Special to Transport Topics

Fleets Turn to Predictive Analytics to Prevent Crashes, Reduce Driver Turnover

[Stay on top of transportation news: Get TTNews in your inbox.]

A trucking company’s success and reputation depend directly on its drivers’ safety performance, but it’s not so easy to determine which drivers are most likely to be involved in a crash or incur a safety infraction.

However, advances in data analytics are making it increasingly possible for fleets to understand the individual risk profile for each driver and proactively provide coaching and training to those who need it — before an unfavorable event occurs.

While data collection and analysis have existed in trucking for many years, the recent incorporation of artificial intelligence and machine learning has created new opportunities for predictive analytics applications to uncover deeper insights that can help fleets minimize risk.

This software aggregates data from a variety of sources, including fleet telematics systems that track driver performance; electronic logging devices; the Federal Motor Carrier Safety Administration’s Compliance, Safety, Accountability program; in-cab video cameras; crash claims; human resources documents and drivers’ personal motor vehicle records via state agencies.

Idelic's software integrates and interprets a variety of data sets. (Idelic)

Predictive analytics also can ingest inspection report data elements that are outside of a driver’s control, including weather, time of day, road conditions and traffic.

“It’s accidents of this type, for drivers who have a history of ‘X’, who have a tenure of ‘Y’, who also have these telematics events and these violations or incidents,” said Hayden Cardiff, founder and CEO of Idelic. “All these combining factors get taken into account. That’s what makes it so effective in identifying which drivers are most at risk.”

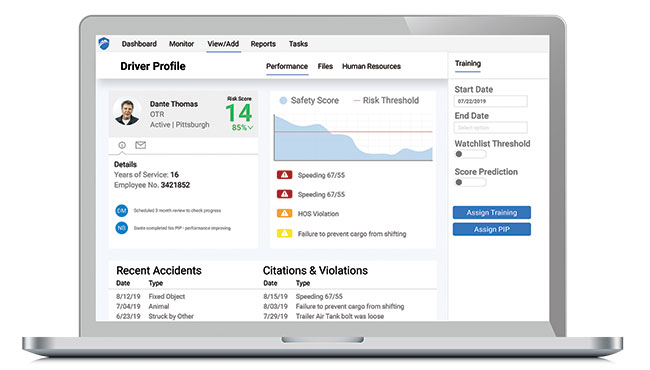

Idelic's software assigns a risk score to each driver. (Idelic)

Idelic’s Safety Suite integrates fleets’ various data systems into a driver watch list. The product began as a risk management system developed in-house by motor carrier Pitt Ohio, which went on to commercialize the software through Idelic.

Predictive analytics uses historical data to identify patterns that determine the probability of certain events occurring. Some online retailers, for example, adopted the practice to understand customers’ purchasing patterns and to recommend additional products based on past buying behaviors.

For trucking, predictive analytics can calculate the likelihood of a fleet incurring increased risk from safety incidents — specifically, preventable accidents — by analyzing drivers’ past actions and records. The software alerts managers to potential problems so they can stage appropriate interventions.

“We’re able to see who’s good and who’s bad. Now we can coordinate our safety training based upon habitual problems,” said Ron Faherty, president of ARL Network.

The owner-operator fleet implemented Idelic’s analytics platform about a year ago.

Faherty describes the system as “a silo that we’re able to connect so many different third-party systems into,” such as telematics and in-cab cameras, for increased data richness.

AI models pick out patterns and draw conclusions that humans would have difficulty recognizing, either because of time constraints or the inability to process so many data sets concurrently.

Hub Group has implemented analytics software to identify and proactively coach drivers who may pose a risk to safety. (Hub Group)

About four years ago, intermodal transportation company Hub Group began using driver safety software from Vigillo, which SambaSafety acquired in 2017.

“There have been times where SambaSafety has alerted us to issues we would not have known about,” said Tim Smith, Hub Group senior vice president of safety. “That allowed us to take action to engage potentially risky drivers before that behavior impacts our organization or the safety of those around us. That’s paramount.”

“During the last couple of years, we have gotten very deep into — and have a high level of expertise around — AI, machine learning [and] analytics,” said Steve Bryan, executive vice president and general manager of SambaSafety, and founder of Vigillo. “Are we seeing anything in the data that is indicative of crashes? The answer is, absolutely, yes.”

Some fleets employ their own data scientists to track and evaluate this type of information, but a benefit of using a dedicated data analysis company’s services is the wider array of information from which patterns can be identified. Plus, they handle the demanding task of organizing the slew of data in a way that produces relevant insights.

“[We] organize and cleanse that data and prepare it for being able to apply more sophisticated AI-based predictive models,” said Rich Lacey, SambaSafety executive vice president of product management.

Transportation predictive modeling assesses risk factors including a driver’s past speeding tickets, lapsed licenses, on-time performance, hard braking incidents and lane departures, then it assigns each driver a score. The complex process boils down to letting managers quickly see a driver’s risk ranking in an easy-to-understand format.

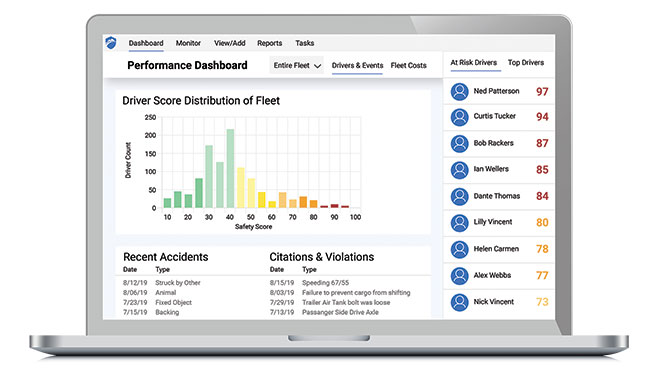

Green and red universally serve as colors indicating “go” and “stop,” and the same concept holds true for many predictive analytics dashboards.

Host Seth Clevenger went to CES 2020 to look at the road ahead for electric-powered commercial vehicles. He spoke with Scott Newhouse of Peterbilt and Chris Nordh of Ryder System. Hear a snippet, above, and get the full program by going to RoadSigns.TTNews.com.

Drivers labeled green are at the top of their game, whereas those labeled red pose potential risk to the company. Some fleets prefer setups besides color coding, such as listing all the drivers sequentially by their calculated risk scores.

After receiving an alert, safety managers can open an individual driver’s scorecard to see why they were flagged and determine appropriate interventions. Public complaints, FMCSA violations, speeding, backing incidents and other elements all contribute different points to a driver’s overall safety score.

“Was the issue with the driver serious — something coming from an MVR, like a DUI? Or is this just the 37th time they hit a hard brake?” Bryan said. “That’s where the AI comes in … Send alerts and then bring the customer back into the system to make it actionable.”

Some systems let safety man- agers assign different types of training to a driver via the analytics dashboard. The system tracks the progress on that task and can notify the manager if an assigned training is not completed in the desired time frame.

The technology also can track drivers’ positive behaviors and adjust their scores accordingly. Undergoing training activities is one way for drivers to improve their scores, but time away from negative incidents also plays a part.

“[Training] and time are the two things that help to improve scores. The further you go in time without having negative events, the better your score is going to get,” Idelic’s Cardiff said.

Read more iTECH stories

Larger fleets may have been the first to invest in predictive analytics platforms, but fleets of all sizes increasingly are adopting them, technology vendors said.

“Data science and AI used to be reserved for sophisticated organizations with big budgets and IT resources. A big part of [our] mission is to make that type of technology accessible to the 10- and 20-truck fleets,” SambaSafety’s Lacey said. “We believe it’s that valuable.”

Tech companies say their predictive analytics products provide fleets with tangible benefits that offer an appreciable return on investment.

“The before and after results are rather dramatic,” Bryan said. “Once you put a system like this in place, [there is] about a 22% reduction in the violations that you see from the results out on the road and a 14% reduction in crashes.”

The data and insights can help fleets keep rising insurance pre- miums in check and potentially avoid the massive cost of a nuclear verdict. Fleets say improving an already strong safety culture also provides inherent value.

“The ROI for us is pretty clear: eliminating even one accident, regardless of the cost of it, with the safety culture we’ve built and insist on at Hub Group. One accident is too many, if it can be prevented,” Smith said. “You have to find where technology is applicable. Technology for technology’s sake, I’m not fan of.”

As the practice advances, predictive analytics is not just for predicting future events, but also to glean real-time insights about what happens in a truck cab and alert the back office immediately if necessary, said Ashim Bose, Omnitracs’ chief data scientist and vice president of artificial intelligence, machine learning and data.

Safety is the primary reason fleets adopt predictive analytics, but these systems increasingly are developing capabilities to assess the risk of driver turnover, another leading concern for trucking operations.

“I would rank safety at the top, but retention is a close second in terms of predictive modeling,” Bose said. “We are in an industry where attrition is extremely high … [and] we’re focused on making sure that we’re doing everything we can to reduce [it].”

The predictive models consider safety elements as well as driver pay, hours on the road, time off and the amount of communication with dispatch or safety managers.

“Those are all things we can use to enrich our models and have accurate prediction on who is most likely to quit and when,” Bose said.

Generally, humans still figure out the best way to engage drivers to improve safety or to retain a driver once they are alerted to an issue. However, that’s another aspect tech companies are working to automate.

“We are past predictive modeling — we’re on to prescriptive modeling now,” said Chris Orban, vice president of data science for Trimble Transportation. “It’s everything we did with predictive modeling, but also, ‘What action does that predictive model recommend we take?’ It can’t just be that we do a great job identifying an issue, we’ve got to have a solution, too.”

In the future, ARL Networks’ Faherty would like technology vendors to aggregate customers’ data to provide a more holistic view of industry safety and aid with benchmarking. Several software developers are looking into such features for anonymized data. But even when information is scrubbed of identifying information, safely sharing it with other customers presents a challenge.

“It’s not something we’re doing today, but in the future we could see potential — with customers’ permission — to anonymize data and share things like safety… and [traffic] congestion areas… so the customer community can benefit from each other,” Omnitracs’ Bose said. “We are extremely sensitive to our customers’ data privacy and data security needs.”

Technology vendors hope to release additional advances soon, including mobile apps to let drivers see and understand their safety scores.

“These are the kind of things that are really transformative for our industry,” Orban said. “We have the technology and data to do it, and I believe our customers have the will to do it, too. We can be better together.”

Want more news? Listen to today's daily briefing: