Staff Reporter

Diesel Price Falls to $4.092 in Sixth Consecutive Drop

[Stay on top of transportation news: Get TTNews in your inbox.]

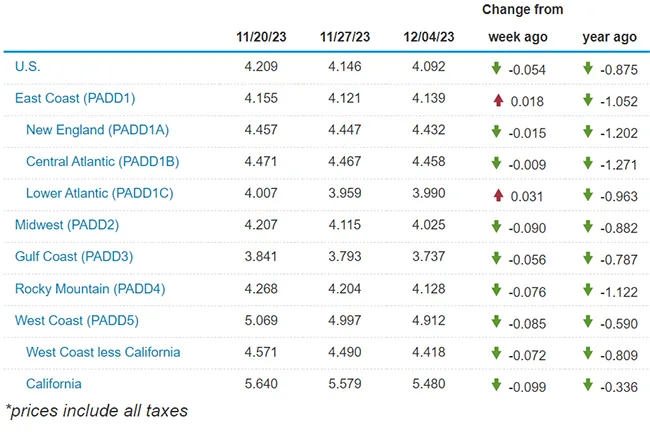

The national average price for a gallon of diesel fuel fell another 5.4 cents this week, dropping it to a level that hovers around the $4 mark. Falling for the sixth consecutive week, diesel now averages $4.092 a gallon across the U.S., according to the Energy Information Administration.

“Nineteen states with average diesel prices are $3.99/gal or lower, and the odds are looking better for the national average for diesel to fall below that soon!” GasBuddy Head of Petroleum Analytics Patrick De Haan wrote Dec. 6 on social media network X, formerly known as Twitter.

Diesel is now 87.5 cents a gallon cheaper than it was a year ago. The price has fallen 45.3 cents in the last six weeks; it was at $4.545 on Oct. 23.

The average price fell in eight of 10 regions EIA follows. The only regions with increases were the East Coast (up 1.8 cents) and Lower Atlantic (up 3.1 cents).

U.S. average on-highway #diesel fuel price on December 4, 2023 was $4.092/gallon, DOWN 5.4¢/gallon from 11/27/23, DOWN 87.5¢/gallon from year ago #truckers #shippers #fuelprices https://t.co/lPvRNZG7iO pic.twitter.com/EfhFhuWTnk — EIA (@EIAgov) December 5, 2023

Prices in the Midwest were the closest to the $4 mark with a national average of $4.025, while the refinery-heavy Gulf Coast region saw the lowest regional price at $3.737 a gallon. Both regions can expect substantial further decreases in the coming weeks, according to De Haan.

“It is now possible that some could see prices for diesel in the Great Lakes and Gulf Coast falling to $2.99/gal (or lower) in the days/weeks ahead,” he wrote Dec. 6 on X.

Diesel demand compared with production, technical indicators for wholesale diesel futures, and weakness in the underlying crude market all point to further price weakness, analysts say.

Demand for distillate fuel, which encompasses diesel and heating oil, averaged 3.7 million barrels a day on a rolling four-week basis, EIA data shows.

Distillate fuel production increased to 5.1 million barrels per day last week from 5.0 million barrels per day a week earlier, according to EIA, only the 10th time output has topped 5 million barrels a day in 2023.

As a result, U.S. distillate inventories increased by 1.3 million barrels to a total of 112.0 million barrels, EIA data shows, although this is 6.8 million barrels, or 5.7%, less than a year ago. Distillate inventories are about 13% below the five-year average for this time of year.

Production remains relatively high because the crack spread for diesel is so much better than that for gasoline, analysts say. The crack spread is the overall pricing difference between a barrel of crude and the refined product distilled from it.

“From an economic perspective, diesel is a good product to make,” Wood Mackenzie Principal Analyst Austin Lin said Dec. 7.

U.S. average price for regular-grade #gasoline on December 4, 2023 was $3.231/gal, DOWN 0.7¢/gallon from 11/27/23, DOWN 15.9¢/gallon from year ago #gasprices https://t.co/jZphFa0Ptd pic.twitter.com/J9d4Tap9Cn — EIA (@EIAgov) December 5, 2023

U.S. Gulf Coast crack spreads for diesel versus West Texas Intermediate crude are roughly $23 a barrel at the moment, Lin said, while the equivalent gasoline crack spread is running anywhere between $5.50 and $6 a barrel.

The national average price of gasoline fell by less than a penny, 0.7 cent, to $3.231 a gallon. Gasoline is 15.9 cents a gallon cheaper than it was a year ago.

De Haan is similarly bearish about gasoline. “GasBuddy now counts 19 states with an average gas price of $2.99 or lower, including Indiana, New Mexico and Utah for the first time in this downturn,” he wrote. He forecasts that the price of gas may be on its way to its lowest level since May 2021.

The downturn in the prices of diesel and gasoline mirrors that of the underlying benchmark crude prices, which have fallen as a result of weaker-than-expected European and Chinese economic indicators despite the best efforts of OPEC+ producers.

At OPEC+ oil ministers’ latest meeting Nov. 30, they promised more than 2 million barrels per day in voluntary cuts through the first three quarters of 2024. However, as one observer told Transport Topics, the key word in the alliance’s communiqué related to the cuts was “voluntary.”

Led by Saudi Arabia, the OPEC+ alliance has been attempting to put a floor under crude prices, largely through the output cuts.

However, Wood Mackenzie’s Lin said the $80-a-barrel price floor sought by the Saudis is unlikely to be seen on a consistent basis before the second half of 2024. On Dec. 7, the front-month crude futures contract was trading below $70 a barrel.

Alongside the slower-than-expected normalization of Chinese industrial output, parts of Europe have been flirting with a technical recession in recent quarters, said Lim. That limits demand for U.S. diesel exports, adding to the softness in the market.

There are no real support pillars for diesel prices at the moment, said David Thompson, executive vice president at Washington-based brokerage Powerhouse. Even after the consistent decline in retail and wholesale prices, technical indicators in the futures market are not drastically oversold, said Thompson.

Source: EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: