IRS Proposal Could Rewrite Rules on How Certain Equipment Is Taxed

This story appears in the June 13 print edition of Equipment & Maintenance Update, a supplement to Transport Topics.

Determination of whether a truck will be used for on- or off-highway duty is central to a proposal from the Internal Revenue Service that could rewrite the rules on how certain equipment is taxed.

Howard

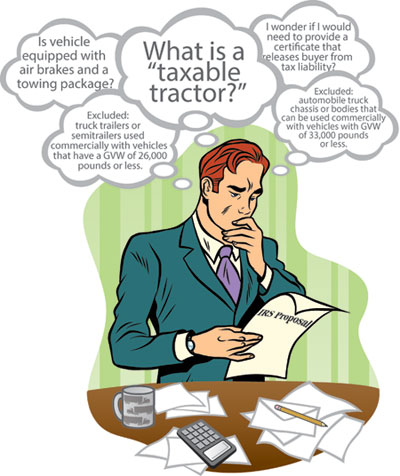

HowardIRS has proposed revisions to the definitions of tractors and chassis cabs so that a seller can establish the tax status of what the agency describes in a notice of proposed rulemaking as an “incomplete chassis cab.” If a buyer states that it will not add the equipment necessary to bring a chassis cab up to the level of what the March proposal calls a “taxable tractor,” then the seller will provide a certificate that releases the buyer from tax liability.

“No tax is imposed on the sale of an incomplete chassis cab when accompanied by a qualifying certificate,” the NPRM states.

BEST OF JUNE E&MU: More stories, columns

The document also lays out in detail what distinguishes one vehicle type from another. IRS defines a tractor as “a highway vehicle primarily designed to tow a vehicle, such as a truck trailer or semitrailer.” The agency specifically notes that a vehicle equipped with air brakes and a towing package will be “presumed to be a tractor unless it is established, based on all the vehicle’s characteristics, that the vehicle is not primarily designed to tow a vehicle.”

Conversely, the absence of a system to control trailer brakes — whether via air, hydraulic or electric power — denotes an incomplete chassis cab. In these cases, the vehicle will be treated as a truck, which is defined as a highway vehicle “primarily designed to transport its load on the same chassis as the engine, even if it is also equipped to tow a vehicle, such as a trailer or semitrailer.” Also tied up in the proposal are “toters,” or trucks that pull trailer homes. The proposal treats these vehicles as taxable tractors — a move IRS notes is a departure from previous practice.

The NPRM also makes clear distinctions among types of trailers. A trailer is defined as a non-self-propelled vehicle hauled, towed or drawn by a truck or tractor, and which consists of a chassis and a body. Under this definition, the body accommodates the load. A semitrailer, by comparison, denotes a trailer that the front end of which is designed to attach to and rest on the back of its towing vehicle. A portion of its weight and load rests on the towing vehicle. A third definition, a truck trailer, is one that carries all of its weight and the weight of its load on its chassis.

Drilling down, the proposal also defines a tractor as a vehicle that has the capacity to tow trailers with a gross vehicle weight of 20,000 pounds, or a GVW of 23,000 pounds and a gross combined weight of 43,000 pounds. From there, the proposal goes into increased detail regarding cabs, engines and equipment, among others. IRS also notes that if a vehicle does not have air brakes and a towing package but still is used primarily to tow a vehicle, it is then defined as a tractor.

Excluded from the proposal are automobile truck chassis or bodies that can be used commercially with vehicles that have a GVW of 33,000 pounds or less. Also excluded are truck trailers or semitrailers used commercially with vehicles that have a GVW of 26,000 pounds or less. The proposal also departs from previous practice as it relates to IRS taxation of tires. While the NPRM lets stand an existing rule that imposes a tax on applicable tires for each 10 pounds of the maximum load capacity that exceeds 3,500 pounds, it removes references to tread rubber, inner tubes and the determination of a tire’s weight. The new rules also would include definitions for rated load capacity and super-single tires. In addition, the NPRM addresses multiple load ratings and the consequences of tampering with a tire’s maximum load rating.

The rule proposal is intended to “reorganize and partially restate” tax regulations that have existed in various forms since 1983, IRS said. The complete NPRM was published in the Federal Register on March 31. The agency will accept public comment on the proposal through June 29.