Commodities’ Best Quarter Since 2016 May Be Tough Act to Follow

Commodities had their best quarter in almost three years, driven by supply concerns and optimism over demand. Investors, though, might not want to get too cocky.

The outlook for demand is running into troubling signs in the United States and China, the two biggest consumers. In early March, China cut its goal for economic expansion, while a report last week showed U.S. growth cooled more than forecast.

“It’s hard to make the case that, overall, commodities can stay in this uptrend,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management in Seattle, which oversees $164 billion. “Grains will have a tough time, and for industrial metals the underlying question is: What really is going on with China’s growth?”

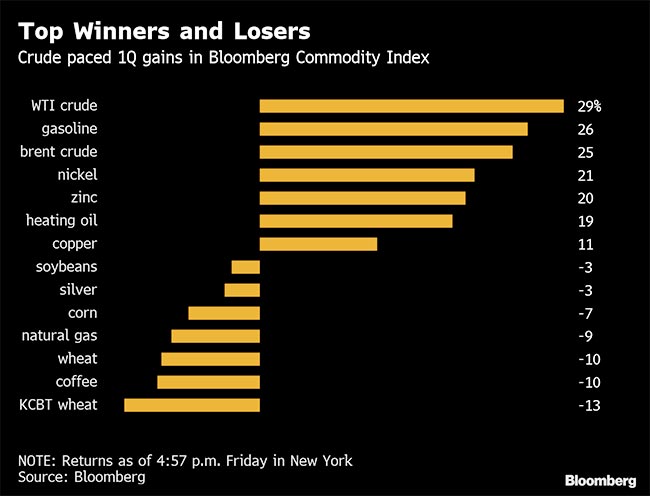

In the first quarter, total returns for the Bloomberg Commodity Index of 23 raw materials rose more than 6%, the most since the three months ended in June 2016. Crude oil paced the advance, while nickel led gains in industrial metals. A surge in January propelled the index amid bets on resilient global economic and signs of tight supplies in many markets.

Optimism has wavered, with the index falling in March as manufacturing and auto sales data weaken from Europe to China and central banks look for ways to shore up their economies.

Still, even with the uncertainty, analysts say commodities demand has yet to fall out of bed, and supply concerns aren’t going away soon for many raw materials. Also, a dovish stance at the U.S. Federal Reserve on interest rates could ease dollar strength, underpinning demand. On April 1, the Bloomberg Commodity Index advanced as much as 0.6% after China’s first official economic gauge for March signaled a stabilization.

“The fundamental concerns remain on the supply side, with constraints for many commodities,” said Darwei Kung, a money manager at DWS Investment Management Americas Inc.’s $2.8 billion Enhanced Commodity Strategy Fund. “Capital investment necessary to expand capacity at a faster pace than demand was just not spent for the last several years.”

Oil prices stormed back in the first quarter, recovering from worries about a global oversupply that pushed crude into a nosedive to end 2018. The new year brought orchestrated production cuts by OPEC, Russia and other major suppliers, and the outlook for interest rates in the United States calmed investors.

“We’re in the later innings of an expansion. We’re not calling for a recession in 2019, but with the global growth slowdown, it’s not going to feel good in the second half for earnings and for global trade, even with a trade deal,” said Chad Morganlander, a money manager at Washington Crossing Advisors, which oversees $2.5 billion. “My belief is that oil prices will moderate.”

The drop in oil prices in the fourth quarter and early this year spurred a rise in demand, and supply issues support the near-term outlook, said Jeffrey Currie, global head of commodities research at Goldman Sachs Group Inc. He said the bank is neutral on commodities.

“We are only bullish on oil for the next two, three months, after which we become bearish” on the outlook for increased supplies from the Permian Basin and elsewhere, he said.

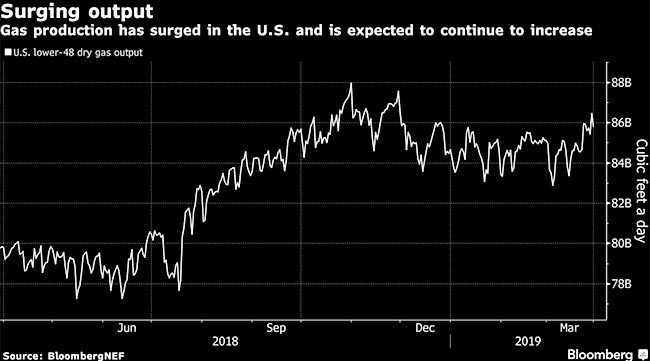

Natural gas prices are collapsing across the globe as supplies from the United States to Australia flood the market, sparking concern some exporters will have to curtail output and raising questions about new investments. While prices typically ease at this time of year as mild weather in the Northern Hemisphere crimps demand, a boom in output of the heating and power-plant fuel is exacerbating the slump.

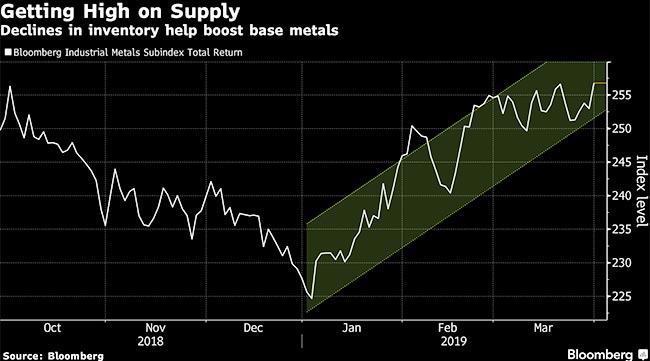

Falling stockpiles and the outlook for production deficits in some metals, including copper, helped bolster prices in the first quarter, with an index of metals traded in London posting its first quarterly gain since the end of 2017.

The rally in metals at the start of the year has hit a roadblock. While supply concerns are expected to persist, that may not be enough to fuel further price gains should demand ebb, even after the Chinese government announced economic stimulus measures.

One metal that may benefit from economic angst is gold. Futures posted their second straight quarterly gain on haven demand and the outlook for low interest rates.

Among crops, even with the fewest U.S. acres planted in about a century, the hard red wheat variety formerly known as Kansas City wheat has been foundering. Abundant supplies in storage and sufficient rainfall, especially in the top wheat-growing state of Kansas, have weighed on wheat prices. Similarly in coffee, a glut led by a record-large Brazilian crop sent prices to the lowest levels since 2005.