Staff Reporter

February Medium-Duty Sales Post 3.4% Decline

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales for medium-duty trucks declined 3.4% in February compared with year-ago levels, according to data from Wards Intelligence.

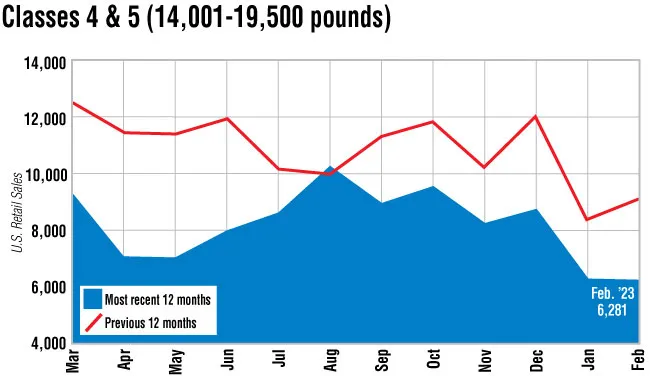

Total retail sales for Classes 4-7 trucks fell to 16,760 units from 17,355 last year, dragged down by Classes 4 and 5, which saw combined sales figures drop 31.2% year-over-year to 6,281 from 9,134.

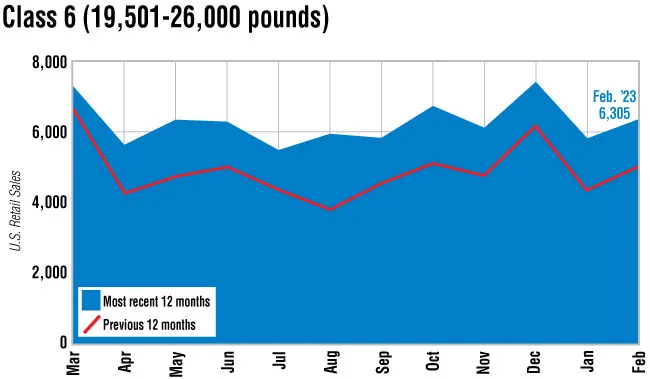

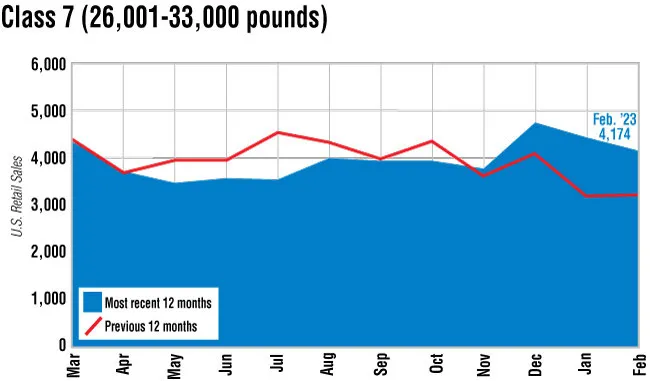

It was a different story in the heavier classes, as Class 6 sales rose 25% to 6,305 from 5,044 and Class 7 sales increased 31.4% to 4,174 from 3,177 last year.

Freightliner, a brand of Daimler Truck North America, sold the most in Class 6 at 2,355, and notched the highest tally in the Class 7 category at 2,214. Ford sold the most Class 5 trucks at 1,948, while Isuzu led the pack in Class 4 with 722 units sold.

“More of the same is the phrase that comes to mind,” Steve Tam, vice president at ACT Research, said in response to the February numbers. “Very similar situation there as far as the distinction between fleet growth and replacement. It’s been interesting to see — the large lease rental companies typically are running Classes 6 and 7 equipment, and even though they’re large customers they’ve also been hamstrung by not being able to get as much equipment as they want to keep their fleet age where they’d like to.”

Tam noted that the gains in the heavier classes tracks with the business case for manufacturers looking to maximize output in a constrained market. “[They’re] going to make the one that’s going to be more profitable, and generally speaking the bigger the truck, the more profitable it’s going to be,” he said. “I think that’s why we’re seeing some deterioration in that lighter duty portion of the commercial truck market.”

Tam noted the lack of available new equipment keeps utilization rates high for lease and rental companies, which presents a challenge for their customers — especially smaller fleets — who typically turn to them when they have an immediate need for equipment. With lease and rental firms facing the same challenges as their customers, some customers turn to lighter trucks, he said.

“I still can’t help but think that folks are trying to stay away from that [commercial driver license] requirement because of the labor situation — driver availability — and focusing on under-CDL trucks as the primary or first choice when they can get them,” Tam said. “On the light-duty side — that Class 4 and 5 market — it’s interesting to see, long-term, some pretty meaningful erosion.”

The overall drop in medium-duty sales for February follows a 3.8% gain in January. That result was the first increase across Classes 4-7 since August 2021.

Want more news? Listen to today's daily briefing below or go here for more info: