Senior Reporter

Medium-Duty Market Creeps Higher on Mixed Sales

[Stay on top of transportation news: Get TTNews in your inbox.]

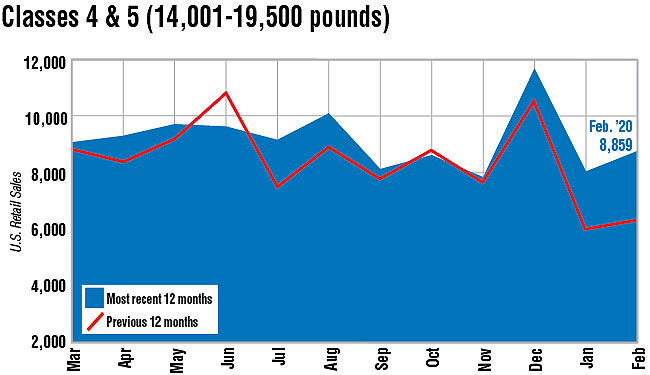

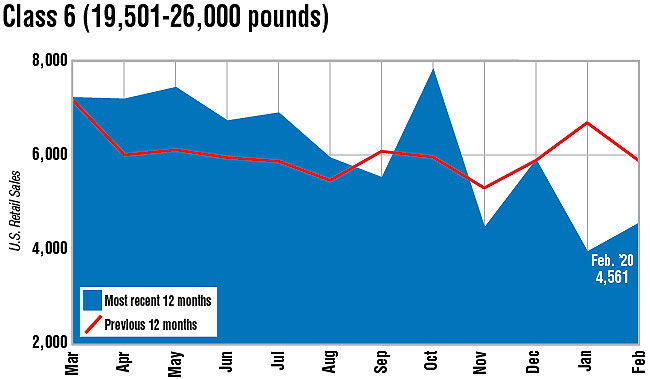

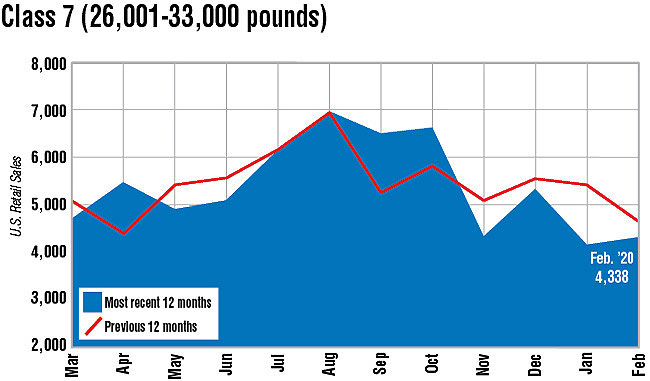

Medium-duty sales in February posted a 5% gain as the two lighter segments offset weakness in the heavier two, WardsAuto.com reported.

Classes 4-7 sales reached 17,758 compared with 16,907 a year earlier.

Year-to-date sales slipped 2.9% to 34,027 compared with 35,061 in the 2019 period, according to Wards.

Class 7 sales dropped 6.2% to 4,338.

Class 6 sales fell the most in the month, 22.9% to 4,561 units compared with 5,917 a year earlier. The segment is one in which truck rental and leasing companies are active when a strong freight market increases demand for trucks. But the industry already was in a softer market and now faces the ramifications of COVID-19.

At the same time, Classes 4-5 sales zoomed up 39.2% to 8,859 compared with 6,363 a year earlier.

One key supplier, Allison Transmission Holdings Inc., is expanding its presence in the Class 5 segment through an agreement with Isuzu.

“I think medium-duty is critical not only to Allison but the broader commercial truck market,” Branden Harbin, managing director of global marketing at Allison Transmission, told Transport Topics. “I think we are seeing that as there are new entrants into this space. Take for instance, Mack Trucks.”

Mack unveiled its Class 6 truck Jan. 30 and is taking orders. Production is scheduled to begin in July.

Allison announced recently it will be the exclusive transmission for Isuzu’s just-announced gasoline-powered NQR and NRR Class 5 trucks, which will be available for order in the fourth quarter. Some deliveries are expected to take place then, and mass production and delivery is expected by the first quarter in 2021, Harbin said.

“We have a long-standing relationship with Isuzu, both from a technical standpoint and a national account level,” he said. “Many of their associates work with us on national account fleets, such as Pepsi that use [Isuzu] cabover trucks for their lighter delivery specs.”

PepsiCo Inc. ranks No. 1 on the Transport Topics Top 100 list of the largest private carriers in North America.

The Class 5 market leader, Ford Motor Co., increased sales to 4,586 compared with 3,549 a year earlier — building on similar gains in January, when the company cited expanding commercial truck franchises.

The overall rise in Class 4 was supported by gains at General Motors Co.

“Dealer trainings and the growing credibility that General Motors is back in this segment have contributed to our increased sales so far this year,” said Paul McKay, Chevrolet medium-duty marketing manager.

Prior to COVID-19, medium-duty vehicles were benefiting from the strong consumer economy, ACT Research President Kenny Vieth said. “With the service sector being undermined presently, it is difficult to imagine that [medium-duty] commercial vehicles won’t be hit hard as a result.”

Want more news? Listen to today's daily briefing: