Staff Reporter

March Medium-Duty Sales Post 5.6% Decline

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales for medium-duty trucks fell 5.6% in March compared with the year-ago period, according to data from Wards Intelligence.

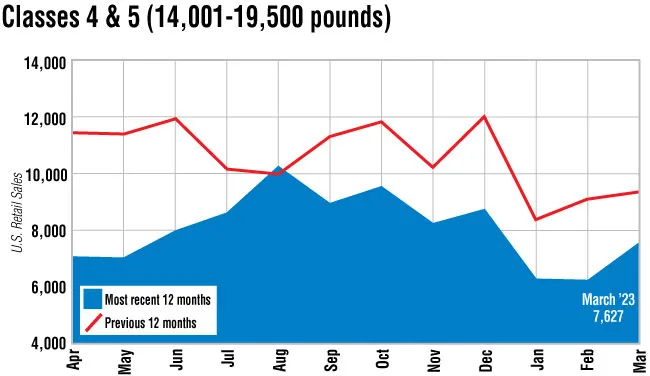

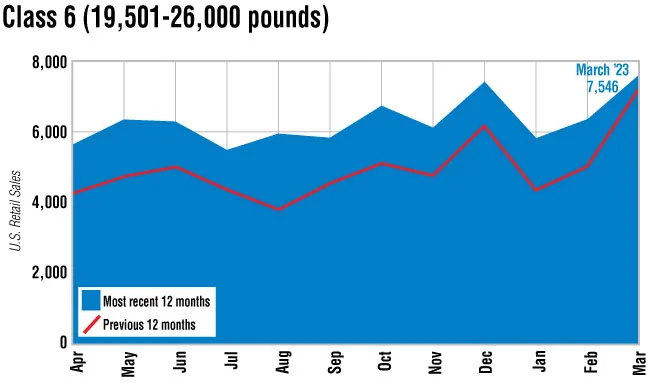

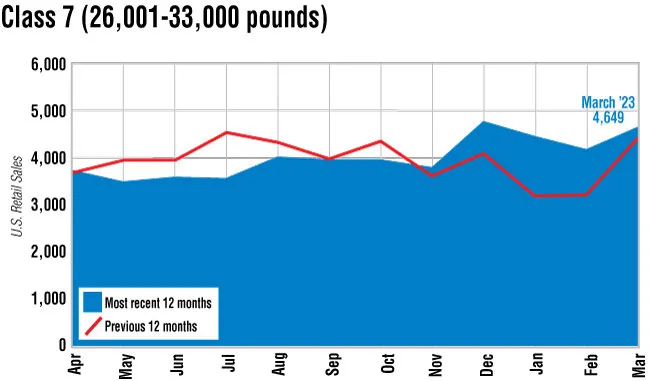

Total retail sales for Classes 4-7 trucks declined to 19,822 units from 21,002 last year, dragged down by Classes 4 and 5, which saw combined sales figures drop 18.8% year-over-year to 7,627 from 9,393. The heavier classes experienced a more favorable year-over-year difference. Class 7 truck sales increased 6.5% to 4,649 from 4,365 units. Class 6 went up 4.2% to 7,546 from 7,244.

Freightliner, a brand of Daimler Truck North America, sold the most in Class 7 at 2,524, as well as in the Class 6 category at 2,418. Ford sold the most Class 5 trucks at 2,021, while Isuzu led the pack in Class 4 with 956 units sold.

“The most interesting thing to see there is kind of the interplay,” Steve Tam, vice president at ACT Research, said. “Classes 4 and 5 both have been lagging behind. Although, it’s really been Class 5 that we’ve kept our eye on and so it’s heartening to see that they had a very strong month relative to where they have been, at least the last couple of months. It’s almost as if the market went to sleep and all of a sudden woke back up. But, I think, for the most part, pretty much in line with our expectations.”

Tam noted that because of the parts shortage, manufacturers would often prioritize trucks that were more profitable. These tended to be bigger trucks such as Class 8. Classes 6 and 7 had been disproportionately impacted by the parts shortage and allocation strategies as a result. But momentum has picked up this year with manufacturers working past those constraints.

“I think they’re finally getting some relief on that front,” Tam said. “I think that’s what we’re starting to see, and we expect that position to be the situation for most of the year and actually even improve into next year. Some of that pent-up demand in the medium-duty space is going to take longer to fulfill. We’ll probably be caught up on Class 8 by the end of the year. But we’ll be working on medium-duty into the 2024 time frame.”

The overall drop in medium-duty sales for March is the second consecutive monthly decrease since a 3.8% gain in January. That was the first increase across Classes 4-7 since August, which was also the only month last year that saw a year-over-year increase.

“It’s just kind of getting incrementally better as time progresses,” Tam said. “So yes, in that regard, that’s part of the reason I think that we’re seeing the improvement that we’re seeing in the medium-duty space. But it’s not gone yet. It’s still there.”

Want more news? Listen to today's daily briefing below or go here for more info: