Managing Editor, Features and Multimedia

Retailers, Private Fleets Expand Delivery Options to Keep Pace With E-Commerce Demand

[Stay on top of transportation news: Get TTNews in your inbox.]

The inexorable growth of e-commerce and rising consumer expectations are quickly elevating the cost and complexity of final-mile delivery.

To remain competitive in this time of rapid change, retailers and fleets are rethinking their distribution networks, implementing innovative delivery strategies and expanding their use of technology.

Retailers are offering more home delivery and pickup options and more transparency in a quest to satisfy online shoppers who are demanding greater control over when, where and how they receive their goods.

The final mile has become a competitive differentiator and an opportunity for retailers to build customer loyalty and drive future sales.

The greatest challenge, however, is controlling the surging costs associated with providing next-day, same-day and even same-hour home delivery.

“All of these digital business models and the rise of customer expectations are putting pressure on retailers. It is really increasing costs, and that’s what’s driving them to use more technology,” said Bart De Muynck, a research vice president at Gartner Inc.

The last mile is the biggest component of overall delivery cost at 53%, compared with 37% for linehaul, according to a global Gartner survey.

“What we’re seeing is all these retailers are absorbing the cost of it just to survive or be able to keep up with the competition,” De Muynck said. “Everyone’s trying to follow Amazon.”

Major retailers, private carriers and technology firms took stock of the changing e-commerce landscape and highlighted their latest final-mile strategies during Home Delivery World, held April 4-5 in Philadelphia.

A common theme was that businesses must adapt to survive in today’s world of digital commerce.

Matt Simon, vice president and chief marketing officer at Giant Food Stores, said an effective e-commerce strategy requires a high level of customer service and a willingness to implement new business models.

“Getting this right is more than a website with the right delivery times,” he told HDW attendees.

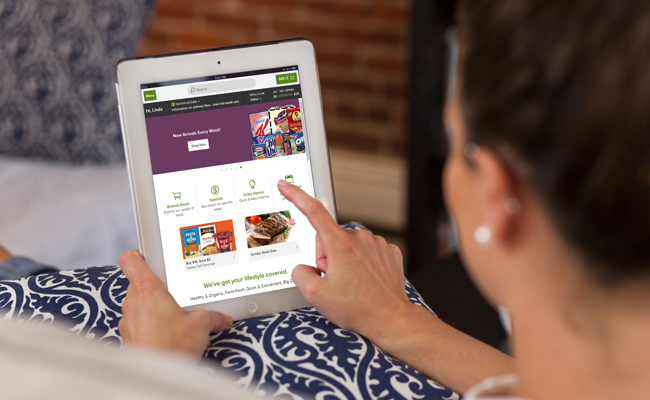

Earlier this year, the grocery chain introduced its Giant Direct e-commerce brand in conjunction with sister company Peapod, which offers home delivery of groceries ordered online.

Apart from the home-delivery option, Giant customers also can place their orders online, then drive to an e-commerce center and have their bagged groceries delivered to their vehicles for quick pickup.

“The courage to innovate — the courage to dream and try new things — I think is what’s going to make or break it for a lot of companies today,” Simon said.

Earlier this year, Giant Food Stores introduced its e-commerce brand, which operates in conjunction with sister company Peapod. (Peapod)

To keep pace with the rapidly shifting grocery landscape and new competitors such as Amazon and Target, retailers can no longer operate the same way as in years past, he said. “You can’t write 10-year plans anymore, because in two years, everything’s changed again.”

Giant Food Stores, which is part of the Ahold Delhaize supermarket chain, operates 170 stores in Pennsylvania, Maryland, Virginia and West Virginia.

Many retailers are converging their in-store and online businesses.

Walgreens, for example, is increasingly utilizing its national network of 9,000 brick-and-mortar stores as pickup and drop-off points.

The pharmacy chain enables customers and patients to order products online and have them shipped to a nearby store for pickup, generally within one or two days, said Sean Barbour, senior director of supply chain.

►Fleets expand to keep up with e-commerce

►Top 100 Private interactive map

►Valley Proteins turns grease into gold

►Reducing emissions in shipping

Sector Rankings

Food Service | Grocery

Beverage

Petroleum/Chemical

Industrial Gases | Agriculture/Food Processing

Wholesale/Retail | Manufacturing Equipment Rental | Building Materials

Waste Management

Paper/Office Products

Construction

Health Care

Uniform Rental

Media & Entertainment

About three-quarters of the population lives within 3-5 miles of a Walgreens location, he said.

