Staff Reporter

June Class 8 Sales Rise 7.7% Year-Over-Year

[Stay on top of transportation news: Get TTNews in your inbox.]

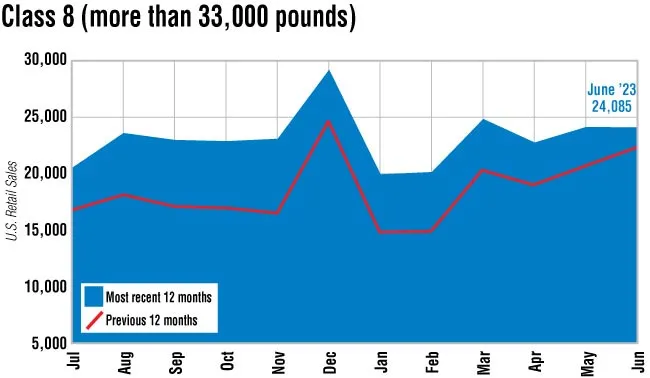

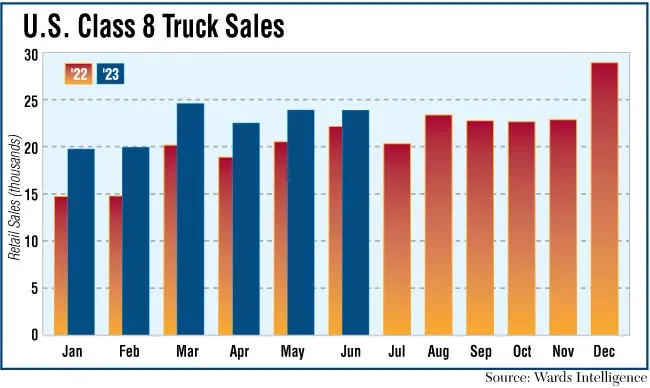

U.S. Class 8 retail sales rose 7.7% in June compared with the year-ago period, but slid marginally compared with May, according to Wards Intelligence.

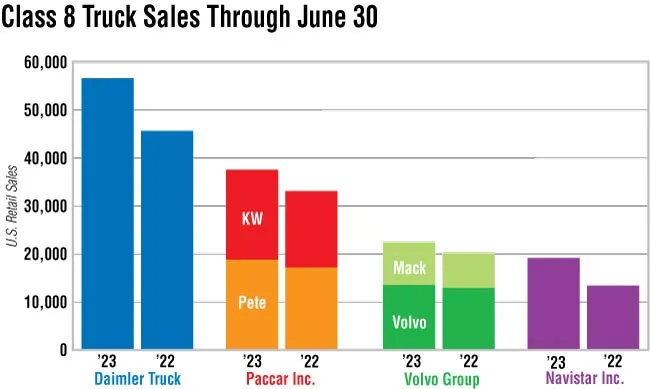

Class 8 sales for the month totaled 24,085 units, up from 22,358 in June 2022, and down 0.1% from the 24,111 sold in May. In the first half of 2023, Class 8 sales rose 21% to 135,802 from 112,255 in the same period in 2022.

June was a very good month, said Robert Gomez, executive vice president of sales for Prestonburg, Ky.-based heavy truck dealership Worldwide Equipment Enterprises. He noted that new sales have been strong in 2023 so far, while used sales were strong in four of the first six months of the year.

Improvements in component availability and smoother supply chains enable original equipment manufacturers to meet demand more easily these days relative to this time last year, said ACT Research Vice President Steve Tam. “OEMs are still looking for parts, but it is a finite number these days,” he said.

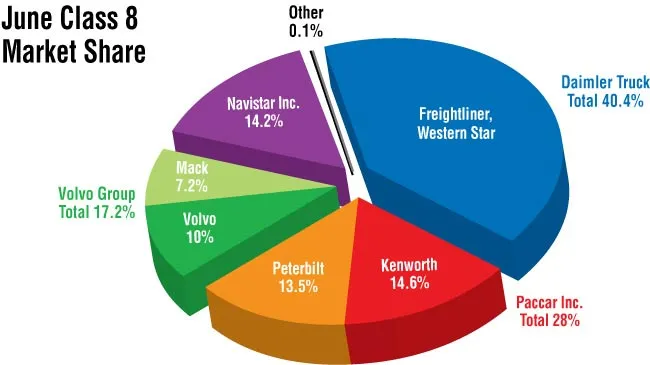

Daimler Truck North America’s Freightliner brand took the largest market share in June with 8,991 trucks sold, accounting for 37.3% of all Class 8 sales in the most recent month, compared with 8,129 trucks in the same period a year earlier.

Western Star, also a DTNA brand, sold 734 trucks in June, for a 3% market share. Western Star posted the largest year-over-year percentage increase in sales, with a 62.7% jump from 451 trucks in June 2022.

Navistar’s International brand sold 3,426 trucks in June, a jump of 17% compared with 2,927 in the year-ago period.

Five out of the top seven brands saw a year-over-year increase in sales, according to Wards data. Two brands saw year-on-year declines in sales.

Volvo Trucks North America — a unit of Volvo Group — saw sales fall 10.3% year-over-year to 2,403 trucks from 2,679 in June 2022, while Paccar Inc.’s Peterbilt unit saw sales drop 5.1% year-over-year to 3,243 trucks from 3,418, the data show.

Kenworth, Paccar’s other brand, posted a 10% year-over-year increase in sales to 3,512 trucks in June from 3,194, the data shows, for a 14.6% share of the market, the second largest slice of the pie. A month earlier, the company was third in the rankings with a 13.3% market share.

Volvo Trucks North America Vice President, Strategy, Marketing and Brand Magnus Koeck told TT that sales had been as expected in the first half of 2023, with continued strong market demand, mainly due to the backlog and pent-up demand among fleets.

“Even if the supply chain constraints have improved, we have still been affected [by] various disturbances through the first six months of the year,” he noted.

As the second half of 2023 gets underway, VTNA expects to see a continued strong market. As Koeck noted, with most OEMs sold out for the remainder of this year, their focus will be getting trucks into customer hands.

“It will be very interesting to see what happens when the OEMs open the order books for 2024. We will have a good indication between August and November [of] how strong 2024 will be,” he added.

Smaller fleets and owner-operators will think twice before they place orders, Koeck said, as they want to ensure freight demand will sustain going forward, but noted that a strong appetite from the larger fleets is still expected due to the backlog situation and their pent-up demand for new trucks.

Mack Trucks, also part of Volvo Group, saw sales increase 11.8% year-on-year in June to 1,744 from 1,560 and expects a positive second half of 2023, said Jonathan Randall, president of Mack Trucks North America.

“Preliminary industry sales numbers for the U.S. and Canada for the first six months of 2023 indicate a solid 19.6% increase over the same time frame in 2022,” he said, adding: “Mack Trucks’ growth rate of 22% YTD is still besting the market growth rate and is assisting in our steady increase in market share. We remain confident in the consistency of the market demand and forecast steady sales for the second half of 2023.”

Want more news? Listen to today's daily briefing below or go here for more info: