Diesel Prices Rise for First Time in Two Months

[Stay on top of transportation news: Get TTNews in your inbox.]

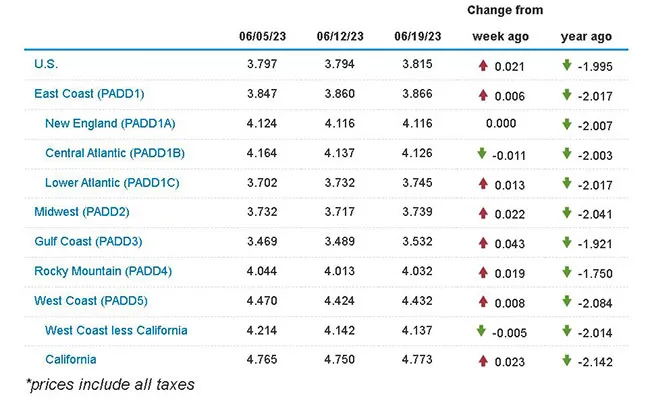

Diesel prices increased 2.1 cents to a national average of $3.815 a gallon, according to Energy Information Administration data on June 19.

The average diesel price rose for just the fifth time this year, and the latest increase was the first since a 1.8-cent rise April 17. The other three increases occurred in January. Diesel prices are down an average of $1.995 from this time in 2022.

Diesel prices rose in seven of the 10 regions in EIA’s weekly survey, fell in two and remained unchanged in New England. The biggest increase was 4.3 cents on the Gulf Coast; the biggest drop was 1.1 cents in the Central Atlantic region.

On-highway prices rose as a result of a rebound in sentiment and demand, energy market and trucking industry observers said, although they cautioned that expectations about the upside potential were to be avoided.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

The diesel market has hit the bottom when it comes to demand, GasBuddy Head of Petroleum Analysis Patrick De Haan said June 21.

There’s been a change in the market’s psyche, De Haan said, noting a little more optimism regarding the Federal Reserve and its perspective on interest rate increases.

Over the past six to eight weeks, freight volumes have been fairly consistent, Leonard’s Express CEO Kenneth Johnson said June 21, and it has been a similar situation for freight rates. “Consistency is our friend,” he added.

Johnson

That steadiness in freight volumes came after several months of decreases, Johnson said, and is likely being driven by preparations for the long July Fourth weekend. July is set to be a soft month for demand, he added. Farmington, N.Y.-based Leonard’s Express ranks No. 88 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

A true picture of where summer 2023’s freight demand and therefore diesel consumption is will only emerge once the impact of the holiday has been assessed, Johnson added.

Support for retail prices also is coming from the wholesale futures market, where the front-month July contract in recent days busted out of a tight range of $2.20 a gallon to $2.40 a gallon that had held since the end of April. Initial support for a new range before the Juneteenth holiday was confirmed in the days after the long weekend.

U.S. average retail prices for June 19, 2023:

Regular grade #gasoline: $3.58/gal

On-highway #diesel: $3.82/gal #gaspriceshttps://t.co/dsfxiPA8Wj — EIA (@EIAgov) June 20, 2023

The $2.70-a-gallon level previously was seen as a key front-month futures market level. Diesel has seen a short-term bottom and could rally further, said GasBuddy’s De Haan, who noted there were supportive supply-side factors in addition to the brighter picture for consumption.

Storage inventories are tight, said De Haan, at around 2% higher than where they were a year ago. In addition, refinery utilization at 93% of capacity is not as high as it was at the same time last year, when U.S. facilities were running at 95%.

Hayden Cardiff, co-founder and chief innovation officer of Idelic, discusses predictive analytics software and scoring driver practices. Tune in above or by going to RoadSigns.ttnews.com.

Long term, though, market watchers say the perspective is cloudier. Johnson said domestic worries over the impact of inflation remain. Those concerns continue to bedevil the energy futures complex beyond diesel, particularly benchmark crude contracts Brent and West Texas Intermediate. The latter benchmark crude front-month futures eyed a downside breach of the psychological support level of $70 a barrel on a couple of occasions in the most recent shortened trading week.

That weakness has dragged on gasoline futures, which tend to influence the direction for diesel futures. On-highway gasoline prices dipped 1.8 cents a gallon to a national average of $3.577, EIA data showed June 19.

Also, U.S. diesel prices may be under pressure toward the end of the year because refiners around the world are expected to increase output, including the Dangote refinery in Nigeria, which would hurt U.S. exports and leave more supplies in the domestic fuel pool, De Haan said.

Want more news? Listen to today's daily briefing below or go here for more info: