Government Contests Fitzgerald Gliders' $83 Million Court Win

A civil jury found in favor of former glider manufacturer Fitzgerald in an $83 million federal tax dispute with the IRS. Federal attorneys haven’t given up on the outcome of the trial.

IRS Reminds Truckers of Aug. 31 Tax Payment Deadline

For truckers who first used their vehicles in July on a public highway, the IRS is reminding them of an Aug. 31 deadline to electronically file their heavy highway vehicle use tax return.

Tax Credits Kick in Jan. 1 for Alternative Fuel Infrastructure, Commercial EVs, Related Items

New tax credits for installing alternative fuel infrastructure or buying new commercial electric and fuel cell vehicles are available from the Internal Revenue Service starting Jan. 1.

IRS Proposal Could Rewrite Rules on How Certain Equipment Is Taxed

Determination of whether a truck will be used for on- or off-highway duty is central to a proposal from the Internal Revenue Service that could rewrite the rules on how certain equipment is taxed.

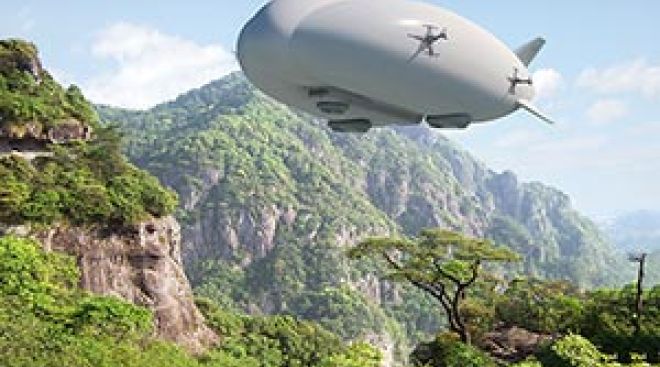

Lockheed Wins $480 Million Order for 12 Freight-Hauling Airships

Lockheed Martin Corp. won an order for as many as 12 airships worth $480 million as lower crude receipts spur cost-conscious oil and gas companies to consider aircraft able to carry workers and cargo to remote locations without the need for hefty investment in runways and roads.

MoDOT Director Says 'Tidal Wave' of Repairs on Horizon, Urges Lawmakers to Act

The new director of the Missouri Department of Transportation on Jan. 26 continued his call to boost state transportation spending.

New IRS Tax Rules on Assets to Affect Fleets, Experts Say

New tax rules that start Jan. 1 will change the way trucking companies and other U.S. businesses account for real estate and business equipment and could create room for more same-year deductions rather than multiyear depreciation, according to several tax experts.

December 2, 2013Communication Is Key to Getting Trucks Fixed After Roadside Breakdowns, Repairers Say

When trouble strikes and a truck is disabled, establishing clear lines of communication between the driver, the driver’s dispatcher and the technician handling the problem are paramount to ensuring that the vehicle gets back on the road quickly and at minimal cost, according to the managers of several roadside-repair networks.

December 10, 2012