Staff Reporter

Diesel Price Drops Another 8.5¢ a Gallon to Reach $4.209

[Stay on top of transportation news: Get TTNews in your inbox.]

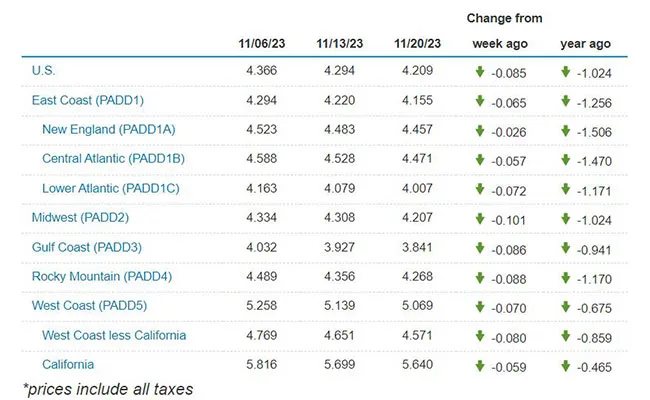

The national average diesel price extended its pronounced decline, falling 8.5 cents to reach $4.209 a gallon, according to Energy Information Administration data released Nov. 20.

The average price for a gallon of diesel has shed 33.6 cents over the past four weeks after a 10.1-cent rise Oct. 23.

Diesel’s price is $1.024 lower than it was at this time in 2022.

The average price for trucking’s main fuel dropped in all 10 regions in EIA’s weekly survey, from a high of 10.1 cents a gallon in the Midwest to a low of 2.6 cents in New England.

Meanwhile, the average U.S. gasoline price slid 6 cents to reach $3.289 a gallon. Two regions — the Gulf Coast and Lower Atlantic — averaged below $3 in the most recent week.

EIA.gov

Retail and wholesale refined product prices continue to fall on the back of underlying crude weakness, say analysts.

It is not a mystery why prices continue to fall, with crude oil futures falling for the past four weeks, GasBuddy Head of Petroleum Analysis Patrick De Haan said in a Nov. 20 phone call with Transport Topics.

The long Thanksgiving weekend offers more downside potential too given the chances of further underlying energy complex weakness.

Flynn

“I don’t know who should be more afraid around the Thanksgiving weekend — oil traders or turkeys,” Price Futures Group analyst Phil Flynn wrote Nov. 21. “Turkeys traditionally end up on the serving plate over the Thanksgiving holiday and oil bulls know how they feel as many … get carved up around the Thanksgiving holiday. Thanksgiving in the oil market is known for its surprising epic oil selloffs.”

However, this Thanksgiving may be different. Hanging over the global energy complex is the question of whether OPEC and its allies will cut crude oil production volumes yet further, said De Haan.

OPEC+ ministers are set to meet in Vienna, Austria, on Nov. 26. Key players in the producer group are expected to push for output cuts beyond those already implemented in an effort to support their budgets, which are heavily dependent on oil revenues, analysts say.

Beyond the long weekend and into the Christmas season, supply and demand dynamics in the U.S. are expected to put their own pressure on retail diesel prices though.

The immediate downside is limited, but refineries are returning from seasonal maintenance outages, so landlocked areas are likely to see pressure on retail prices, said De Haan.

Kloza

“Refiners in Great Lakes and Great Plains states [could] have trouble finding a home for the diesel they produce,” Oil Price Information Service founder and energy analyst Tom Kloza told TT in an email.

Alongside the extra diesel on offer, expectations are for freight markets to continue to bounce along the bottom, according to ACT Research’s latest freight and transportation forecast, released Nov. 20, although there likely will be some holiday volatility.

The market is still challenging at best, said Leonard’s Express CEO Kenneth Johnson. Farmington, N.Y.-based Leonard’s Express ranks No. 91 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

One exception of late was northwestern states, Johnson said, noting that there were fairly strong potato, onion and apple crops this year.

But Johnson said the freight market seems to be at the bottom. “I hope it is at the bottom, I think it is at the bottom, but I think there is a little risk in the first quarter,” he said.

Denoyer

Still, ACT is cautiously optimistic about the holiday season. “We see retail sales turning back to real growth this holiday season, after over a year of declines. The acceleration in real disposable income growth as inflation slowed sharply this year, and the ongoing strong labor market, support a recovery in goods demand,” ACT Research Senior Analyst Tim Denoyer said in commentary accompanying the forecast.

Other analysts are looking beyond Christmas at the heart of the winter season.

“If the weather on both sides of the Atlantic (northeastern U.S. and northwestern Europe) is normal or colder than normal [this winter], I believe we may see some sharp increases for diesel fuel prices. Inventories are quite low unless one counts on a very mild winter,” Kloza said.

“The biggest wildcard would come if there were natural gas interruptions,” said Kloza, adding: “A cluster of very low temperatures can sometimes dictate that utilities and large commercial [natural gas customers] have to burn oil if downstream natural gas supplies are drained, as they often are during periods of subfreezing weather.”

“In the entire 2022-23 winter, we only saw an occasional interruption in the Middle Atlantic. If there is a polar vortex that descends on northern tier states, the diesel/heating oil might fly out of the terminals when dual fuel customers are forced to use oil,” he said.

Risks around prices in New England are particularly high as a result of the inventory tightness, De Haan said. East Coast distillate stocks currently stand at 24.6 million gallons, compared with 36.3 million gallons at the same point in 2021, according to EIA data.

Want more news? Listen to today's daily briefing below or go here for more info: