Bloomberg News

Rivian Plans to Cut 10% of Salaried Staff as EV Rush Stalls

[Stay on top of transportation news: Get TTNews in your inbox.]

Rivian Automotive Inc. shares fell in early trading after the electric vehicle maker issued a disappointing production forecast and announced another round of job cuts.

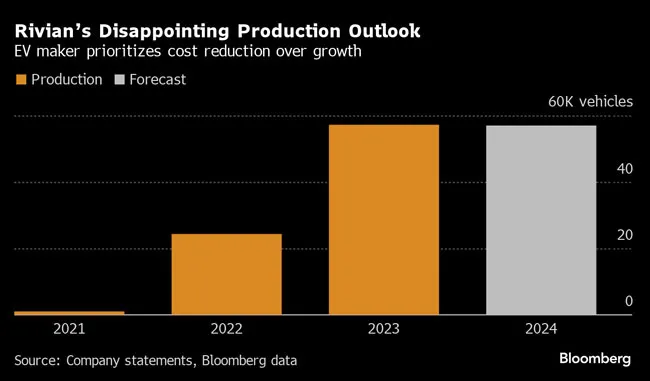

The maker of plug-in pickups, SUVs and delivery vans expects to build just 57,000 vehicles this year, in line with last year’s output and well short of analysts’ average estimate for more than 80,000 units. The company said late Feb. 21 it will reduce its salaried workforce by about 10%, its third paring in the last year and a half.

The outlook underscores the challenges Rivian is having with scaling production and stemming losses amid a slowdown in the battery-powered vehicle market. The company seen as a challenger to Tesla Inc. has struggled with supply chain snags and now must contend with more budget-conscious consumers.

“Our business is not immune to existing economic and geopolitical uncertainties,” CEO RJ Scaringe said on a conference call. “Most notably, the impact of historically high interest rates, which has negatively impacted demand.”

Rivian shares dropped as much as 22% to $12.02 before the start of regular trading Feb. 22 in New York and already had tumbled 34% this year as of the close on Feb. 21.

Rivian will prioritize cost-cutting over volume growth this year, though it’s still expecting an adjusted loss of $2.7 billion before interest, taxes, depreciation and amortization. The Irvine, Calif.-based company laid off workers early last year and in mid-2022.

Rivian builds the R1T pickup, which starts at $69,900, and R1S sport utility vehicle, with a base model cost of $74,900, at a plant in Normal, Ill. It also makes a battery-electric delivery van for commercial use. A second factory is the works near Atlanta, where the manufacturer plans to build its first lower-priced EV starting in 2026.

Still Bullish on Big

Scaringe said in an interview that he expects demand for Rivian’s higher-priced vehicle models to bounce back with lower interest rates, and that for now a new leasing program is helping to blunt the impact of high financing costs.

“As interest rates come back down, we’ll see purchase behavior and overall demand for high-price products and premium products return to what we were seeing earlier,” he told Bloomberg. “We’re very bullish on the large premium SUV and premium truck space.”

“Interest rates are so high that I’m currently leasing a Rivian,” he said.

Rivian lost over $40,000 on every vehicle it delivered in the last three months of the year, about $10,000 more than it lost per vehicle in the third quarter. The company attributed this in part to delivery of fewer vans to Amazon.com Inc. A year ago, Rivian was losing $124,000 per vehicle as it struggled with supply issues.

COMTO's April Rai offers tips to increase workforce diversity and grow profits.. Tune in above or by going to RoadSigns.ttnews.com.

The company reported an adjusted loss of $1.36 a share for the fourth quarter, a bigger deficit than the $1.33-a-share average estimate compiled by Bloomberg. Revenue of $1.32 billion narrowly topped expectations.

Capital expenditures will rise to $1.75 billion this year, Rivian said, up from about $1.03 billion in 2023. The company initially forecast that it would spend $2 billion last year. Chief Financial Officer Claire McDonough told analysts on the conference call that production-efficiency gains have allowed the company to rein in spending.

Lucid’s Loss

Lucid Group Inc., another relatively new player in the EV market, also let down investors with its outlook for the year ahead. The maker of the Air sedan said late Feb. 21 it expects to make 9,000 vehicles this year, up from just under 8,500 last year but short of what analysts were expecting.

The Newark, Calif.-based company lost 29 cents a share in the fourth quarter and said it has enough liquidity to continue operations “at least into 2025.” Lucid shares slumped as much as 10% in early trading Feb. 22 and have slumped 12% this year.

Want more news? Listen to today's daily briefing below or go here for more info: