Staff Reporter

Diesel Price Rises 4.8¢ to $4.54 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

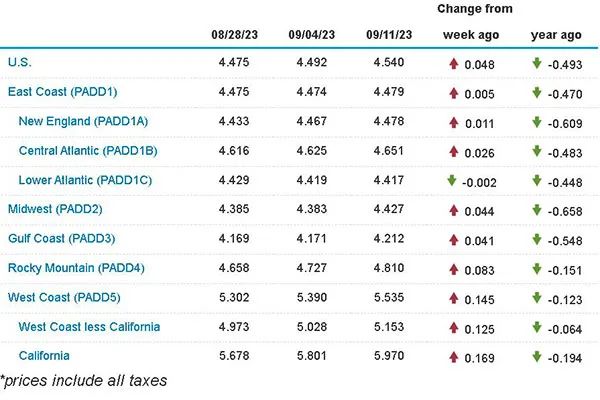

The national average diesel price kept on its upward course, climbing 4.8 cents to reach $4.54, according to Energy Information Administration data released Sept. 11.

The EIA found a gallon of diesel on average now costs 49.3 cents less than it did at this time in 2022. Its average price has risen for eight straight weeks, with the increases totaling 73.4 cents. The most recent price decline for trucking’s main fuel was a 3.9-cent drop July 10.

The average price of diesel increased in nine of the 10 regions in EIA’s weekly survey. The exception was a dip of two-tenths of a cent to $4.417 in the Lower Atlantic. California experienced the biggest gain at 16.9 cents to $5.970. The East Coast region reported the smallest increase at 0.5 cent to $4.479. The West Coast, the West Coast less California and California are the only regions in which a gallon of diesel on average costs more than $5 a gallon.

The average price for a gallon of gasoline nudged up 1.5 cents a gallon on average to $3.822. It now costs 13.2 cents more than it did at this time a year ago. The price increased in seven of the 10 regions surveyed. The West Coast region saw the biggest increase at 5.7 cents to $4.969 a gallon.

U.S. average retail prices for September 11, 2023:

⛽️ Regular grade #gasoline: $3.82/gallon

⛽️ On-highway #diesel: $4.54/gallon#gasprices https://t.co/dsfxiPA8Wj — EIA (@EIAgov) September 12, 2023

“We have seen diesel prices, whether we’re talking about retail prices or wholesale prices, climb considerably since the middle of summer,” said Matt Muenster, chief economist at the transportation management and market insights company Breakthrough. “It’s been driven by a number of different factors.”

The International Energy Agency warned of significant oil supply shortfall through the fourth quarter in a report Sept 13. The notice came in response to Saudi Arabia and Russia announcing a week earlier they plan to extend voluntary oil cuts through the end of the year. Saudi Arabia is a member of the Organization of the Petroleum Exporting Countries, while Russia is one of the largest oil producers outside the organization, a group known as OPEC+.

“That had prices climb in the month of September so it’s certainly been a factor,” Muenster said. “But even before that the diesel market never recovered in full from the experience of 2022. We had a really intense price spike last autumn.”

Muenster added those price spikes were due to inventory levels as well as market uncertainty around whether Russian crude oil and refined products would leave the market. He noted that didn’t end up happening and instead the international fuel markets underwent a logistical shuffle.

“But all this considered, we have a tight diesel market because of the supply side,” Muenster said. “We’ve had a number of refinery challenges. The heat has turned into a challenge in many geographies. In California, recently, we had the impacts of a hurricane that temporarily shut down refinery production, and all this is added up.”

EIA announced Sept. 12 that it had raised its diesel price forecast because of expected lower distillate inventories and higher-than-expected diesel crack spreads in August. The spread represents the price of a gallon of diesel minus the price of a gallon of crude oil.

Oil production cuts from #OPEC+ members contribute to our forecast for decreasing #oil supplies.

But we expect global production of liquid fuels to continue increasing in 2023 and 2024 due to production growth in non-OPEC+ countries. #STEOhttps://t.co/omAfuxyJUU pic.twitter.com/XD9884ep0K — EIA (@EIAgov) September 12, 2023

“We saw the diesel crack spread hit the highest level since January,” said Phil Flynn, senior energy analyst at The Price Futures Group. “And so, there’s more concerns about the tightness of supply of diesel for a multitude of reasons. We saw the inventories are already low. We have refineries and maintenance.”

The Irving Oil refinery in New Brunswick, Canada, and the Monroe Energy refinery in Trainer, Pa., going into maintenance is expected to reduce distillate fuel oil supplies to the East Coast. But distillate inventories have already been well below average since last year.

“We’ve had a little bit of a scramble on the cash side to secure supplies,” Flynn said. “And with the refineries going to maintenance and the possibility that Hurricane Lee could get close to that big refinery down in New Brunswick, that could further hit supplies.”

The American Automobile Association fuel index as of Sept. 13 found diesel prices increased 1.4% to $4.514 from $4.452 a week earlier. That compared to the highest recorded average price of $5.816 in June 2022.

“Now we are easing back a little bit on the diesel price on the futures so it seems like the panic has subsided just a little bit, but make no mistake about it, because the supplies are so tight, there’s no room for error,” Flynn said. “So, you get a little refinery outage, you can see some big spikes up or if you get some cold weather, things could really get out of control.”

U.S. On-Highway Diesel Fuel Prices

EIA.gov