Senior Reporter

Class 8 Sales Show Resurgence in July

[Stay on top of transportation news: Get TTNews in your inbox.]

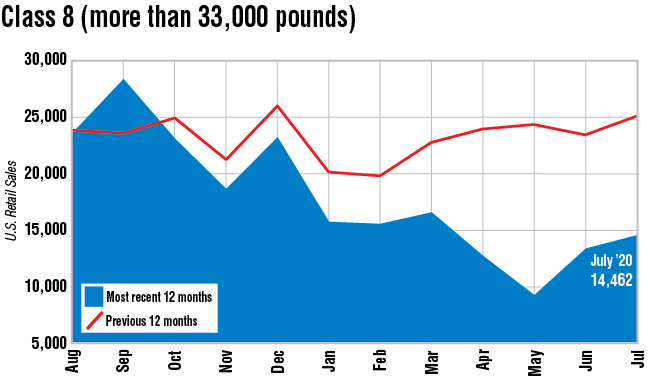

U.S. Class 8 retail sales in July cleared 14,000 to reach the highest total since March, WardsAuto.com reported as the freight economy grew stronger.

Sales hit 14,462, off 42.5% compared with 25,164 a year earlier. Year-to-date sales fell 39.3% to 97,110 compared with the 2019 period.

All truck makers posted large year-over-year declines.

At the same time, a sense of optimism was palpable among experts.

“This has been a very different cycle from an economic perspective in that it has been services-led, if you will,” ACT Research Vice President Steve Tam said. “At the crux, it just seems things are not as bad as everyone had expected.”

He noted the consumer sector is about 70% of the economy, and about two-thirds of that 70% actually is services — in which money is moving but freight is not involved.

“If you look at the decline in second-quarter GDP,” Tam said, “the goods portion is only down low- to mid-single digits whereas services are down 25%.”

“[July’s number is] still relatively weak compared with last year, but you are not comparing it to that,” said Don Ake, vice president of commercial vehicles at FTR. “You are comparing it to how bad things were. This is the biggest month since March [16,477]. It’s a nice approximately 9% gain over last month [13,276], so it’s not like the market has taken off, but it’s still growing.”

He added, “Our outlook remains conservative, but there is some enthusiasm in the market. There’s freight to haul. They can make money, and then they can invest in new equipment.”

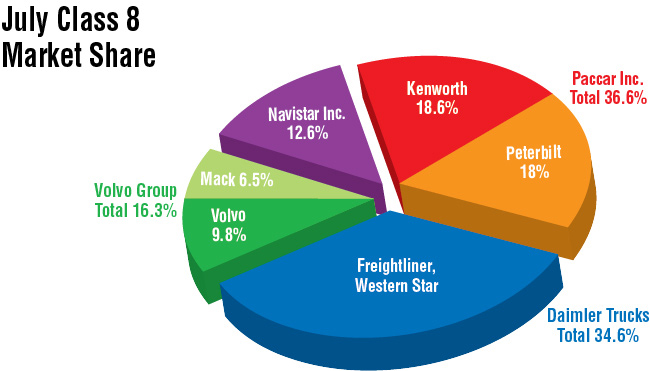

Freightliner, a unit of Daimler Trucks North America, remained the market leading brand with 4,646 sales, off 47.7% compared with the 2019 period. It earned a 32.1% share.

Western Star increased its market share by 1 percentage point to 3.3%. (DTNA)

Western Star, also a DTNA brand, posted sales of 356, down 42.2% compared with a year earlier. It had a 2.5% share.

Together, the DTNA brands had a 34.6% share.

At the same time, Paccar Inc.’s two brands — Kenworth Truck Co. and Peterbilt Motors Co. — combined to deliver a leading 36.6% share.

Peterbilt notched 2,608 sales for an 18% share. Sales were down 29.7% compared with the 2019 period.

Kenworth had 2,686 sales and an 18.6% share. Its sales fell 33.5% compared with a year earlier.

Paccar CEO Preston Feight said during a July earnings call that freight levels are “kind of similar” to the beginning of 2018.

“So, really solid levels of freight going on in the world, and our customers are profitable, fuel prices are low and activity continues to be high” Feight said. “And that’s carrying our buildup into the third quarter.”

Truck makers are definitely stabilizing their production rates, Tom Linebarger, chairman and CEO of engine maker Cummins Inc., said July 29 during a second-quarter earnings call. “They’re seeing stronger demand. It’s not fabulous; it’s just stronger.”

International, a unit of Navistar Inc., had sales of 1,815 for a 12.6% share. However,that’s down a leading 51.1% compared with a year earlier.

One Nashville, Tenn.-based International truck dealer executive said offering an exceptionally efficient Class 8 has sent sales skyrocketing.

Cumberland International Truck is about to put into the hands of certain customers for testing the third generation of its C10 Class 8 that is spec’d to achieve 10 mpg in the longhaul segment. (Cumberland International Truck)

Matt Smart, director of fleet sales at Cumberland International Truck, gives its demonstration C10 model — spec’d for longhaul operations and fuel efficiency — to potential customers for up to a month to use in normal circumstances. That way, they can experience the gains that have proved to be up to 10 mpg over the past three years.

“It has changed our dealership from selling a couple of hundred trucks a year to about tenfold that amount in both 2018 and 2019,” Smart said. “A lot of things aligned. Although, this year we’ll probably sell about half that just because of the pandemic.”

The latest C10 version comes with the 2021 Cummins X15 Efficiency Series paired with Eaton Cummins Endurant HD 12-speed automated manual transmission.

The C10 was introduced in 2013.

About 6,000 versions of a C10 are on the road today “and it works,” Smart added.

Over the next 18 months he hopes 10 to 15 fleets will be able to run the demonstration truck.

“Then I’ll be accepting orders for other units like it,” Smart said.

Volvo Trucks North America notched 1,416 sales and a 9.8% share, but sales fell 43% compared with the 2019 period.

Mack Trucks had 935 sales and earned a 6.5% share. That was down 45.7% compared with a year earlier.

VTNA and Mack are units of Volvo Group.

Volvo and Mack each grew market share over the seven-month period compared with last year, increasing to 9.7% from 9.5%, and to 8.1% from 7%, respectively.

Kenworth grew its share the most, climbing 1.2 percentage points to 15.8%. Western Star increased by 1 percentage point to 3.3%.

Other truck brands lost year-to-date market share.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More