Staff Reporter

Medium-Duty Truck Sales Jump 10.9% in July

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales for medium-duty trucks grew 10.9% in July compared with the year-ago period, according to data from Wards Intelligence.

Total retail sales for Class 4 through Class 7 trucks increased to 19,618 units from 17,682 units, marking the fourth consecutive month showing a gain from the prior year.

The only other year-over-year increase this year was in January. The only increase last year occurred in August.

But the latest results were down 10.5% sequentially, with 21,924 units sold in June.

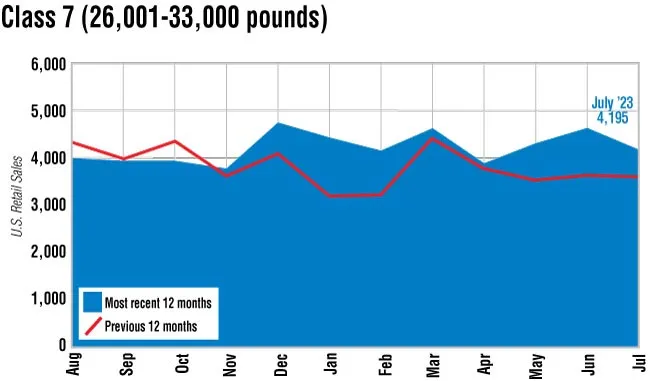

Every class saw an increase in sales from the prior-year period. Class 7 experienced a 17.8% gain to 4,195 from 3,560 units.

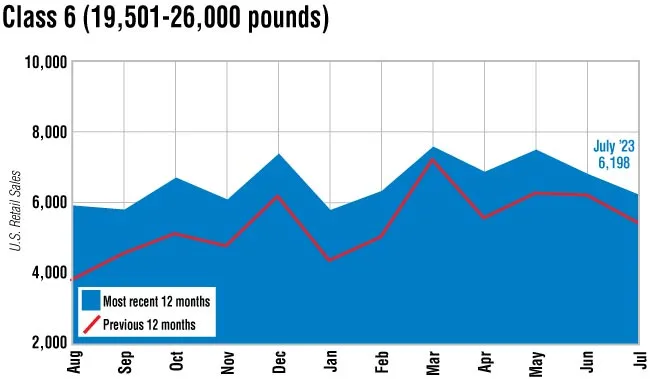

Class 6 reported a 13.9% increase to 6,198 from 5,440 units.

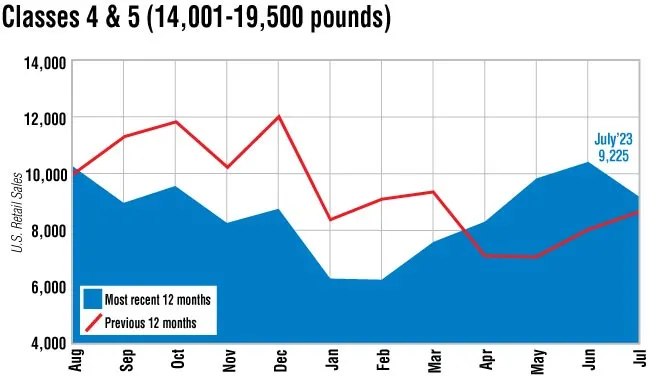

Classes 4-5 collectively saw sales increase 6.3% year-over-year to 9,225 from 8,682 units.

Freightliner, a brand of Daimler Truck North America, sold the most Class 7 trucks at 1,909 units. It also sold the most in Class 6 at 1,637.

Ford sold the most in Class 5 at 3,800 units while Isuzu led the pack in Class 4 with 889 units sold.

“I feel sorry for the medium-duty buyers,” said ACT Research Vice President Steve Tam. “They’re still experiencing an elevated level of frustration in terms of trying to get delivery of units that they’ve ordered.”

Tam said that he has heard anecdotally that truck manufacturers were allocating scarce resources to maximize profit per unit. The bigger classes of trucks tend to be more profitable. But there has been growing demand among the lower classes as some carriers have sought to gain vehicles that don’t require a commercial driver license.

“It all goes back to that, let’s employ our scarce resources where they can create the biggest bang for the buck,” Tam said. “You cannot fault the OEMs for adopting that strategy, but it doesn’t make it any less frustrating for the medium-duty folks.”

ACT Research is expecting a 10% year-over-year increase in sales. But Tam notes there are differences among the weight classes because of those carriers moving more of their operations to vehicles in classes below the CDL requirement.

“The for-hire trucking industry doesn’t make up as large a share of new truck sales in medium duty as it does in Class 8,” said Chris Brady, principal for Commercial Motor Vehicle Consulting. “So, the truck sales are definitely more private fleets and they haven’t been as aggressive purchasing new trucks as compared to the Class 8 and for-hire trucking industry. So, I don’t expect that side to be, going forward, as fragile right now as the Class 8 market.”

Brady also echoed the point that the truck manufacturers have been leaning in favor of Class 8 output.

“Probably because they make more money on a Class 8 truck than a 6 or 7,” Brady said. “So, they probably put their resources to increasing that for profitability and maybe that, with the supply chain issues, constrained 6 and 7.”

Want more news? Listen to today's daily briefing below or go here for more info: