Contributing Writer

The Rise of the Warehouse Robot

[Stay on top of transportation news: Get TTNews in your inbox.]

The COVID-19 pandemic has accelerated the decline of brick-and-mortar retail establishments and accelerated e-commerce, creating a massive logistical challenge for warehouse and distribution center operators.

But robots are coming to the rescue.

While much of the freight transportation industry is watching the development of autonomous trucks for the open road, regulatory and technical obstacles remain. Yet other forms of autonomous vehicles — such as small robots that select and move goods inside a warehouse and self-driving yard trucks for distribution centers — already have been working their way into the supply chain.

Companies such as autonomous mobile robot builders Locus Robotics and 6 River Systems, as well as Outrider, a developer of autonomous zero-emission yard trucks, are partnering with warehousing and logistics clients looking to improve productivity and reduce reliance on human physical labor.

XPO Logistics is one of the companies at the forefront of this transformation. The transportation and logistics provider is spending more than $500 million annually on innovation and technology that increases the efficiency of warehouses, said Ashfaque Chowdhury, XPO’s president of supply chain for the Americas and Asia Pacific.

“We have thousands of robots in our facilities that are already operating,” Chowdhury said.

The company achieves up to four times as much productivity in some jobs by utilizing robotics, which in turn supplies the capacity it needs to deal with the boom, Chowdhury said.

Autonomous mobile robots move stacks of products through XPO Logistics’ facility in Aberdeen, Md. (XPO Logistics)

“What the pandemic has done is bring us to the e-commerce volumes of 2025 in 2020,” Chowdhury told Transport Topics.

XPO, based in Greenwich, Conn., ranks No. 1 on the Transport Topics Top 50 list of the largest logistics companies in North America.

Other logistics companies also are investing heavily in automation.

DHL International is investing $300 million in emerging technologies at 350 of the German parcel company’s U.S. and Canadian distribution centers.

More Q4 iTECH stories

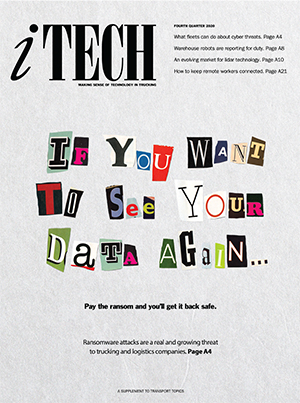

- The Rising Threat of Ransomware: How Trucking Can Fend Off Cyberattacks

- E-Smart Targets Better Tractor-Trailer Connectivity

- The Rise of the Warehouse Robot

- Trailer-Sharing Startup vHub Expands Marketplace

- Plus, FAW Self-Driving Truck Passes Certification Test in China

- Clevenger: Assembling the Autonomous Truck

- Spearin: Can On-Demand Freight Really Work for Trucking?

- Dysart: Curing Remote Workers’ Blues

Much of the money is going into autonomous mobile robots from Locus Robotics and auto-guided vehicles. It’s also looking at unmanned forklifts. DHL is testing technology that can autonomously perform multiple warehouse tasks, such as unloading trucks, transporting pallets to and from the dock and to different parts of the warehouse and placing pallets into racking, said Adrian Kumar, global head of operations science and analytics at DHL Supply Chain.

What Kumar likes about these new technologies is their flexibility and ability to work within existing warehouses without infrastructure changes.

“If you have 10 sites that are all running Locus Robotics, you could move those robots between the different sites as one site hits a peak and another hits a trough. We could lease more robots at peak season,” Kumar said.

In all of these endeavors, companies are attempting to leverage the use of people by pushing time-consuming and repetitive tasks such as the need to walk 10 miles throughout the warehouse on a daily basis. That allows humans to spend more time on tasks requiring judgment and other work that is difficult to automate.

Much of the innovation has focused on automating the processes that are the most physical and labor-intensive, such as picking and packing, said William O’Donnell, who leads Prologis Ventures, the venture capital and innovation arm of Prologis. The San Francisco-based distribution center and warehouse operator owns or has investments in almost 1 billion square feet of properties spread across 19 countries.

XPO, meanwhile, has partnered with food giant Nestlé to construct a 638,000-square-foot “digital warehouse” at the SEGRO East Midlands Gateway Logistics Park in Leicestershire, U.K.

“It’s a state-of-the-art logistics environment that enables us to pilot and launch different new technologies,” Chowdhury said.

Across its operations, XPO is using two different types of robots.

A goods-to-person robot — essentially an autonomous cart — can navigate the warehouse to bring goods to workers. It saves time and reduces miles of walking by employees.

The other leading technology is a cobot, or collaborative robot. It works alongside a human staff member, picking up shelves of goods and transporting them to a work station to pick and sort.

Automating logistics is more difficult than installing robots in a factory, where they conduct the same repeatable process with a limited number of product types, said O’Donnell of Prologis Ventures.

“Warehouse automation is a more complex problem because you have an unlimited number of SKUs that potentially could come in. And the arrangements that they go through will continually be different,” O’Donnell told TT.

Prologis is testing Locus robots, which help create a more efficient picking and packing process, and it is looking at autonomous forklifts, which have proven to be more of a challenge.

A series of robots developed by Locus Robotics automates the picking process in a warehouse. (Locus Robotics)

Autonomous driving inside a warehouse isn’t that hard, given the state of current technology, he said.

“But how do you pick a pallet that might be 30 feet up in the air autonomously? It’s a pretty interesting, challenging problem,” he said.

Prologis also is looking outside the warehouse at the distribution yard. It has invested in Outrider, a Golden, Colo.-based startup that equips zero-emission, electric yard trucks with an autonomous driving system.

The Outrider vehicle autonomously couples with trailers to shuttle them between docks, parking spots and staging areas where they will be picked up by longhaul trucks. It creates a site infrastructure of maps, communications and controls to allow the trucks to operate safely.

“An investment in an autonomous vehicle in a yard makes sense because it is a contained environment. You don’t have to solve for the kid running out in the middle of the street,” O’Donnell said.

Startup firm Outrider is automating yard operations with its electric, self-driving yard tractor. (Outrider)

Other companies also see potential in automated yard tractors.

Shipping giant UPS is testing electric-powered yard trucks developed by French company Gaussin to move semi-trailers and containers on the grounds of UPS’ advanced-technology hub in London. The first phase of the pilot involves drivers in the cab to measure the vehicles’ efficiency, but UPS said it would later test the vehicles’ autonomous driving capabilities as well.

UPS told TT that it is exploring a wide range of robotic technologies inside and outside the warehouse, including investing in TuSimple, a San Diego-based startup that is working with manufacturers Navistar and Traton Group to develop and produce self-driving Class 8 trucks.

“We have test lanes for autonomous tractors/trailers, yard shifting and customer pickups,” said Bobby Clements, vice president of marketing and strategy for UPS Global Logistics and Distribution.

Multiple factors are pushing the need for physical warehouse space, automation and improved efficiency, industry executives said. One is the need for speed. The growth in next-day shipping creates pressure for warehouses to operate more efficiently to meet consumers’ expectations.

The historical role of a warehouse is to provide a staging area to ship raw materials to factories and bundled goods to retailers. But e-commerce changes the retail side of the business. Warehouses must now stage large consumer durables such as appliances, furniture and large-screen televisions for shipment to individual residences. They also must sort many small items — books, clothing, shoes, electronics — for delivery to homes and offices. It’s a challenge to organize multiple, disparate items into a single order.

XPO has a rule of thumb. It takes three times as much space and effort to individually ship to consumers from a distribution center than it does to send boxes of goods to a retail store for shoppers to come and purchase for themselves, Chowdhury said.

Even as robotics and automation continue to advance, all of this technology is not about to make human warehouse workers obsolete.

“With all the growth we see in demand and e-commerce, we are continually looking for more and more workers while we are adding more and more robots,” Chowdhury said.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More