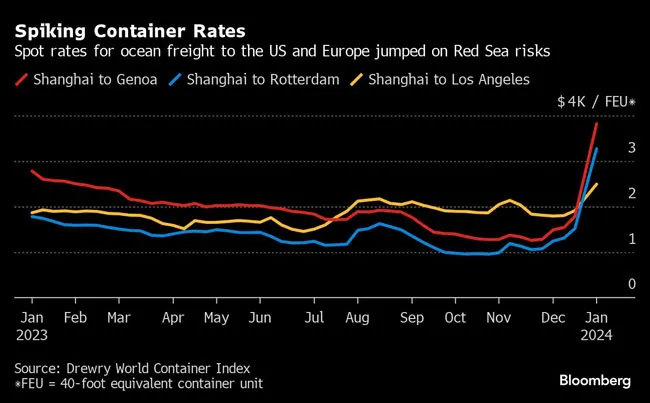

Spot Container Shipping Rates Soar 173% on Red Sea Threats

[Stay on top of transportation news: Get TTNews in your inbox.]

Short-term rates for container shipping between Asia, Europe and the U.S. are climbing on reduced capacity caused by the threats to cargo vessels in the Red Sea.

The spot rate for shipping goods in a 40-foot container from Asia to northern Europe now tops $4,000, a 173% jump from just before the diversions started in mid-December, Freightos.com, a cargo booking and payment platform, said late Jan. 3.

The cost for goods from Asia to the Mediterranean increased to $5,175, Freightos said, adding that some carriers have announced prices above $6,000 for this route starting in mid-January. Rates from Asia to North America’s East Coast have risen 55% to $3,900 for a 40-foot container.

Services from Asia to northern Europe and to the Mediterranean both cost more than twice their levels in January 2019, but are still well below their peaks during the COVID-19 pandemic, said Judah Levine, head of research at Freightos.

A separate gauge of spot container rates released Jan. 4 also showed a surge. According to the Drewry World Container Index, rates from China to Europe have more than doubled since Dec. 21, and those from Shanghai to Los Angeles rose 30%.

The rate spike is part of the fallout from a slowdown in Suez Canal traffic, which has slumped by more than a quarter in recent days as vessels take longer routes to avoid missile strikes from Yemen’s Iran-backed Houthi militants. The Houthis say they are going after any vessels that have a connection with Israel, although those purported links have looked increasingly tenuous.

Shipping lines raise their prices when capacity is stretched, and add surcharges for the extra time it takes to deliver the goods and during busier-than-normal periods of the year.

Meanwhile, blasts near the grave of Iranian commander Qassem Soleimani, which killed nearly 100 people, threaten to widen the Middle East conflict. Tehran has said the attacks were carried out to punish its stance against Israel, although the U.S. said neither Israel nor itself were involved.

“This is no longer taking place during the holiday lull either — demand may be increasing as shippers start to pull forward volumes to make up for longer transit times and in preparation for China’s Lunar New Year holiday in early February,” Levine said in a blog post. “Together, this could increase the risk of congestion.”

In the 10 days through Jan. 2, the number of Suez transits was down 28% from a year earlier, according to figures released Jan. 3 by the International Monetary Fund’s PortWatch platform, which is produced with Oxford University. That’s consistent with 3.1% of global commerce being diverted away from the Red Sea, according to the data.

The IMF called the Red Sea a “systemically important” shipping lane that handles more than 19,000 vessel transits a year. Reduced traffic has been observed since Dec. 16, the Washington-based institution said in the note.

Want more news? Listen to today's daily briefing above or go here for more info

For cargo owners seeing their freight costs rise, the risk is that spot rates will stay elevated and leave them with less leverage when they’re negotiating long-term contracts, which typically takes place between March and May. Most ocean freight moves on rates set in these contracts.

The impact goes beyond the container sector.

Oil tanker markets have also seen some gains, ship broker Braemar wrote in a research report, mostly for vessels hauling refined fuels like gasoline and diesel. Earnings for ships hauling refined fuels from the Mediterranean to Japan via the canal have climbed from about $8,000 a day in early December, to $26,000 this week.

“Any route involving the Red Sea is red hot,” the Braemar analysts said.