Staff Reporter

Diesel Price Falls Below $3.80

[Stay on top of transportation news: Get TTNews in your inbox.]

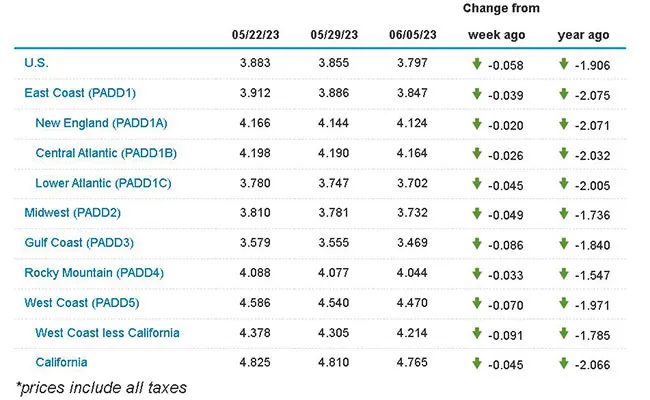

On-highway diesel prices fell by a nationwide average of 5.8 cents to $3.797 a gallon, according to Energy Information Administration data released June 5.

The current average price marks the first time the national diesel average has been below $3.80 since it was $3.78 on Jan. 24, 2022.

Diesel prices have dropped for each of the past seven weeks, shaving 31.9 cents off the average cost of a gallon.

Diesel prices are down $1.906 a gallon from this time in 2022.

The average diesel price dropped in all 10 regions in EIA’s weekly survey, ranging from 9.1 cents a gallon on the West Coast less California to 2 cents in New England.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

However, further downside is set to be limited, according to a veteran market observer.

“I don’t believe we’ll go much lower since diesel margins have narrowed substantially for refiners and probably are within 5-15 cents a gallon of a bottom” on the retail side, Tom Kloza, global head of energy analysis at price reporting agency Opis, told Transport Topics in an email.

“Now that wholesale gasoline prices are higher than wholesale diesel, refiners are tilting their output to make maximum gasoline and a bit less diesel,” he said. “In a sense, they may be planting the seeds of the next rally (perhaps in front of heating season 2023-24) by concentrating on higher gasoline yields.”

Kloza

The average on-highway price of gasoline dropped 3 cents a gallon to $3.541. That is down $1.335 year-over-year.

Another positive factor for diesel prices is future export demand, analysts say. FGE Energy consultant Krista Kuhl said June 7 in an email that the arbitrage window from refining hubs on the U.S. Gulf Coast to key price-setting markets in Northwest Europe is again profitable for diesel.

U.S. Gulf Coast exports across the Atlantic fell 40% week on week in the week that ended June 2, but are more likely to follow May’s example as June progresses, Kuhl said. She said May as a whole saw strong Trans-Atlantic exports, with the USGC shipping some 290,000 barrels per day to Europe, its highest level since August 2019.

Exports are quite robust and that will probably continue, added Kloza, noting the U.S. is pumping lots of diesel to send to Latin America and that will continue.

However, an expected boost to crude oil prices and subsequently refined products such as diesel and gasoline has yet to materialize as a result of coming production cuts by OPEC’s key member. The oil cartel is keen to boost members’ revenues after a slump in benchmark prices over the past year.

Front-month West Texas Intermediate crude futures closed above $120 a barrel on June 8, 2022. A year later, they barely top $70 a barrel.

A promised output decrease by OPEC kingpin Saudi Arabia in July failed to light a fire under crude prices over the past few days. On June 4, the Middle East nation promised a 1-million-barrels-a-day cut in output in July to 9 million barrels a day. Market watchers are waiting on whether the production decrease is prolonged or temporary.

Hayden Cardiff, co-founder and chief innovation officer of Idelic, discusses predictive analytics software and scoring driver practices. Tune in above or by going to RoadSigns.ttnews.com.

“If the Saudis cut for more than just the month of July, we could see crude oil prices move up by $5-$10 per barrel,” said Kloza, but he warned this was contingent on no countries falling into recession and also requires no quota cheating from OPEC or non-OPEC countries. There is too much crude available and too much economic worry in consuming countries such as the U.S., Kloza said.

That economic worry and its impact on freight levels was underlined by figures from North Carolina-based carrier Old Dominion Freight Line Inc., which ranks No. 9 on the Transport Topics Top 100 list of the largest for-hire carriers in North America. In May, said the company, its less-than-truckload revenue per day was down 15.7% year-over-year, largely due to a 14.4% decrease in LTL tons per day.

“Old Dominion’s revenue results for May reflect continued softness in the domestic economy as well as a decrease in fuel surcharge revenue,” CEO Greg Gantt said in a statement.

That softness is compounded for trucking companies by the ongoing decline in freight rates across the U.S., Artur Express Inc. Vice President of Operations Mark Koch told Transport Topics June 7. Artur Express ranks No. 96 on the TT 100.

Want more news? Listen to today's daily briefing below or go here for more info: