Staff Reporter

January Classes 4-7 Retail Sales Surpass Year-Ago Period

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales for medium-duty trucks experienced a 3.8% increase year-over-year in January, according to data from Wards Intelligence.

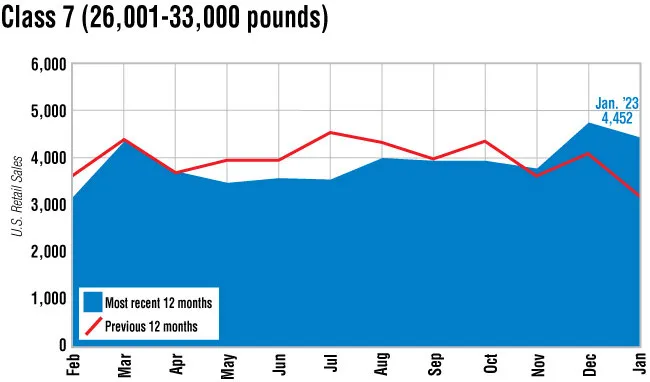

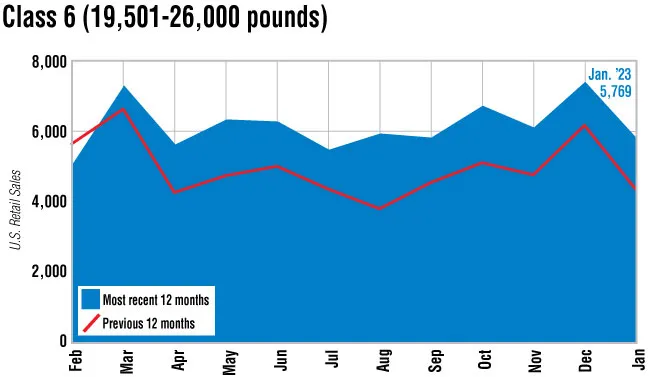

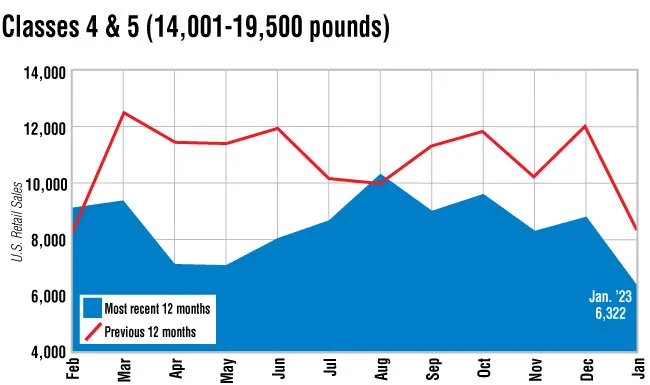

Classes 4-7 saw total retail sales increase to 16,543 from 15,933 last year.

This is the first year-over-year increase in medium-duty truck sales since an 11.7% rise in August. That was also the only month last year that saw an increase compared with 2021.

The gains were primarily driven by a 41.1% increase in Class 7 to 4,452 from 3,155 last year. Class 6 saw a 32% increase to 5,769 from 4,372. These gains were partially outset by a 24.8% drop in Classes 4-5 truck sales to 6,322 from 8,406.

Freightliner, a brand of Daimler Truck North America, sold the most trucks in the Class 7 category at 2,184. It also sold the most in Class 6 at 2,186. Ford sold the most Class 5 trucks at 1,931. Isuzu sold the most units in Class 4 at 670.

“We again did better than expected,” ACT Research Vice President Steve Tam said. “We don’t have a good sense on the medium-duty side what that incomplete chassis situation looks like. I would have to believe that it’s probably similar [to Class 8], but in typical fashion not as severe. So I think that it’s probably a parallel storyline for Class 6 and 7.”

Tam noted that medium-duty sales tend to see a decline after a year-end boost. But the decrease this year was not as bad as would be expected for Classes 6 and 7.

“On the lighter duty side, the Class 4 and 5, it was actually softer than that,” Tam said. “Fours were down almost 30% and 5s were down about 28%. That’s kind of been a pattern, especially in the 5s that we’ve seen for the whole second half of last year. And I think that goes back to the customer set. For sure on the Class 6 side, we’ve seen some strength and I think that’s probably fleets, especially private fleets and maybe to some degree the leased rental folks, pushing for non-CDL trucks in this labor-challenged market.”

He noted that CDL requirement is another obstacle when it comes to recruitment. “So if you can go Class 6 you can still get the vast majority of the benefit in terms of freight hauling in particular but without the added hurdle of having a CDL,” Tam said. The differentiation between Class 5 and 6 he ascribes to the lease rental sector, noting that typically they’re more Class 6 and 7 focused.

“And so I think they’re really pushing hard on trying to get deliveries of those Class 6 vehicles and that is coming at the detriment of smaller and lighter vehicles,” Tam said.

Want more news? Listen to today's daily briefing below or go here for more info: