Staff Reporter

Diesel Price Resumes Decline

[Stay on top of transportation news: Get TTNews in your inbox.]

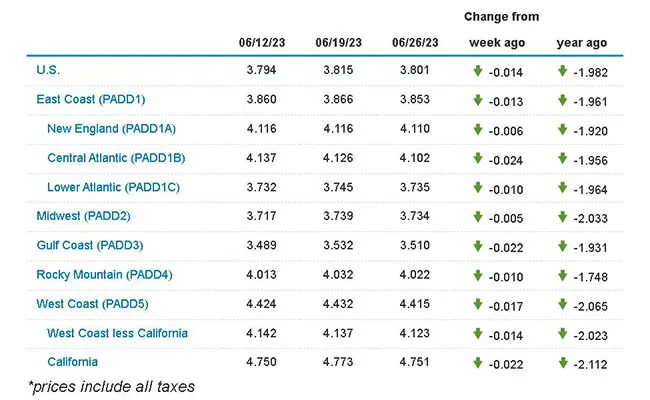

Diesel prices slipped 1.4 cents a gallon to settle at a national average of $3.801, according to Energy Information Administration data released June 26.

The national average resumed its decline after rising for just the fifth time all year June 19 — a 2.1-cent increase. The other price increases happened April 17 and three times in January.

Diesel prices fell in all 10 regions in EIA’s most recent weekly survey, ranging from a high of 2.4 cents a gallon in the Central Atlantic to a half-cent in the Midwest.

The average nationwide cost for a gallon of diesel is $1.982 lower than at this time in 2022.

U.S. average retail prices for June 26, 2023:

⛽️ Regular grade #gasoline: $3.57/gal

⛽️ On-highway #diesel: $3.80/gal #GasPrices

➡️ https://t.co/dsfxiPA8Wj pic.twitter.com/HYR43Tu4Mm — EIA (@EIAgov) June 26, 2023

However, prices have hovered either side of the $3.80 mark for the past three weeks’ data releases after starting June by breaching the level for the first time since Jan. 24, 2022.

As is the case in the wholesale diesel futures market and much of the wider energy complex, there is a battle going on between the bears and the bulls, Price Futures Group oil trader Phil Flynn told Transport Topics in an interview June 28.

Diesel demand has been pretty solid, Flynn said, and that offers a major upside risk for prices.

Demand is especially strong in certain pockets of the country, said Debnil Chowdhury, S&P Global Commodity Insights vice president Americas head of refining and marketing. Demand is near five-year highs on the East Coast and Gulf Coast, he said, although the latter is to be expected, given that U.S. oil production remains elevated compared with historical marks.

Still, on a countrywide basis, the number of trucks available exceeds demand by a large margin, Logistics Plus Chief Operating Officer Yuriy Ostapyak said in an interview. There has been a slowdown in raw material shipping, he said, among other things.

Logistics Plus ranks No. 100 on the Transport Topics Top 100 list of the largest logistics firms in North America, and No. 45 on the TT list of dry storage warehousing firms.

Wider economic concerns, particularly about the Federal Reserve raising interest rates, are capping the upside for diesel, gasoline and crude, Flynn said.

Guy Broderick of Kriska shares how he successfully combined data reports and a simple understanding of human nature to become one of the best driver coaches in North America. Tune in above or by going to RoadSigns.ttnews.com.

Fed Chair Jerome Powell told the U.S. Senate Committee on Banking, Housing, and Urban Affairs June 22 that inflation remains higher than the central bank is comfortable with, and it was taking a wait-and-see approach at present.

Powell said more rate increases are likely, and the first could come as early as July, according to reports. The next rate setting Federal Open Market Committee meeting is scheduled for July 25-26.

Wholesale diesel prices could be a lot higher, given where supplies are globally, Flynn said. EIA data released June 28 showed domestic distillate stocks rose 100,000 barrels week-on-week in the seven days that ended June 23, but remain 14% below the five-year average for this time of year.

Diesel output is lagging too. U.S. refineries operated at 92.2% of capacity in the most recent week, EIA data shows, compared with around 95% a year earlier.

There have been unplanned outages on the Gulf Coast, including at Marathon Petroleum’s Galveston Bay reformer in Texas and a crude distillation unit at Calcasieu Refining in Louisiana, Chowdhury said.

On top of that, more of the crude barrel is being used for products other than trucking’s main fuel.

The most recent week’s U.S. gasoline output rose 300,000 barrels a day to 10.1 million barrels per day. Meantime, distillate output fell a similar amount to 4.7 million barrels a day, its lowest level since the start of May, according to EIA data.

That’s despite WTI refinery cracks for diesel, the profit made by producers, strengthening. Tom Kloza, global head of energy analysis at price reporting agency Opis, noted in a tweet that Gulf Coast cracks increased more than $5 a barrel to more than $30 a barrel between late May and late June, while California cracks jumped more than $10 a barrel.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: