Price Futures Group oil trader Phil Flynn warned Aug. 14.

Balancing such bullish sentiment are expectations that upside for the underlying wholesale energy market, particularly crude, is limited.

Blanch

Bank of America is maintaining a 2024 WTI forecast of $85 per barrel. Commodity and Derivatives Strategist Francisco Blanch said in an Aug. 15 note.

With oil supply and demand likely to remain nearly balanced in 2024, a sustained run-up in prices would depend on “deeper oil supply cuts by OPEC+ (unlikely), unplanned supply disruptions (uncertain), or much better demand conditions (unexpected),”Blanch said

Blanch’s 2024 price forecast for the other global crude benchmark, Brent, also remained unchanged at $90 a barrel.

Fundamentals have improved for the energy sector, with supply dynamics triggering the rally in energy prices, but demand would need to “improve materially for a sustained move above $100 per barrel in Brent,” he said.

In the short term, another bearish factor also may come into play for the WTI market — technical pattern trading. Pickering Energy Partners Chief Investment Officer Dan Pickering said in a tweet Aug. 15 that without a front-month WTI close above $84 a barrel some time “soon” then technical sellers would enter the market.

Want more news? Listen to today's daily briefing below or go here for more info: