Staff Reporter

July Class 8 Sales Up 2.5% Year-Over-Year

[Stay on top of transportation news: Get TTNews in your inbox.]

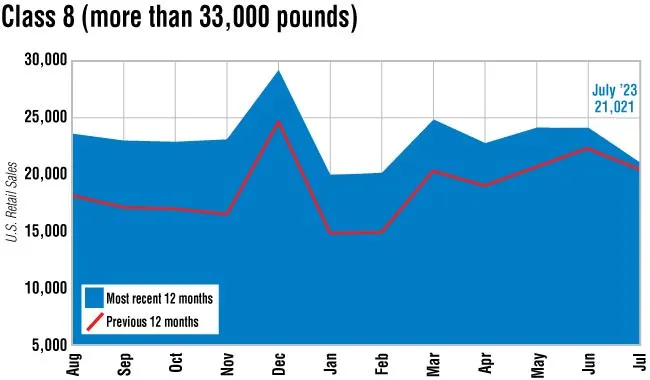

U.S. Class 8 retail sales in July increased 2.5% from a year ago but were down from the prior month, Wards Intelligence reported.

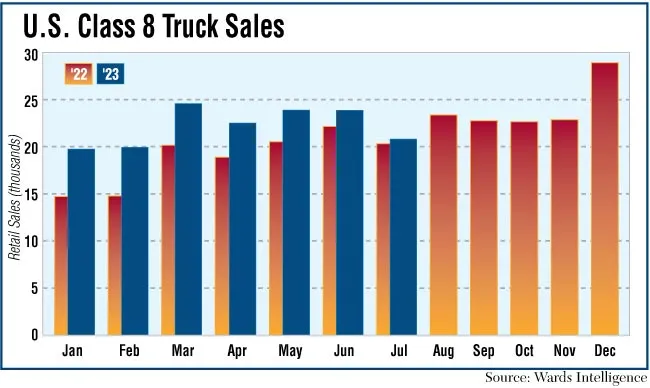

Class 8 sales reached 21,021 units, up from 20,513 in July 2022, but volumes were down 12.7% from the 24,085 sold in June. Retail sales have experienced a year-over-year increase every month this year. Year-to-date, Class 8 sales are up 18.2% to 156,823 compared with 132,694 at this time in 2022.

“In terms of the sequential decline, it pretty much exactly met expectations with what happens on a seasonally adjusted basis,” said Steve Tam, vice president at ACT Research. “So, not too surprising or too concerning in terms of the actual movement on a month-on-month basis. Of course, longer term, we definitely like seeing the improvement. We’d like to see more improvement, but it is what it is.”

Tam pointed out there was also a decrease in days month-to-month, which means fewer opportunities to make a sale. He noted that like the last couple of years, the sales performance will ultimately depend on the ability of truck manufacturers to produce.

“In general, everything was right in line with what we thought they should be,” said FTR Chairman Eric Starks. “The production numbers have been good, the sales numbers have been good, they’ve been able to hold their inventory levels at a decent amount so we’re not seeing excess inventories.”

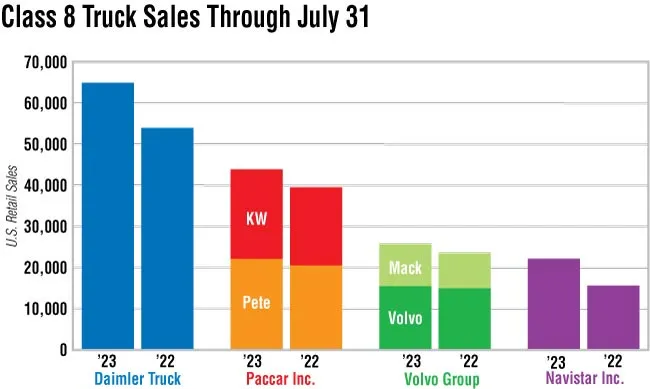

Wards found that four of the seven major truck makers experienced a year-over-year decline despite the overall total being positive. Navistar, parent of International Trucks, helped drive the total with the biggest year-over-year percentage increase at 36.3%, to 3,039 units from 2,229 units. Western Star followed with its sales increasing 23.4% to 681 units from 552.

“While several disruptions to production still exist, supply capacity inches in a positive direction, and market demand remains rock solid in the majority of the industry segments,” said David Kriete, president of Kriete Truck Centers. “I anticipate strong demand in the regional and vocational markets for the rest of 2023 and well into 2024.”

Freightliner continued to hold the largest market share at 36.2% but experienced a 3.1% year-over-year decline to 7,610 from 7,855. Kenworth Truck Co.’s sales decreased 1.3% to 3,026 units from 3,067, while Peterbilt Motors Co. saw sales fall 2% to 3,325 from 3,392. Both are brands of Paccar Inc.

“We’ve seen a 2.5% increase year-over-year for the U.S. and Canada, specifically 3% in the U.S. market,” said Magnus Koeck, vice president of brand, marketing and strategy at Volvo Trucks North America. “We’ve seen the backlog in new truck demand continue to carry over and the supply chain continues to improve slowly. While we still face some constraints on the supply chain it is better than it was. Pent-up demand for new trucks still exists, although supply chain improvements have allowed the market to satisfy some of that backlog in demand.”

Mack Trucks’ sales rose 5.5% to 1,366 from 1,295, but Volvo Trucks North America’s sales slipped 8.4% year-over-year to 1,944 from 2,123, according to Wards. Mack and VTNA are brands of Volvo Group.

“It’s been a real strong year so far,” said Chris Brady, principal for Commercial Motor Vehicle Consulting. “You’ll probably see the numbers compared to last year, going forward, maybe equal or be slightly below a year ago. But from August of last year through December was real strong. So, even if the numbers stay strong, comparisons to a year ago might be slightly below or above.”

Brady warned that if carriers continue to purchase equipment at the current pace, they could create excess capacity that will further drive down rates.

“Many dealers continue feeling economic pressures with a higher number of units sitting on their lots,” said Ann Brodette, senior vice president of sales for the eastern region at Mitsubishi HC Capital America. “Although sales for the industry were up slightly compared to July 2022, dealers remain uncertain about the state of the industry. Class 8 dealers are eagerly anticipating the upcoming fall selling season with hope that demand will increase.”

Commercial Truck Trader is able to track interest based on how actively people are looking into the specifics of online truck listings. Peterbilt, Kenworth, Freightliner, International, Western Star and Volvo posted strong gains in the number of vehicle detail page views.

“Because sales generally lag interest, as the buying cycle is relatively long, it takes several months to really understand the relationship between buyer interest and sales,” said Charles Bowles, director of strategic initiatives for Commercial Truck Trader. “We thought that we would see a decrease in demand during the summer months as the economy continued to struggle with sagging spot rates and higher interest rates, but it didn’t occur.”

Want more news? Listen to today's daily briefing below or go here for more info: