Staff Reporter

February Class 8 Sales Up 35% to 20,136

[Stay on top of transportation news: Get TTNews in your inbox.]

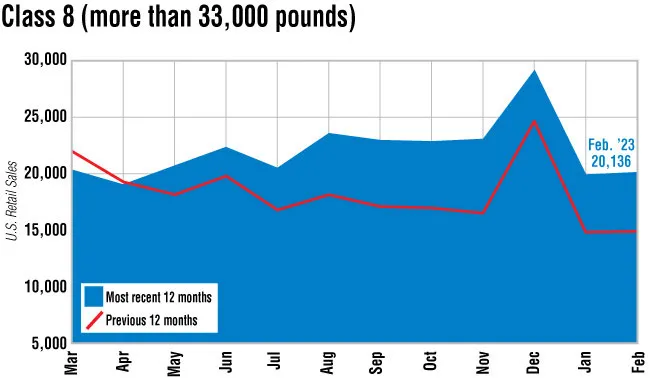

U.S. Class 8 retail sales in February jumped 35% from a year ago, and notched a slight increase from the prior month, Wards Intelligence reported.

Class 8 sales for the month reached 20,136, easily besting the year-ago mark of 14,916 and outpacing January’s total of 19,932 units.

“I think that number is not only in line with what we’re seeing, but also seems to make a lot of sense,” said Steve Tam, vice president at ACT Research. “Last year was a very different year. We were still in the thick of all the supply chain challenges and whatnot. And the industry, I think, has made a lot of progress in terms of moving past that.”

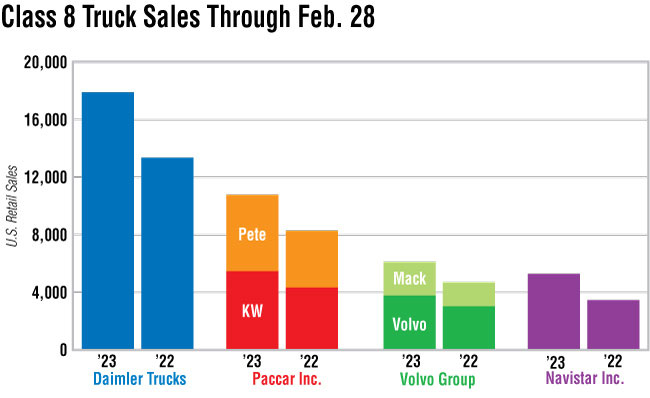

Freightliner, a brand of Daimler Truck North America, led the pack with 7,368 trucks sold, accounting for a market-leading 36.6% share. Navistar experienced the largest year-over-year increase as sales jumped 86.8% to 2,828 units from 1,514.

All of the major truck manufacturers posted sales gains over the prior year. Kenworth Truck Co.’s sales increased 34.2% to 2,843 from 2,118, while Peterbilt Motors Co. sales rose 22.2% to 2,843 from 2,327. Both are brands of Paccar Inc.

Mack Trucks’ sales increased 36.7% to 1,344 from 983, and Volvo Trucks North America’s sales grew 45.6% year-over-year to 2,366 from 1,625. Mack and VTNA are brands of Volvo Group.

“Mack sales grew at a similar rate in February as we continue to optimize output. These numbers are indicative of the strong demand and healthy backlog of orders from customers eager to refresh their fleets,” Mack Trucks President Jonathan Randall said.

Western Star, a Daimler brand, experienced a 16.6% increase in sales to 534 from 458.

In addition, Tesla sold 10 of its Class 8 Semi electric trucks.

“If you take that number and seasonally adjust it, it’s almost a 290,000-unit seasonally adjusted annual rate,” Tam said. “Our forecast right now: we’re sitting at just shy of about 260,000 for the U.S. market. So, in that regard, it’s quite a robust number. But bottom line, I think, no matter how you look at it, truckers are out there still purchasing vehicles.”

Tam noted that most of these purchases are likely aimed at replacing older units over growing fleets, given economic uncertainty in the broader economy and the freight market.

“February started to trend back towards the numbers that we would like to see after a slower than expected start to the year in January,” Magnus Koeck, vice president of strategy, marketing and brand management at Volvo Trucks. “For North America in February the preliminary numbers had us at an 11.6% market share, 11.8% in the U.S. and 9.7% in Canada. That’s a significant improvement from January in the U.S. market, but we did see a slight decline in Canada. While February was better, we are focused on March and are optimistic that we can see a stronger month.”

FTR, an economic and freight forecasting firm, is also expecting its own truck sales results to be similar when published for February. FTR CEO Jonathan Starks noted the sales environment has been very stable outside of December.

“That was a really huge December sales environment and that was not going to be sustained,” Starks said. “But even just accounting for that, we’ve been running at a good solid clip for basically close to a year. Starting in March of last year is when we hit a point of time in which the sales environment ticked up and has held up at a good solid clip ever since then.”

Starks is anticipating that there will be slightly better sales as the year progresses. But around the midyear point he thinks there will be an inflection point that will lead to a slight softening in that trend.

“They’re at a fairly stable inventory level and they’ve essentially hit a fairly stable production environment,” Starks said. “So, whatever they can produce, they can basically translate that straight into a near term sale. And so, there’s not a bunch needing to go in into inventory and the amount that they’re taken out of inventory, they’re able to replenish.”

Starks also noted that the backlog numbers have probably already peaked, meaning they’re going to slowly come down going forward. But even so he doesn’t think that the backlogs are really what is driving the environment right now.

“While not fully back to normal, we’re seeing an increasingly more manageable supply chain for critical components and continued strong demand for our Western Star and Freightliner trucks,” said David Carson, senior vice president of sales and marketing at Daimler Truck North America. “The combination bodes well for both our customers and dealers, and we remain focused on ensuring we can meet demand to keep the nation’s fleet moving smoothly.”

Want more news? Listen to today's daily briefing below or go here for more info: