Senior Reporter

Dealers Prepping for the Inevitable Shift Toward Electric Vehicle Service

[Stay on top of transportation news: Get TTNews in your inbox.]

Trucking industry insiders as well as certain state regulators agree electric trucks will eventually pull significant market share away from diesel trucks. And truck dealers are already making decisions on how, when or even if to accommodate that seemingly inevitable advance.

A central question they face is how to adjust their traditional business models to remain profitable as they sell and service costlier, more durable zero-emission electric trucks that come with new battery-related technology and fewer parts compared with diesel trucks.

While diesel as trucking’s primary fuel is not expected to disappear soon, the writing is on the wall that diesel is facing new competition in a business and regulatory environment looking more closely at sustainability and zero emissions.

More Q2 EMU stories

“If the times are changing, everyone involved needs to adapt or the winds of the times pass by them,” Martin Daum, chairman of Daimler’s global truck business, told Equipment & Maintenance Update.

“We will certainly take care of our dealers and provide them with the necessary processes and equipment,” Daum added. “And yes, if it is necessary, the dealer has to invest.”

There were 1,521 Class 8 truck dealerships in the United States at the end of 2020, according to American Truck Dealers, a division of the National Automobile Dealers Association.

“If you are going to have a more than one generation business and continue to go, you are going to have to get invested in the electric product,” said Oscar Horton, CEO of Sun State International Trucks in Tampa, Fla., who was ATD’s 2020 dealer of the year.

“We are not going to let it catch us by surprise,” he said. “I am still going to make the business work, but it is going to take fewer and fewer people doing it.”

Eventually the cost to repair battery-electric trucks could skyrocket, Horton suggested. So could replacement parts to ensure a dealership maintains an adequate margin to stay in business in a world where, as experts have said, a durable electric truck could also have 40% fewer parts compared with a diesel truck in a similar duty cycle.

While dealerships favor electric-powered vehicles, some are still skeptical of the current technology costs connected with it. (North American Council for Freight Efficiency)

“Today it’s the razor, razor blade business,” Horton said. “We give the truck away. All of the margin is really in parts and service.”

Friedrich Baumann, president of sales, marketing and aftersales at Navistar Inc., said he would not be surprised if within 7-10 years battery-electric vehicles will be “a 30% application” in the medium-duty and bus environment.

One truck dealer principal said he believed diesel could be a fuel for 20 more years due to the longevity of new diesel trucks that are the cleanest ever.

“So there’s a runway to the time where the vast, vast majority is this other type of electric truck that requires different facilities, different people, different skills,” said David Kriete, CEO and principal owner of Kriete Group Inc. in Milwaukee.

Meanwhile in January, the brands he sells — Hino Trucks, Mack Trucks and Volvo Trucks North America — all published some dealer needs from a facilities’ standpoint “for the future, for electric,” Kriete said.

Kriete, a third-generation executive, said his company is at ground level.

“We don’t have too much that we’ve done, but we are certainly preparing for it from a human capital standpoint. We have a lot of our managers and technicians who are enrolled in and engaged in the training for electrical vehicles. It really depends on the capital investment in our footprint, our facilities, which can be awfully expensive.”

Other truck dealer executives said they see a greater role for dealers to act as consultants for customers in a world where powertrain options are growing.

“We believe we are going to be an expert consultant to our customers not only for EVs but helping them decide where EVs make sense or might make sense in their operation, or where it might make more sense to stick with diesel or natural gas or some other powertrain coming down the road,” said Scott Chowaniec, vice president of medium-duty truck and bus sales at Rush Enterprises.

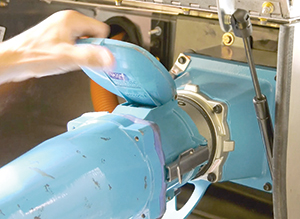

Electric trucks feature new components such as lithium-ion batteries and electric motors. (Mindy Long for Transport Topics)

He added: “Every electric truck requires a charging station. If you talk to the people who are putting charging stations in or who have them in any scale, many of the troubleshooting calls they get from people are not involving the vehicle itself. It’s the charging station.”

Chowaniec also wondered if a dealership technician could travel to work on charging station issues as well as repair the vehicle, adding a 5%-7% BEV share in Classes 4-7 is achievable in 5-7 years and 1%-3% in Class 8.

Scott Zeppenfeldt, senior vice president of operations for Velocity Truck Centers, a unit of Whittier, Calif.-based Velocity Vehicle Group, said customers need to start focusing on infrastructure now and get construction plans and support from utilities. “That has to be the biggest challenge, and the biggest opportunity to continue to educate our customers about infrastructure.”

Meanwhile, Class 6 and Class 8 electric demonstration trucks from Daimler Trucks North America have accumulated 500,000 miles, almost all of that in Velocity’s area of responsibility, Zeppenfeldt said.

“Since day one, we have been instrumental in helping launch this equipment,” he said, and he reports back to DTNA.

“Educating customers on the needs for infrastructure, engaging with utilities and seeing if incentives are available, but all that takes time,” he said. “If you are thinking about delivering equipment [as DTNA is, and others] by the end of 2022, a full production vehicle, you know we are going to blink and that will be here pretty quickly.”

Volvo Trucks North America dealer Vanguard Truck Centers recently opened a new flagship location in Houston. (Vanguard)

One of the key factors pushing the electric vehicle shift is the impending implementation of zero-emission truck regulations established by the California Air Resources Board that take effect in stages starting in 2024.

Rush’s Chowaniec said in the first year of the CARB regulation, 9% of Classes 4-8 straight trucks sold in the state have to be zero-emission vehicles.

From there, the percentages mount. CARB is requiring by 2035 zero-emission truck/chassis sales in the state would need to be 55% of Classes 2b-3 truck sales, 75% of Classes 4-8 straight truck sales and 40% of truck tractor sales.

Another truck dealer principal noted he was in favor of alternative-fueled trucks but was skeptical of electric vehicles given the current state of the technology.

“The technology itself has some functional, logistical problems that yet have not been resolved. Both in terms of the battery capacity and regeneration of electricity. Of course, for every pound of battery that is one less pound of payload,” said Kyle Treadway, dealer principal for Kenworth Sales Co. in West Valley, Utah. “As best as I can tell the equipment is almost double the price of the standard diesel-powered equipment. Our customers are business people and that double cost upfront does not pencil out. They are not seeing a business case to recover those extra costs. Today, the only way anybody could take the risk is if government subsidizes it.”

Want more news? Listen to today's daily briefing below or go here for more info: