Bloomberg News

Oil’s Ample Supply Has Analysts Seeing Tough Year for Crude

[Stay on top of transportation news: Get TTNews in your inbox.]

Supply is back in the driver’s seat for global oil markets.

At issue is rising crude production from non-OPEC+ nations including the U.S., which could outstrip global demand that’s still growing but at a slower pace. The oil cartel’s response has been to pledge deeper output cuts, but traders are skeptical they’ll be sufficiently implemented to fully eliminate a surplus.

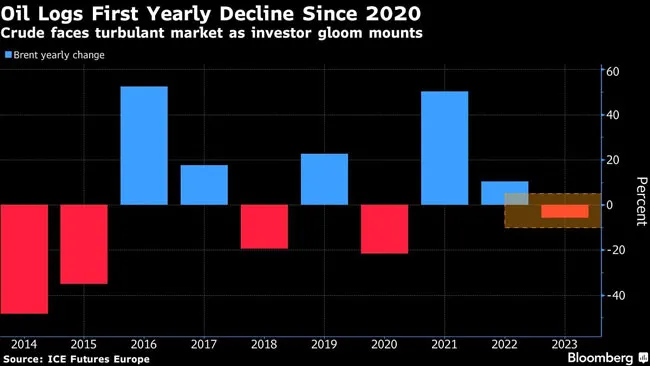

The combination has already pushed crude to its first annual decline since 2020 — both Brent and West Texas Intermediate fell over 10% last year — upending expectations of higher prices stemming from a post-pandemic recovery. Complicating the picture further, speculators have tightened their grip on the market, fueling price swings that are sometimes divorced from fundamentals.

Looking ahead “further than a quarter seems very difficult to me” said Trevor Woods, chief investment officer of commodities fund Northern Trace Capital. “This year coming up is a tricky, tricky year.” Oil is relying heavily on the Organization of the Petroleum Exporting Countries and allies for support, and a collapse in the group’s earlier agreement to curb supply could send prices crashing, he said.

There’s weakness coming through in multiple indicators. The Brent futures curve stood in a bearish contango structure for most of December, with contracts for near-term barrels trading at discounts to later ones. And speculators in 2023 were the most bearish they’ve been on the commodity in more than a decade. Net-long positions held by noncommercial players across the major oil contracts on average stand at the lowest in records dating back to 2011, according to data compiled by Bloomberg.

“The market may have finally moved into ‘show-me mode,’ which will require some combination of substantial stock draws, stronger grades, structure and margins before buying interest returns,” said Vikas Dwivedi, Macquarie Group Ltd.’s global energy strategist.

At least twice in 2023, money managers piled into short positions ahead of OPEC+ meetings and responded to the group’s production cut announcements with waves of selling. Their diminishing faith in the cartel’s ability to balance the market has been further compounded by the rise of algorithmic trading, which can now account for nearly 80% of the daily trades in oil and increasingly fuel prices swings that are independent of fundamentals. A wave of consolidation among producers is also weakening the futures market’s link to physical flows.

Speculators will need some convincing before deciding to turn decisively long on oil in 2024. Commodity hedge funds saw returns slump last year to the lowest since 2019, while raw-material prices logged their first decline in five years, according to Bloomberg indexes. Notably, oil trader Pierre Andurand’s eponymous hedge fund was headed for its worst loss on record.

OPEC Versus Shale

OPEC+’s additional 900,000 barrels a day of voluntary supply curbs, agreed to just a few weeks ago, are a sticking point for analysts and traders trying to price in global demand and supply balances. Traders wonder if the group will deliver enough of the cutbacks to rein in the looming surplus.

The cartel faces a “balancing act,” said Parsley Ong, head of Asia energy and chemicals research at JPMorgan Chase & Co. It “revolves around the fact that U.S. producers are fundamentally price sensitive. The higher OPEC+ keeps oil prices by reducing production, the more traditional oil producers and U.S. shale production will respond to that and boost supply.”

In the U.S., weekly crude production hit a record 13.3 million barrels a day last month, as drillers from the Permian Basin in West Texas to the Bakken Shale of North Dakota ramped up oil production well beyond what analysts foresaw. And in 2024, output is expected to set a new all-time high, according to the U.S. Energy Information Administration. Brazil and Guyana are also set to boost supplies significantly, contributing to a wave of new crude from the Americas.

Demand Growth

On the demand side, global consumption growth should slow as economic activity weakens, according to the International Energy Agency’s latest market outlook. The group forecasts demand will edge up by 1.1 million barrels a day this year.

While that’s less than half of 2023’s latest estimated growth rate, the figure is still high by historical standards. Consumption is normalizing after the once-in-a-generation disruption caused by the pandemic and in the U.S., growing expectations of a so-called soft landing are buoying energy demand.

Still, the global picture is uneven with a rapid switch away from oil in some sectors. In China, Asia’s top crude importer, the electrification of cars is presenting structural headwinds for oil consumption, weighing on demand growth, said Anthony Yuen, head of energy strategy at Citigroup Inc.

Want more news? Listen to today's daily briefing above or go here for more info

“This is limiting oil’s sensitivity toward wider macroeconomic factors,” he said. “In the past, economic indicators might directly translate into higher ground transportation and fuel demand,” but this relationship now appears to be weakening as electric vehicle uptake increases.

Analysts are, however, mindful of geopolitical risks. Attacks in the Red Sea by Yemen-based Houthi militants remain in focus, and Russia is still waging war in Ukraine.

The year’s opening week has already seen such risks come to the fore, with multiple attacks in the Red Sea by the Houthis and two of Libya’s oil fields, which normally pump about 365,000 barrels a day combined, shut by protesters. That’s adding to short-term price fluctuations and more uncertainty.

But ultimately, global producers still have the power to withhold output to meet demand trends, although that will boil down to discipline and intention.

“OPEC+ is interested in maximizing their revenue, so it’s in their interest to consider producing more,” said Citi’s Yuen. “But I think it will depend on how production from non-OPEC sources pans out over next year.”