The company also has partnered with FedEx to extend its pickup and drop-off services. Through that partnership, customers ordering products from a range of eligible e-commerce sites can direct those packages to a Walgreens location via FedEx.

“It’s not just Walgreens.com. It’s not just Walgreens products. It is any product you are shipping with FedEx,” Barbour said. “That is an amazing amount of access for customers and patients.”

This also will give customers the option to direct high-value products such as a new smartphone to a Walgreens store for pickup, which avoids the potential danger of a porch pirate stealing the package.

“You know it’s safe. You know it’s behind the counter in our custody. And perhaps you can also accomplish other mission trips while you’re there,” Barbour said. “That opportunity to consolidate mission trips is going to grow rapidly.”

Missed home deliveries could also be redirected to a nearby Walgreens store rather than a fulfillment center for pickup, he added.

Meanwhile, many final-mile deliveries now involve significant work inside the home.

Today, customers often want a full product installation rather than just a delivery, said Shelby McMahon, fleet director at The Home Depot.

“They want something assembled, installed, put into a certain location,” he said, “so we’re seeing less and less of the drop-and-runs that you normally had seen in the old days.”

While basic curbside delivery might take less than five minutes per stop, much more time is needed to complete a delivery inside the home, which can involve not only assembly and setup, but also answering customers’ questions.

One of the greatest barriers to providing that level of service, McMahon said, is a pervasive labor shortage.

“No one’s raising their kids to be truck drivers anymore,” he said. “That’s just the reality of the world we live in.”

However, shippers can play a part in alleviating this labor challenge, McMahon said.

Companies can become “shippers of choice” by providing carriers with the density they need to be productive and ensuring that drivers aren’t detained at their facilities.

That’s especially important because drivers and trucking companies have the leverage to choose their business partners.

“There are a lot more of us retailers than there are of the box truck providers,” McMahon said. “So are you doing the right things to give them the tools that they need to be successful? Are you making sure they’re not getting detained?”

Guy Bloch, CEO of Bringg. (Seth Clevenger/Transport Topics)

Consumer Expectations

Amazon.com and other e-commerce firms have dramatically altered consumers’ expectations for online orders and product delivery.

The average time of delivery from “click to door” has dropped significantly in recent years, Gartner’s De Muynck said.

In 2015, a week or longer for home delivery was typical, but as of February 2018, Amazon was down to an average of 3.07 days and other retailers were at 4.52 days, he said, citing data from a Rakuten Intelligence study.

Retailers have redesigned their transportation networks to support these faster delivery times.

“Companies have positioned inventory closer to the end customer to satisfy that same-day, next-day, two-day delivery,” De Muynck said.

But given the high cost of next-day and same-day delivery, some retailers have begun offering incentives to customers who are willing to wait longer.

Companies such as Walmart, PetSmart and Kohl’s have introduced discounts and rewards to online shoppers who choose to pick up their orders at physical stores.

While they’re giving away a certain percentage of revenue to offer those discounts, “they also found that when people go into the store, they also buy more product,” De Muynk said.

The revolution in final-mile delivery can be an opportunity, not merely a threat, said Guy Bloch, CEO of Bringg, a provider of delivery-orchestration software to help retailers fulfill e-commerce orders.

Today, consumers want to have full control of when, where and how they receive an order; they expect transparency as the product is in transit, and they even want the ability to intervene during the delivery process with more detailed delivery instructions.

To meet those expectations, businesses must provide an expanded menu of delivery options, such as same-day delivery, click and collect, curbside pickup and delivery to storage lockers, Bloch said.

But those final-mile delivery services add complexity and cost. Companies can’t afford to absorb all of that cost, nor can they simply push that cost to their customers, because they will lose their business.

“You have to optimize every step of the way, every step of the life cycle, to eventually create efficiencies to give you control of your costs and the ability to compete in this market,” Bloch said. “In essence, we need to assume control of the last mile.”

In e-commerce, the customer experience is paramount.

“We are moving from a transactional model with our customers to relationships,” said Lior Sion, founder and chief technology officer at Bringg.

This means businesses must provide customers with options and visibility, he said.

Customers may not need one-day delivery, but they are more likely to return if they know that option is available. Similarly, customers may only look one time at a tracking app to check their orders in transit, but they know it’s there.

“That’s what’s getting them back in your store,” Sion said.

Marc Gorlin, founder and CEO of Roadie. (Seth Clevenger/Transport Topics)

New Delivery Models

The demands of final-mile delivery and limited freight capacity have sparked innovative new approaches to modern transportation challenges.

Technology startup Roadie, for one, has built an “on-the-way” delivery network with its crowdsourced delivery app.

In contrast to a more traditional hub-and-spoke model or even Uber or Lyft’s on-demand approach, Roadie’s local, same-day delivery network utilizes existing, untapped capacity by connecting delivery jobs with nearby passenger-car drivers that are already heading in the right direction.

“You remove a lot of frictional costs when you’re getting people to do things they were already going to do anyway,” said Marc Gorlin, Roadie’s founder and CEO.

The company uses machine learning and vehicle routing to determine the best, most cost-effective matches between drivers and cargo. The underlying technology constantly learns as it begins to more fully understand which data points matter the most for a particular type of gig.

Roadie has partnered with major companies such as The Home Depot, Walmart and Tractor Supply Co. to help them solve their toughest delivery challenges.

“We’re delivering everything from makeup to soft drinks to mattresses to dog food,” Gorlin said.

Due in large part to the size and scope of its major retail partners, Roadie’s on-the-way delivery model can reach nearly 89% of U.S. households and is growing every day, he said.

“We’re not building an infrastructure. We’re revealing and unlocking one that already exists,” Gorlin said. “We see a future that’s beyond these rigid, asset-heavy logistics models, where untapped resources can address delivery demand.”

A tablet showing Peapod's app. (Peapod)

Emerging Technologies

Aerial drones, urban sidewalk robots and autonomous vehicles may also help ease the cost of final-mile delivery.

Manufacturers such as Mercedes-Benz Vans and Workhorse Group have showcased vans equipped with roof-mounted drones for package delivery.

Meanwhile, companies such as Udelv are developing autonomous vans designed specifically for the final mile.

Gartner’s De Muynck said he sees potential for drones and autonomous vehicles to boost efficiency in the final mile, but regulatory frameworks will be needed for broad deployment.

Despite continuing strides in the technology development, it will take many years to ramp up deployment of autonomous vehicles, even after they clear all the regulatory hurdles, he said.

Roadie’s Gorlin said this “robot revolution” may be coming, but cautioned that it won’t immediately solve today’s labor and logistics challenges.

In the meantime, retailers and fleets will need to find other ways to improve productivity at a reasonable cost.

Jewel Hunt, vice president of e-commerce at Albertsons. (Seth Clevenger/Transport Topics)

E-Commerce Expands in Grocery Sector

The food and grocery sector has seen a surge in e-commerce investment in recent years as companies pursue ways to better address the inherent challenges of delivering perishable food products while increasing convenience for customers.

Like many of its competitors, Albertsons Cos. has implemented a multipronged e-commerce strategy that gives its customers a variety of delivery options.

The grocery chain has built an in-house fleet of more than 1,000 trucks for home delivery, including same-day and future-day service.

In addition to the home-delivery option, Albertsons last year began rolling out drive-and-go services, where business and residential customers can order their groceries online, pull up to the store and have those orders loaded into their vehicles without having to enter the store.

The company also recently partnered with Instacart to offer rush delivery in two hours or less.

The combination of those various delivery options is designed to meet the needs of multiple generations of customers, all with their own unique preferences, while still protecting the quality of perishable products regardless of delivery method, said Jewel Hunt, Albertsons group vice president of e-commerce.

“They want to receive everything they ordered, they want to get it on time, and they want the highest quality,” she said. “That ensures the customer comes back time and time again.”

Maintaining the cold chain during home delivery is a key element of ensuring customer satisfaction.

As Albertsons employees pick customer orders ahead of delivery, the products are placed in three temperature zones — frozen, chilled and ambient temperature. The company’s in-house delivery trucks have three compartments with those temperature zones.

“It really does make a difference on quality,” Hunt said.

Albertsons Cos. has 2,275 stores in 34 states operating under more than 20 brands. The company merged with Safeway in 2015.

Hunt said Albertsons serves more than 30 million households with e-commerce deliveries.

As traditional grocery retailers evolve their e-commerce offerings, they also are competing with new players such as HelloFresh that offer meal-kit plans selected online and delivered to customers’ homes.

This meal-kit business model can greatly reduce food waste, which accounts for 30-40% of the U.S. food supply, said Adam Kalikow, senior director of operations at HelloFresh.

“Food waste is really a supply chain problem, because you have a perishable product, and you have to throw out if you don’t use it,” he said.

The key to effectively dealing with the time-sensitive nature of food is to better match supply and demand through data analytics, Kalikow said.

HelloFresh is able to forecast demand more effectively than a typical food retailer by utilizing the customer data it collects through its subscription-based business model and customer surveys, he said. “Data is the linchpin in making all of this work.”