Senior Reporter

Classes 4-7 US Retail Sales Rise in August on Class 6 Surge

[Stay on top of transportation news: Get TTNews in your inbox.]

Classes 4-7 U.S. retail sales in August climbed 11.7% overall compared with a year earlier to more than 20,000, primarily because of a huge jump in Class 6 sales, Wards Intelligence reported.

Sales reached 20,261 compared with 18,132 a year earlier.

Year-to-date sales fell 8.6% to 143,854 compared with 157,475 in the 2021 period, according to Wards.

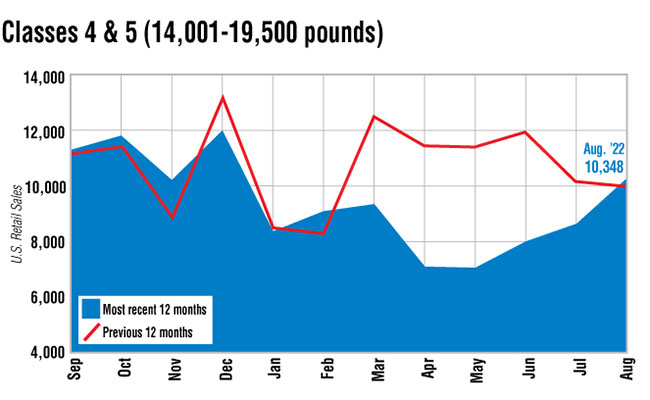

Source: Wards Intelligence/Transport Topics graphic

One truck dealer executive said the medium-duty market has changed substantially in 2022.

“The manufacturers also selling Class 8 commercial vehicles have put more focus on building Class 8 trucks then their Classes 6-7 trucks,” said Robert Gomez, executive vice president of truck sales for Worldwide Equipment Enterprises Inc.

“So we probably have a higher demand for a medium-duty truck today than I do Class 8 trucks,” he said. “It’s the same allotments in 2023, so I won’t be able to meet demand unless they increase production.”

Knoxville, Tenn.-based Worldwide Equipment has locations in six states, including 15 full-service, multibrand medium- and heavy-duty dealerships, six satellite parts stores and 10 leasing locations, and 900 employees.

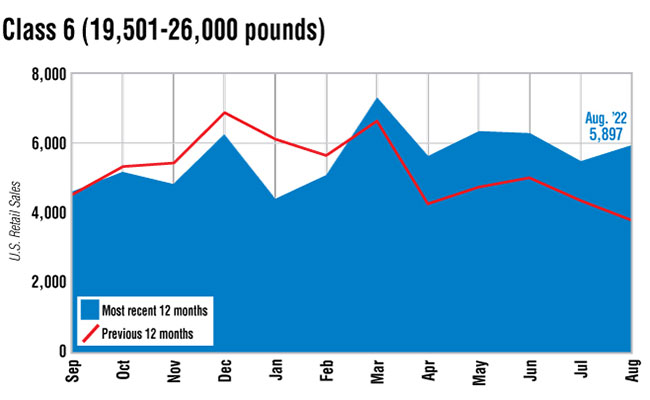

Source: Wards Intelligence/Transport Topics graphic

Signs of a possible increase appeared in August in Class 6, at least for one month.

Class 6 sales were 5,897, up 54.3% compared with 3,821 a year earlier. But the total for the month was only the fourth best of 2022.

As usual, three truck makers landed in a tight battle for market share.

Ford Motor Co. had a 26.5% share with 1,564 sales; International, a brand of Navistar Inc., had a 25.8% share on sales of 1,525; and Freightliner, a brand of Daimler Truck North America, had a 24% share on sales of 1,418. The segment draws buyers from major truck leasing companies seeking new equipment.

Class 7 sales of 4,016 dropped 6.2% compared with a year earlier, but August sales were the second highest of the year. March had 4,365 sales.

In the segment, Freightliner had a 43.5% share on sales of 1,747. International had a 36.4% share on sales of 1,462.

Source: Wards Intelligence/Transport Topics graphic

In Classes 4-5, sales of 10,348 climbed 3.2% compared with a year earlier. It was the combined segment’s highest monthly total in 2022.

In Class 5, Ford dominated with sales of 4,071, or 51.9% of the total 7,843. A year earlier, Ford’s sales were 4,605.

“Notably, Class 5 volumes rose to a new record level in 2021, but production constraints continue to limit volume in 2022 and into 2023,” ACT Research President Kenny Vieth said in a release.

In this special edition of RoadSigns, hosts Seth Clevenger and Mike Freeze provide an inside look at Transport Topics' 2022 Top 100 Private Carriers list. Tune in above or by going to RoadSigns.ttnews.com.

Class 4 sales rose to 2,505 compared with 2,294 a year earlier.

Isuzu Commercial Truck of America notched a 38.9% share with 976 sales. Ford was next with a 26.9% share on 675 sales.

In related news, Ford announced new fleet management software for its Pro Intelligence suite. It is designed to help make what Ford termed “mountains of paperwork and endless spreadsheets” a thing of the past for small business owners. The software is focused on fleets of 150 vehicles or less, including non-Ford vehicles. The size of the vehicles within the business fleet does not necessarily matter, according to the company.

Want more news? Listen to today's daily briefing below or go here for more info: