Average Diesel Price Unchanged at $3.806 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

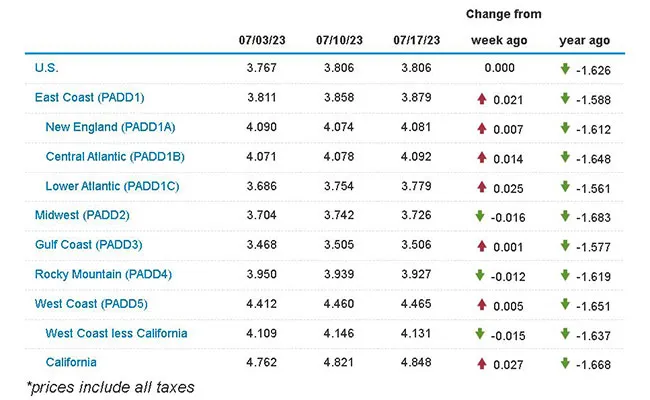

The needle refused to budge on the average national on-highway diesel price, holding at $3.806 a gallon, according to Energy Information Administration data released July 17.

The last time there was no change in the average diesel price was April 26, 2021, when it cost $3.124 a gallon.

The average diesel price held steady after a 3.9-cent gain July 10, which marked just the sixth increase of the year and third since January.

Of the 10 regions in EIA’s weekly survey, the average price rose in seven and fell in three. The largest increase was 2.7 cents a gallon in California; the biggest decline was 1.6 cents in the Midwest.

The national average diesel price is $1.626 less than it was at this time in 2022.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

That relative fuel price weakness is going to hurt surcharge revenues for less-than-truckload carriers in the third quarter of 2023 through rate-per-pound declines for a third consecutive quarter, according to investment bank TD Cowen and third-party logistics specialist AFS Freight.

The second-quarter 2023 rate per pound came in materially below expected rates as fuel surcharges moderated alongside diesel prices during the period, they said, noting that softening demand conditions also added to rate pressure.

However, the TD Cowen AFS Freight Index indicates an inflection point for truckload rates in the current quarter, paving the way for a rebound. The index suggests the truckload rate per mile will rise 20 basis points in the third quarter compared with the second quarter to 6.6% off the January 2018 baseline.

U.S. average retail prices for July 17, 2023:

Regular grade #gasoline: $3.56/gal

On-highway #diesel: $3.81/gal #gasprices https://t.co/dsfxiPA8Wj pic.twitter.com/M1GkKwvryM — EIA (@EIAgov) July 17, 2023

The freight market has normalized, or at least appears to be steadier, Dave Csontos, senior vice president of logistics at Transervice Logistics, told Transport Topics. The market has found its homeostasis, Csontos said, adding that Transervice is not seeing a continuation of the customer volume decline.

He said fuel prices seem to have stabilized and that he expects a slight increase over the next couple of weeks. But Csontos said he sees a range of $3.50 to $4 per gallon remaining in place for a while in the retail market.

Csontos

Lake Success, N.Y.-based Transervice Logistics ranks No. 97 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

There is no real catalyst for demand until the fall harvest starts in a couple of months, said Tom Kloza, global head of energy analysis at Oil Price Information Service.

“I’m a little surprised by the current strength” in the wholesale ultra-low-sulfur-diesel market, Kloza said, adding that it seemed to be a “preseason rally.” Diesel is wobbling higher, he said.

Kloza

Front-month CME ULSD futures wandered between $2.55 and $2.65 per gallon over the past 10 days or so after breaking out of a $2.25- to $2.40-gallon range that held through May and June. Kloza does not expect a major price move in the next 90 days, he said.

Fundamental support for retail and wholesale diesel prices remains in place from the wider energy complex, with underlying benchmark crude prices holding steady.

Front-month WTI crude futures hovered on either side of $75 per barrel over the past few trading sessions, as market watchers eye Chinese demand and output levels in Saudi Arabia, Russia and the United States.

U.S. crude production is set to fall in August for the first time this year to 9.4 million barrels a day, according to Price Futures Group oil trader Phil Flynn, as rig counts have plunged.

Flynn

Data from Baker Hughes showed the U.S. oil rig count totaled 537 in the week that ended July 14, down 62 or 11.5% year-on-year. The rig count is seen as an indicator of future production.

Oil production is not just falling in the U.S., according to the latest data issued by the Joint Organizations Data Initiative, a global data transparency mechanism.

Crude production in JODI-reporting countries fell by 800,000 barrels a day in May, driven by lower production in Saudi Arabia, Canada and the United States, the International Energy Forum said. On top of that, the data covers a period before Saudi Arabia instituted a 1 million-barrels-a-day output cut and Russia instituted a production decrease of 500,000 barrels a day.

How effective have third-party services proved to be for fleets? Let's find out with Michael Precia of Fleetworthy Solutions and Dan Rutherford with Summit Virtual CFO by Anders. Tune in above or by going to RoadSigns.ttnews.com.

In addition, oil demand in JODI-reporting countries rose by more than 3 million barrels per day month-on-month in May, IEF said. Chinese consumption jumped 1.7 million barrels a day month-on-month to 17.37 million barrels — the second-highest level ever reported by JODI.

Overseas demand for U.S. diesel remains high, providing further support for prices, analysts say. Refiners in coastal states are not having any trouble exporting diesel, Kloza told TT, adding that operators are making higher margins on diesel production than on gasoline.

The average national on-highway price for gasoline rose 1.3 cents to $3.559 a gallon, EIA data show.

Want more news? Listen to today's daily briefing below or go here for more info: