Staff Reporter

March Medium-Duty Sales Hit Five Months of Gains

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales for medium-duty trucks hit their fifth consecutive month of year-over-year gains in March but at a lower rate of 0.7%, according to data from Wards Intelligence.

Classes 4-7 total retail truck sales increased to 19,961 units from 19,822 during March 2023, marking the lowest year-over-year increase since the streak of positive gains started in November. But it was 4.9% higher sequentially from the 19,022 units in February.

“From a sales perspective, there’s not a lot driving change in demand this year for the medium-duty market,” ACT Research Vice President Steve Tam said. “One of the big challenges that buyers in this space have had is just getting delivery of units that they already have on order.”

Tam noted that the data suggests about a 2% increase on a month-over-month basis for Classes 5-7. That also puts medium-duty sales about 4% higher year-to-date. That aligns closely with his current forecast for sales this year of a 3.3% increase. But he does point out that there is still a significant backlog, with truck manufacturers being more focused on heavier units.

“The manufacturers have made, I think, the intentional choice to favor fulfilling heavy-duty orders before they focus on the medium-duty side,” Tam said. “So our backlog of orders in medium-duty is more than twice — it’s about 2.2 or 2.3 times its normal level. So we’ve got a lot of units that have been ordered and have yet to be delivered.”

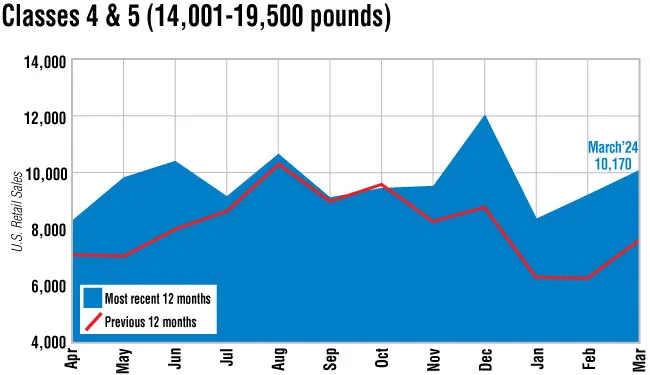

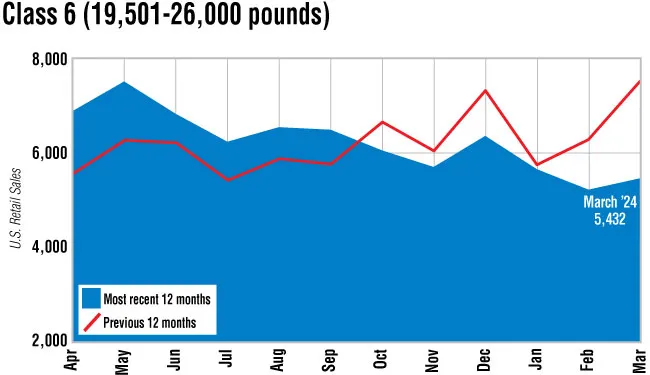

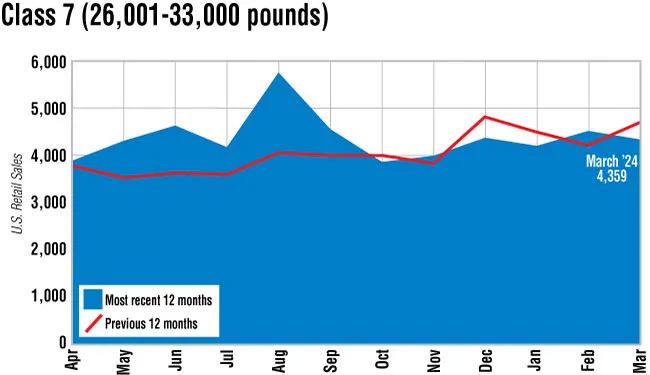

The data showed that two of the four medium-duty classes saw a year-over-year gain. Class 7 sales decreased 6.2% to 4,359 units from 4,649. Class 6 fell 28% to 5,432 units from 7,546. Classes 4-5 increased 33.3% to 10,170 from 7,627.

“On the heavy-duty side, their backlog has actually fallen to pretty close to normal levels,” Tam said. “I had hoped to see a pickup in deliveries or in sales in the medium-duty market earlier because we had a bigger downturn forecast in the heavy-duty space. But when the OEMs started implementing some of these programs, we were compelled to increase our Class 8 forecast, and unfortunately that was largely at the expense of medium-duty.”

The Environmental Protection Agency is set to revise existing heavy-duty vehicle standards to reduce greenhouse gas emissions starting with model year 2027. The new rule, known as the Phase 3 greenhouse gas standards, will apply to both heavy-duty vocational vehicles and tractors.

“I think the end game of those programs that I talked about is the manufacturers are trying to push some of the anticipated demand ahead of the EPA [2027] mandate,” Tam said. “Right now, we’ve got a huge pre-buy in ’26. So large, perhaps, [that] the industry could be challenged to supply that or meet that demand. So I think with these programs, they’re trying to shift the timing of that demand. So push it into ’25 and even into the second half of ’24 based on what we’re seeing right now.”

Freightliner, a brand of Daimler Truck North America, sold the most Class 7 trucks in March at 1,964 units as well as the most Class 6 trucks at 1,433. Ford sold the most in Class 5 at 3,850 units and the most Class 4 units at 1,077.

“You still have open build slots in the second quarter, and this is April,” Tam said. “Now the third and fourth quarters aren’t empty, but there’s certainly plenty of room to be scheduling production for deliveries this year. I think, unless I’ve missed my guess, we’ll probably see that continue. I liken it to taking a bulldozer over the top of the peak and trying to fill in the valley. I think that type of activity is what we can expect to see as a theme as 2024 continues to progress.”

Want more news? Listen to today's daily briefing below or go here for more info: