Bloomberg News

Broken Supply Chains Threaten Ruin at a Growing Number of Small Firms

[Stay on top of transportation news: Get TTNews in your inbox.]

A growing cohort of smaller companies that survived the cold depths of the pandemic say now they’re in danger because the economy is too hot.

Mattress sellers, flooring manufacturers and makers of clean energy equipment are warning that stretched supply chains and runaway freight bills have pushed them to the brink of ruin. Unlike global giants, they don’t have the cash and scale to hire their own cargo ships or pass on the soaring expenses, forcing them to seek private bailouts.

The roster includes Casper Sleep Inc., which accepted a buyout at a fire-sale price along with a costly bridge loan. Armstrong Flooring Inc., reeling from a 21% cost increase, expects to violate its loan agreement, a fate that has already overtaken TPI Composites Inc., which got cash from distressed-debt specialists to keep the maker of wind turbine blades afloat.

“COVID was tough enough to figure out in terms of consumer behavior, increased leverage,” said Lisa Donahue, global co-head of restructuring at AlixPartners. “And then you add stress on the supply chain, coupled with inflation, that makes it really complicated,” she said. “If you have high leverage and other fixed costs to start with, you’re going to find yourself getting pushed a lot closer to the edge.”

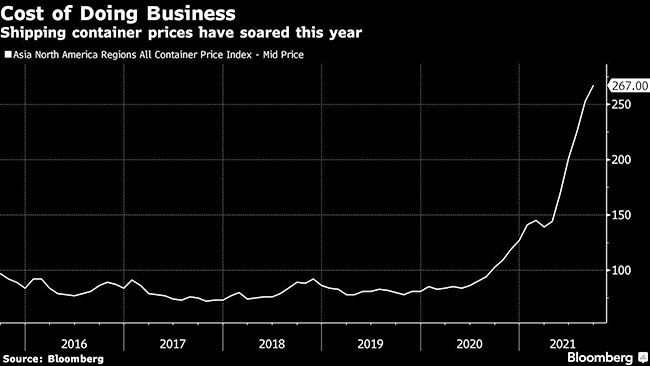

Aterian Inc., which sells consumer products ranging from coffee pots to office chairs online, had to hand lenders an equity stake after landing in default. Dramatically higher shipping rates were the cause, with prices soaring to $20,000 per container in July from $3,000 to $4,000 before the pandemic, CEO Yaniv Sarig said in an interview.

“That’s a lot of money for a company like us,” Sarig said. “So when we realized that was happening, we had to make some very tough decisions.” This included giving about 9.3 million shares to its lender, High Trail Investments, at about a 20% discount. There’s still $25 million of the debt outstanding; the company says it’s now meeting all terms of its loans and that the worst is over.

The companies warning of financial extinction stand out because there are so few other distressed situations left after more than a year of easy credit and federal bailouts to soften the pandemic. Bloomberg Intelligence reckons that distressed bonds in circulation total just $27.2 billion, the second-lowest amount in the past 14 years. At one point in the pandemic, the tally of all distressed debt was closer to $1 trillion.

Big rig braking is an engineering marvel. Host Michael Freeze finds out more about the advanced technology that halts 18-wheelers, no matter the weight, instantaneously. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

One silver lining to the distressed drought is that investors who specialize in troubled companies have plenty of idle cash looking for something to rescue, and there’s no shortage of turnaround consultants.

AlixPartners is helping manufacturers straighten out kinks in their supply chains by moving operations onshore, working with their distressed suppliers and negotiating breaks from lenders.

So far, Donahue said, many lenders have been amenable if borrowers show a clear plan of how they’ll manage the crisis. Investors who agree to help are rewarded with equity stakes, or hefty interest rates and plenty of protection on any loans they grant.

The flexibility is helping to keep firms from bankruptcy for now, according to Joseph Weissglass, a managing director at advisory firm Configure Partners. Given how expensive and disruptive a Chapter 11 case can be for small companies, he said, debt troubles are being resolved with “light-touch restructurings” out of court.

Aterian worked with its shipping partners and got assistance from Amazon, which has helped its merchants get better rates on containers. Sarig says he’s confident about the holiday season, and his company is already well into preparations for 2022, ordering some products as much as a quarter sooner than normal.

Big retailers have more ways to steer around the logistics chaos and higher costs by themselves. Walmart Inc., for instance, is hiring more supply chain workers, chartering entire ships and rerouting them to less-congested ports. “Fighting inflation is in our DNA,” CEO Doug McMillon said during this week’s earnings call. “Sam Walton loved that fight and so do we.”

Retailers will need to show they can get product onto shelves and into customer hands for the holidays, said Lucy Kweskin, a restructuring partner at law firm Mayer Brown.

“Anything retail-based that’s struggled over the past couple of years is hoping to have a gangbusters holiday season,” she said. “Those are the companies that it’s going to affect the most.”

Alas, no one expects supply chains to untangle any time soon. Donahue at AlixPartners hears that normal could be anywhere from 18 to 24 months away. Meanwhile, it’s still possible the economy could lapse back into the Covid doldrums. Aterian’s Sarig isn’t expecting a routine economy until 2023, and he has a close eye on the next few months.

“We’re definitely not taking things for granted,” he said. “Everyone is kind of holding their breath to see how the winter plays out.”

Want more news? Listen to today's daily briefing below or go here for more info: