Diesel Price Posts 11.2¢ Gain in Third Straight Increase

[Stay on top of transportation news: Get TTNews in your inbox.]

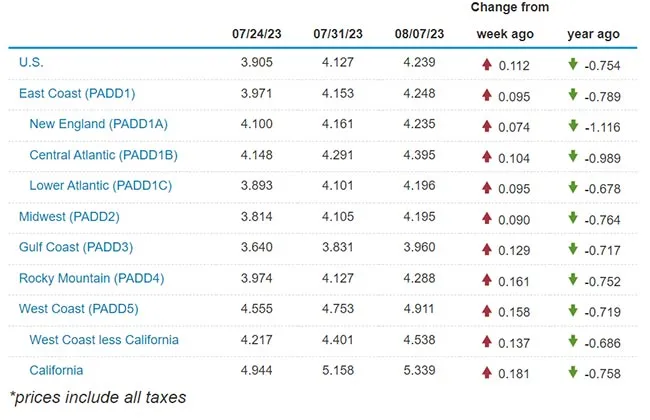

The national average diesel price rose for the third straight week, climbing 11.2 cents to settle at $4.239, according to Energy Information Administration data released Aug. 7.

The national average diesel price has increased 43.3 cents a gallon since July 17, including a 22.2-cent surge July 31. A gallon of diesel now costs 75.4 cents less than it did at this time in 2022. The last time diesel’s average price rose three consecutive weeks was from Oct. 3 to Oct. 24 in 2022, going from $4.836 to $5.341.

The cost of a gallon of diesel went up in all 10 regions in EIA’s weekly survey. California experienced the largest increase, 18.1 cents to $5.339 a gallon. The state already has the most expensive diesel. New England reported the smallest increase at 7.4 cents to $4.235.

Gasoline continued its upward trajectory as well, increasing 7.1 cents a gallon on average to $3.828. That’s 21 cents less than it cost at this time a year ago.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

“I think we had an incredible preseason rally in prices, which was partly tied to the high price of crude and the OPEC+ cuts,” said Tom Kloza, global head of energy analysis at Oil Price Information Service. “But also, to the fear that when we come into the heating season, where a lot of diesel molecules go for home heating in the Northern Hemisphere.”

Kloza believes most of the preseason increases probably have taken place. He noted that traditionally the markets react before the season comes to pass and that prices went up almost every day in July.

Kloza

“If you’re in places where you have access to tidal water — the West Coast, the East Coast, the Gulf Coast — the market for diesel internationally is still pretty strong so those prices are up,” Kloza said. “In the middle of the country a little bit less. But, of course, they’ll be talking about harvest season in another 60 days or so, and a lot of diesel gets used for agriculture.”

Kloza noted the worst of the refinery issues related to intense heat are likely over with, too. He also pointed out that a lot of refinery maintenance last year has largely been worked through. Too, he indicated that diesel was cheaper last year compared with natural gas in Europe and Asia. But that hasn’t been the case this year.

U.S. average retail prices for August 7, 2023:

Regular grade #gasoline: $3.83/gal

On-highway #diesel: $4.24/gal #gasprices

https://t.co/dsfxiPA8Wj pic.twitter.com/UBzmGAZgJ4 — EIA (@EIAgov) August 7, 2023

“It’s hurting my business, obviously,” said Mike Kucharski, owner of JKC Trucking in Summit, Ill. “It’s depleting my cash flow because diesel is so expensive. When it depletes cash flow, it depletes any profits. I actually put my company in the red, causing instability and probably the worst part, it keeps me up at night, gives me plenty of new gray hairs.”

Kucharski said that the higher diesel prices don’t just hurt truckers because of the downstream effects on the supply chain. The cost of goods can go up for end consumers when trucking operations become more expensive, adding that it’s particularly difficult for lower-income families.

JKC Trucking's owner says the high cost of diesel has downstream effects that hurt consumers. (JKC Trucking)

“Everyone’s feeling these high costs, especially at the grocery store,” Kucharski said. “Lower-income households don’t give up luxury. They give up necessities. They have to make a choice between driving to work or putting food on the table.”

Fuel surcharges are one of the tools that trucking companies use to offset fuel costs. It’s a fee charged by transport companies to allow for fuel cost fluctuations and often determined as a percentage of the base rate. Kucharski warns it is not always enough.

“The fuel surcharge helps, but it’s like putting a bandage on a big wound,” Kucharski said. “The surcharge is calculated two ways. We’re doing it as a percentage of the rate or we’re doing it per mile. A lot of customers do it per mile, they have their own fuel graphs, so we have to do it by that.”

Host Michael Freeze clarifies the differences between predictive and preventive maintenance. He gives fresh commentary on everything from how enhanced connectivity boosts your preventive maintenance plans to what predictive possibilities AI can offer your shop. Tune in above or by going to RoadSigns.ttnews.com.

Kucharski added that fuel surcharges can fluctuate among customers since it is calculated different ways, and it’s not always going to catch every cost. It’s particularly difficult when costs quickly jump because the surcharge readjustment often is calculated on a weekly basis.

“The price fluctuations are the biggest issue,” Kucharski said. “There should be a lag between the time prices rise and surcharges are adjusted. We adjust surcharges every Monday, and the customers pay their higher costs. This really pinches the finances of small carriers, but also, I would say all carriers. When it jumps 30 cents so fast, there’s that lag. That lag is what’s killing us.”

Kucharski added these rapid price changes often hurt smaller carriers and owner-operators the most, saying they often don’t have the overhead to easily adjust their budgets and often pay retail prices at the pump when the larger carriers can get it cheaper wholesale.

Want more news? Listen to today's daily briefing below or go here for more info: