Senior Reporter

Class 8 Sales in November Slip

[Stay on top of transportation news: Get TTNews in your inbox.]

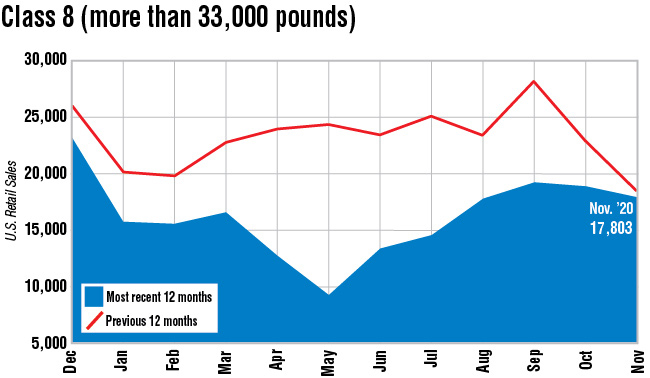

U.S. Class 8 retail sales in November neared 18,000, WardsAuto.com reported. Other industry experts said the market had weathered the coronavirus pandemic and was finishing strong, extending a trend that began in August when sales exceeded 17,000 for the first time this year.

November sales hit 17,803, down 4% compared with 18,545 a year earlier, according to Wards.

“Customers are just being very methodical in what they are doing,” said ACT Research Vice President Steve Tam. “The thing about retail sales is, that’s the customer finally making the decision the transaction is going to be culminated. To me, that is the real score, the true score.”

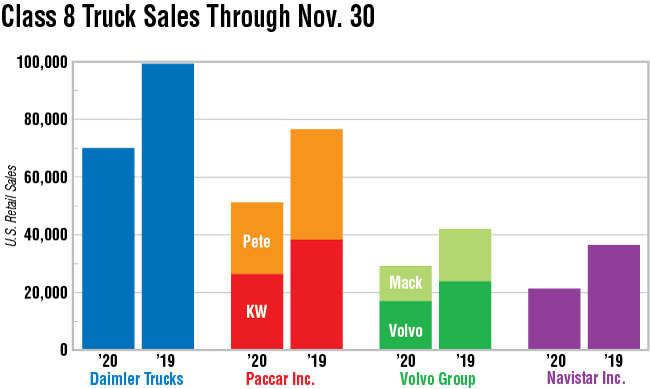

Freightliner, a brand of Daimler Trucks North America, notched a leading 7,709 sales, up 9.4% compared with 7,046 from the 2019 period.

Western Star, also a DTNA brand, posted sales of 492 — one less than a year earlier.

“Our industry has rebounded tremendously from late-spring lows,” Richard Howard, DTNA senior vice president of on-highway sales, told Transport Topics.

DTNA saw a strong month in November, he said, “because our customers know that by choosing total cost of ownership, dependability counts, reliability counts, partnerships count.”

“More than ever, our focus, our intentionality and our continued, dedicated service to the fleets across North America and the world remains resolute,” Howard said.

U.S. Class 8 retail sales hit a low for the year in May at 9,165 after temporary plant shutdowns.

“With the exception of the ‘pandemic pause’ when everyone took some time to get their bearings, it has been a good year. Retail activity was solid,” said Matt Smart, Cumberland International director of fleet sales.

“The lack of readily available drivers,” Smart added, “seems to be a limiting factor in growth with many of our customers. This issue is not new or easily resolved.”

Nashville, Tenn.-based Cumberland operates nine locations in Middle Tennessee and north Florida.

International, a brand of Navistar Inc., posted sales of 1,847, up 45.1% compared with 1,273 a year earlier.

Jonathan Randall, Mack Trucks senior vice president of North American sales, said customers are purchasing vehicles across all heavy-duty segments “although we’ve seen a noticeable jump in longhaul sleeper sales as an overall percentage of total purchases.”

Mack, a unit of Volvo Group, posted sales of 1,057 compared with 1,185 in the 2019 period.

“To have the market mirror where we were at this point last year, considering the market conditions during the second quarter due to the pandemic,” said Magnus Koeck, Volvo Trucks North America vice president of strategy, “is somewhat remarkable.”

VTNA posted sales of 1,430 compared with 1,528 a year earlier. Also a brand of Volvo Group, VTNA had predicted a strong finish to 2020.

“We are happy to see we have hit the mark,” Koeck said. “With the recent launch of our Volvo VNR Electric model and these strong retail sales numbers, we look forward to a good start to 2021.”

Kenworth Truck Co. sold 2,588 compared with 3,508 in the 2019 period, and Peterbilt Motors Co. sold 2,679 compared with 3,506 a year earlier. Both are brands of Paccar Inc.

Meanwhile, Tam said fleets overreplaced trucks in 2017, 2018 and the first part of 2019.

“So we knew 2020 was going to be a down year,” he said.

Home | Video | Heroes' Photo Gallery

Saluting the men and women of the trucking industry who kept America's essential goods flowing during the coronavirus pandemic.

Heroes: Peter Lacoste | Susan Dawson | James Rogers | Reggie Barrows | Kevin Cooper | Cesar Quintana Moreno

Industry sales through the first 11 months fell 32.7% to 170,498 compared with 253,266 in the 2019 period.

ACT expected sales in 2020, pre-pandemic, to be down about 25%, Tam said.

“So if sales finish down 30%, the pandemic will barely have had much effect at all, he said. “And that’s because of people spending a higher proportion of their money on goods moved by trucks as opposed to experiences.”

Last year was the best for Class 8 sales since 2006. All of the major truck makers posted double-digit declines in sales for the 11-month period in 2020.

Only Hino Trucks, a modest new entrant in the segment and a Toyota Group company, saw year-to-date sales climb, jumping 200% to 24 compared with eight a year earlier.

At the same time, this pandemic-driven year did little to change truck makers’ respective Class 8 U.S. retail sales market shares year-to-date compared with 2019.

- The exception was International, whose share fell to 12.3% from 14.3%.

- Freightliner improved to 37.9% compared with 36.8%.

- Western Star increased to 2.9% from 2.4%.

- Kenworth inched up to 15.3% from 15%.

- Peterbilt slipped to 14.6% from 15.1%.

- VTNA’s share inched up to 9.7% from 9.3%.

- Mack Trucks’ share was flat at 7.2%.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More