Special to Transport Topics

Rise of the Smart Trailer

[Stay on top of transportation news: Get TTNews in your inbox.]

Advances in telematics and data analytics are redefining the technology-enabled freight trailer.

The proliferation of inexpensive sensor tags, cameras and data collection hubs combined with real-time reporting and the transition to faster wireless networks have greatly enhanced trailer monitoring capabilities.

These changes are driving a new generation of “smart” trailers that are gathering far more data and business intelligence than just a few years ago.

More fleets are installing cameras to monitor cargo inside the trailer. (PowerFleet)

And with that has come a significant shift in how fleets can manage, measure, allocate and optimize an asset that was once dismissed as “just a dumb box” but is now increasingly recognized as a key factor in supply chain velocity — one that is ripe for improvement.

Knowing a trailer’s location is now “a given,” said Mark Stanton, a general manager at telematics and asset-management provider PowerFleet.

“Fleets now are asking, ‘What is it doing? Is it on the route I expected, or has it diverted? Is it unloaded and can I go get it?’ [Fleets] want that information now rather than waiting for [the shipper] to call [them] three days later,” Stanton said.

The connected devices, data hubs and sensors that are becoming more common on today’s trailers provide real-time information that fleet managers can use to address maintenance or safety issues, protect cargo security and integrity, improve trailer utilization and, perhaps most importantly, keep drivers happy.

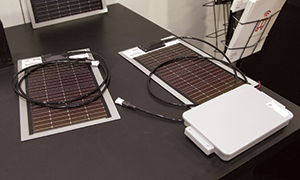

A trailer equipped with a solar-powered tracking unit from PowerFleet. (PowerFleet)

As trailer monitoring technology has matured, the cost of tracking hardware has declined and fleets have learned over time how to use the data more effectively, said Chris Plaat, senior vice president and general manager at BlackBerry Radar, another supplier of asset-tracking systems.

“You can now buy sensors and a gateway for a fraction of the cost of five or 10 years ago,” he said.

Fleet customers’ primary demands are for accurate data and analytics on trailer location, motion and cargo status, he added.

Plaat said these technology platforms are even influencing fleets’ trailer purchasing patterns.

A BlackBerry Radar tracking unit on a trailer door. (BlackBerry)

“Understanding how you are currently using your investment in trailers can inform decisions on how many new trailers you need to buy,” he said. “You buy fewer trailers because you have a better handle on how those you have are being used, and where that capacity can be better optimized.”

Smart trailer technology also can provide maintenance-related insights such as tire pressure and brake performance, alerting fleets to potential safety issues before they escalate.

“The fleet has awareness of a problem before it becomes catastrophic,” said Rob Phillips, CEO of Phillips Connect, which provides a suite of hardware and software on an open platform that consolidates sensor data for intelligent fleet management.

The immediacy of the data and its precision are crucial, he said, because “when you have a tire event happen, you have a very small window to alert the driver” and provide instructions on what to do.

Such actionable data also helps fleets limit or avoid unexpected downtime and its costs. Among the two biggest returns on investment for customers, Phillips noted, are tire management and reducing CSA violations.

Fleets also are leveraging sensor technology to increase revenue and capture “missed” revenues, said Debbie Sackman, senior product manager for the fleets division at SkyBitz.

“For truckload carriers it’s all about decreasing idle time and increasing turns,” she said.

Phillips Connect's Smart7 Pre-Check device scans trailers for potential maintenance issues. (Phillips Connect)

Sensors that provide real-time information on a trailer’s loaded or unloaded status, and if it’s sitting or moving, support more efficient use of that limited capacity.

And with the rise of camera technology inside trailers, fleets now can gain access to cargo images that illustrate shipper and consignee behavior and remove all questions about trailer status.

“Now that you have better documentation, you can have a more productive conversation with the shipper about getting the trailer back faster,” and less quibbling over detention charges, Sackman explained.

A Growing Market for Trailer Intelligence

Trailer-tracking technology typically has found a receptive market in truckload and intermodal operations, where trailers or shipping containers are gone from a depot or terminal for weeks at a time.

However, as trailer costs have been increasing, freight demand has surged and capacity has tightened, these tracking systems are now attracting interest from less-than-truckload providers as well.

Estes Express Lines, for one, is going “all in” on trailer-tracking technology with a companywide deployment of Spireon products across its fleet of 40,000 freight trailers, converter dollies and intermodal boxes. The company plans to complete the rollout by year’s end.

Estes is deploying tracking devices across its fleet of trailers and containers. (Estes Express Lines)

Webb Estes, the fleet’s vice president of process improvement, said the decision at first seemed counterintuitive because LTL trailers typically return to the terminal every evening.

Yet Estes quickly found several advantages to the technology, including fewer disputes over detention charges, reduced manual yard checks and creating a better experience for drivers.

“Driver time is becoming more and more critical,” Estes said. “You want to maximize their hours of service picking up and delivering freight.”

Before, drivers might spend as much as 15 minutes walking the yard looking for a trailer. Now the tracking technology identifies exactly where in the yard that trailer is located, minimizing wasted time and driver annoyance.

“We’re reducing the number of manual yard checks, helping our drivers and keeping better track of trailer status and availability,” Estes said.

Q3 iTECH Stories

►Rise of the Smart Trailer

►Vendors Prep for E-Logs in Canada

►Fleets Find Ways to Harness Trailer Tracking Data

►Dysart: How Fleets Can Double Down on Ransomware Protection

►Clevenger: iTECH Has a New Look With a Familiar Feel

It’s also helped the LTL fleet better manage dwell time with customers.

“Last year we definitely saw dwell increasing,” which delayed recovery and redeployment of trailers, he recalled. “If you don’t have enough room in your warehouse but you want to be able to tell a customer you have the product, the next best thing is [having the product] in one of our trailers outside. It’s today’s version of just-in-time inventory.”

Estes also shared one other unexpected benefit.

“We had a trailer stolen,” he said. “The thief painted it over and put new decals on it, but didn’t know it had the tracking hub. He was pretty surprised when we showed up with law enforcement to recover it.”

Estes, based in Richmond, Va., ranks No. 12 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Tracking Capabilities Expand

As asset tracking has matured, trucking companies have gained access to a wealth of information that extends far beyond dots on a map.

Nonetheless, real-time GPS trailer location remains the first priority, said Roni Taylor, senior vice president of strategy and business development at Spireon, the provider of FleetLocate tracking systems.

Cargo tracking is another core capability. Spireon, for one, offers a laser- and camera-based cargo sensor that provides data on precisely when the trailer is loaded or unloaded — and available for return or pickup.

A Spireoon tracking device installed on a curtain side trailer. (Spireon Inc.)

Taylor said the camera images from inside the trailer show load quality, status and other factors, which “really helps with detention management and claims,” especially when the shipper is loading or unloading the trailer.

“You’re not wasting the driver’s time,” she said. “And the other piece is being able to win your detention battles and really change the behavior of your shipper to get them to unload your trailer faster.”

Another important function is the ability to monitor the health of the liftgate battery.

“If you have a depleted battery that quits halfway through the route, the driver can’t get the remaining loads delivered,” Taylor said. “And you’re looking at a roadside assistance call which might cost $500 to $1,000.”

Meanwhile, with the explosion of “smart trailer” tracking data now available, fleets increasingly are seeking help managing trailer telematics, Taylor added.

Earlier this year, Spireon began offering a managed service program through which a dedicated Spireon employee is assigned to the customer to help manage the data and optimize the asset by monitoring factors such as dwell and turn times, for example.

Another expanding frontier for tracking capability is the use of sensors placed on pallets or directly on the actual freight.

Those types of sensors can collect and transmit data on motion, shock, temperature and humidity.

For a long time, the industry has relied on the driver to check the status of the cargo, “but you really didn’t know what the cargo felt,” said Ron Konezny, CEO of tracking technology provider Digi International.

Fleet managers find that healthy, happy drivers are key to business success. Stephen Kane of Rolling Strong says driver health starts with “being vulnerable enough to listen to somebody that knows about health.” Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

That’s beginning to change.

One of Digi’s customers is premium ice cream maker Haagen-Dazs. Digi’s sensors are attached to individual Haagen-Dazs shipments that go to 90 different receiving locations across the world.

The sensors provide “confidence that during this chain of custody [with the carrier] the temperature is consistent and maintains [product] quality,” Konezny said. “Whether it’s in a truck, on rail or a boat, you know the status.”

Meanwhile, the trailer telematics business has been transitioning to 4G communications as wireless carriers phase out their older 3G networks. Some companies are also beginning to look ahead to 5G.

Road Ready, a telematics brand from Clarience Technologies, in August announced its 5G Ready system, which utilizes today’s 4G networks but is also designed to operate on 5G in the future, thus avoiding service disruptions during the next network upgrade.

Smart trailer devices from vendors such as Road Ready offer solar power options. (John Sommers II for Transport Topics)

Smart trailers also have implications for the development of self-driving trucks.

Lisa Mullen, CEO at Drov Technologies, sees opportunities for her company’s integrated smart trailer system to enable tractor-trailer pairing and communication “that will be essential for a safe and smart connected vehicle.”

“The development of autonomous [trucking] is pulling [the smart trailer] into the picture,” Mullen said. “If you remove the natural senses of the driver, the trailer now also has to be smarter and find a way to communicate directly with the autonomous software operating the truck. ... You have to start enabling trailers today to be ready for future deployment of autonomous trucks.”

Want more news? Listen to today's daily briefing below or go here for more info: