Staff Reporter

Medium-Duty Sales Hit Fourth Month of Gains in February

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales for medium-duty trucks increased 13.5% year-over-year in February, marking a fourth consecutive month of positive gains, according to data from Wards Intelligence.

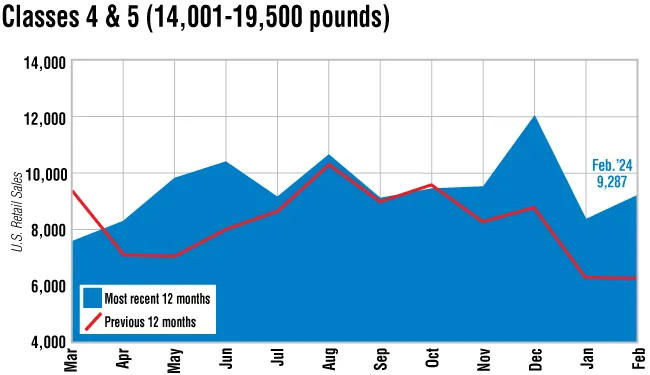

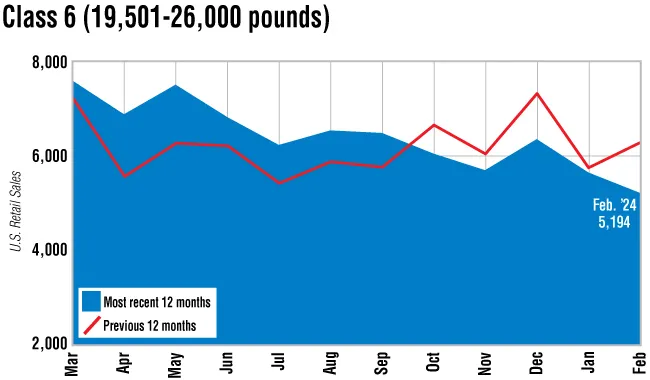

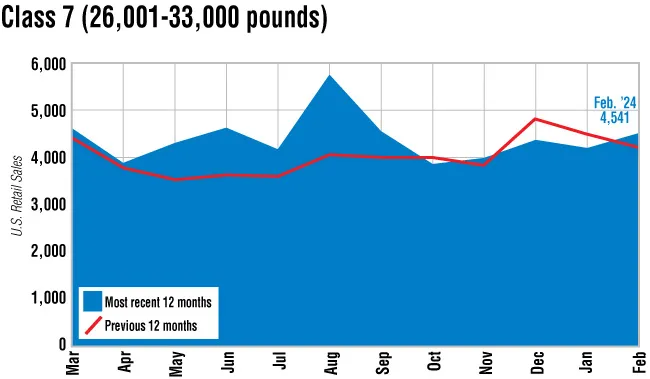

Classes 4-7 total retail truck sales increased to 19,022 units from 16,760 during the same time the previous year. The results also were 4.1% higher sequentially from 18,273 units in January. The most recent year-over-year decline was 4.2% in October.

“It depends on how you slice it and dice it,” ACT Research Vice President Steve Tam said. “Some mix-shifting within the lighter GVWs, but it’s the fact that demand is just so pent-up in that space. Also, we’ve got elevated inventory levels. So, it doesn’t surprise me to see — even though they didn’t hit their build rates — that they were still able to make an improvement in sales.”

The data showed that three of the four medium-duty classes saw a year-over-year gain. Class 7 increased 8.8% to 4,541 units from 4,174, while Classes 4-5 saw sales increase 47.9% year-over-year to 9,287 from 6,281. Class 6 declined 17.6% to 5,194 from 6,305.

Freightliner, a brand of Daimler Truck North America, sold the most Class 7 trucks in February at 1,802 units, as well as the most Class 6 trucks at 1,277. Ford sold the most in Class 5 at 4,179 units. Isuzu topped Class 4 with 885.

“We’re not expecting much in the way of improvements this year,” Tam said. “We’re calling for about a 1% gain in sales this year in the Classes 5 to 7 market. It’s actually flat. And production, for what it’s worth, isn’t going to increase. That sales increase is going to get subsidized by what we have in inventory right now. Hopefully, we’ll be able to end the year with a lower inventory number for mediums.”

He also noted that emissions regulations taking effect in 2027 are already shaking up the broader market.

“The forecast has been kind of in flux on the Class 8 side,” he said. “We are having to capitulate to the OEMs who seem to just be on a real mission to try to flatten out the 2026 pre-buys. Even so far as in maybe delivering some of those units as early as the second half of this year.”

ACT Research also increased its production forecast on the Class 8 side to recognize what has been happening on the medium-duty side. Tam noted that it’s not a zero-sum game, but it has become pretty close, which puts pressure on the mediums.

Want more news? Listen to today's daily briefing below or go here for more info: