Staff Reporter

US Ports Face Renewed Congestion Amid China Reopening

[Stay on top of transportation news: Get TTNews in your inbox.]

As China lifts its latest coronavirus lockdowns, experts worry the resulting influx of goods flowing from the country could renew bottlenecks at ports in the United States.

“We’re expecting some degree of congestion resulting from China reopening,” Patrick Donnelly, senior analyst at Third Bridge, told Transport Topics. “Being the main importer to the U.S. they basically dictate the amount of flows that West Coast ports receive from a container perspective. And so, with China reopening, we’re expecting some degree of congestion to reignite.”

Earlier this year, Shanghai and other Chinese port cities returned to lockdown in response to a reemergence of the coronavirus. On June 1, Shanghai reopened and some companies resumed production output. Since then, some bottlenecks have formed because of inland transportation, labor restraints and the availability of raw materials.

“They’re definitely still in the process of reopening, in the sense of factories and getting employees back to work,” Josh Brazil, vice president of supply chain insights at Project44, told TT. “The problem is that the manufacturing output is ramping up really slowly. On top of that, to get manufacturing to ramp up you also need inputs — the inputs in the form of raw materials.”

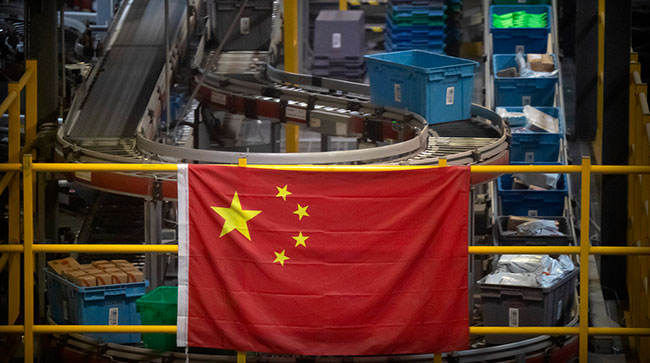

A Chinese flag hangs near an automated parcel handling line at a warehouse for an online retailer in Beijing. (Mark Schiefelbein/Associated Press)

FourKites on June 22 released data showing the two-week average shipment volume for loads traveling from China to the United States was up 10% compared to the day before the latest lockdowns went into effect March 12.

“I’m guessing that within the next four to six weeks we’re going to be back to 100% capacity,” Ryan Closser, director of program management at FourKites, told TT. “What that looks like when you look downstream from a demand standpoint in the U.S. [and] how that might affect what the total volumes are, that remains to be seen. But just from a sheer capacity standpoint, we should be back to normal within a couple weeks, barring no further shutdowns or restrictions.”

The same FourKites data showed Port of Shanghai volumes were down around 5% on a two-week average compared to March 12. That compared to 25% in mid-May.

Closser is optimistic the trucking industry is in a better position to handle the impending increase in imports. “Currently capacity is relatively loose,” he said. “I do think that there’s still significant capacity at the ports that are going to be able to haul these shipments when they actually do arrive, call it 25 to 45 days from now. I think the landscape has changed significantly from a carrier capacity standpoint, even in the past six to eight weeks.”

Closser also doesn’t expect the resulting West Coast port congestion to be as bad as peak shipping season last year, when there were hundreds of ships waiting at times.

“I think when the COVID lockdowns were announced many of us were concerned that there was going to be a massive drop off in shipments from China,” Cowen and Co. analyst Jason Seidl told TT. “While the volumes have been down from Asia for sure, we have noticed that some other ports have picked up the pace as traffic has been diverted, such as Ningbo.”

China's factory output rebounded in May, adding to a recovery from the latest COVID-induced economic slump after controls that shut down Shanghai and other industrial centers eased. (Andy Wong/Associated Press)

Seidl still anticipates some backlogs along the West Coast — he just doesn’t think they’ll be as severe as initially feared since smaller ports were able to release some of that pressure during the lockdowns. He also noted that port-related supply chains are better prepared than when peaks occurred last year.

“I think that the drayage portion of the trucking industry will absolutely be stressed once again,” Seidl said, but noted that this stress will be eased by growth in that sector’s driver base.

Donnelly agrees that the expected backlogs won’t be as bad as during the previous two years. The Chinese lockdowns, he noted, provided port workers and related transportation networks breathing room to work through existing backlogs and improve operations.

“It was unprecedented congestion throughout the past two years,” Donnelly said. “There’s more of a steady flow of containers at this point, both entering and leaving the ports. I would just expect a lesser degree of congestion.”

Donnelly noted the number of backlogged ships waiting to be unloaded hit a six-month low last month. Nevertheless, he is anticipating an initial surge followed by some degree of plateauing.

“Shanghai is opening back up, so you are going to see more capacity. Once we get through summer, then we’re heading into peak season,” Project44’s Brazil added. “It’s definitely going to be a challenge as we go forward. It’s not going to be as bad as last year by any means.”

Want more news? Listen to today's daily briefing below or go here for more info: