Staff Reporter

June Medium-Duty Truck Sales Increase 22.7%

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. medium-duty truck retail sales increased 22.7% in June compared with the year-ago period, according to Wards Intelligence data.

Retail sales of Classes 4-7 trucks rose to 21,924 in June from 17,866 in June 2022, in what was the third consecutive month to see a year-over-year increase and the fourth overall in 2023. Sales also climbed marginally on a month-on-month basis, with 21,687 units sold in May.

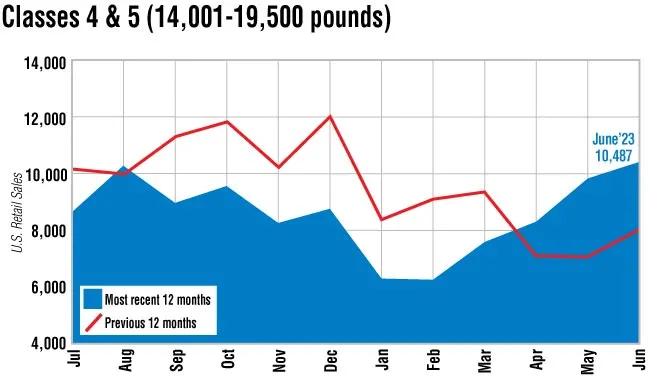

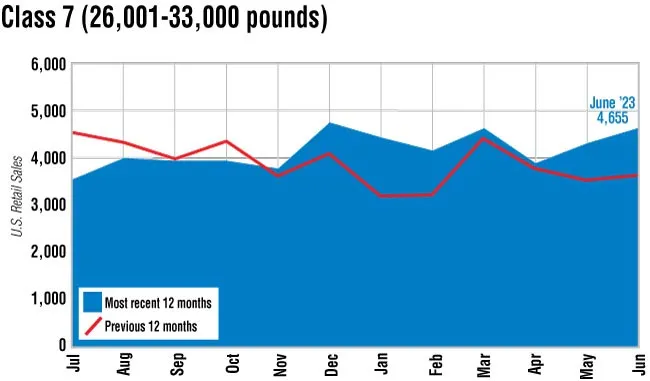

When breaking down the sales further, Classes 4-5 saw the biggest percentage increase in sales on a year-over-year basis in June, jumping 30.4% year-on-year to 10,487, closely followed by Class 7, where the 4,655 trucks sold was an increase of 29.7% compared with the year-ago period.

Through the first half of the year, Classes 4-7 retail sales totaled 115,899 trucks, a 9.9% year-over-year increase from 105,454 in the first six months of 2022.

Trucking companies have the appetite to take delivery, ACT Research Vice President Steve Tam said, adding they had had to age their fleets, leading to pent-up demand. Buyers are eager to refurbish their fleets, he said.

In the medium-duty market, the backlog is twice the normal level, whereas in the heavy-duty market it is 1.5 times normal levels, he said, adding that it had been much harder for medium-duty buyers to secure what they want and need.

In 2024, some of the pressure and backlog in the heavy-duty market will start to ease, which will allow truck manufacturers to focus more on meeting the needs of the medium-duty sector, he said. Tam expects medium-duty sales to be flat in 2024, while heavy-duty sales could fall as much as 20%.

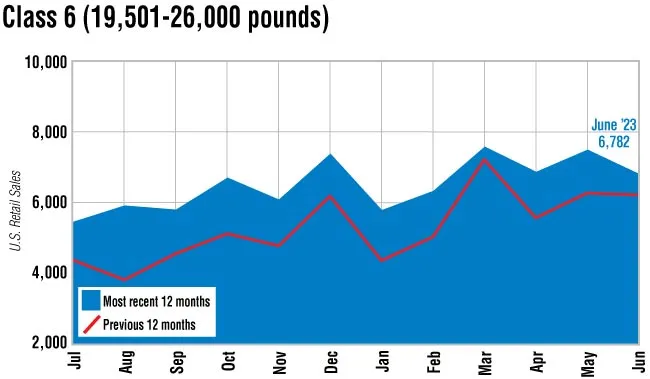

Overall through the first half of 2023, sales of Class 7 trucks in the U.S. totaled 26,225, an increase of 21.9% year-on-year, while Class 6 saw a 17.1% year-on-year increase in sales to 40,707, the Wards data shows. Across Classes 4-5, sales were about flat through the first six months of the year, totaling 48,967 for a decrease of 0.4% year-on-year.

Daimler Truck’s Freightliner brand was the biggest seller in Classes 6-7 in the first half of 2023, while Ford came top of the table in Class 5 and Isuzu in Class 4. The same companies were the top-selling brands in June in each of the classes, although Freightliner snagged the No. 1 spot in Class 6 from Ford, which led in May. Ford also slipped behind Navistar’s International brand in June in Class 6.

Want more news? Listen to today's daily briefing below or go here for more info: