Bloomberg News

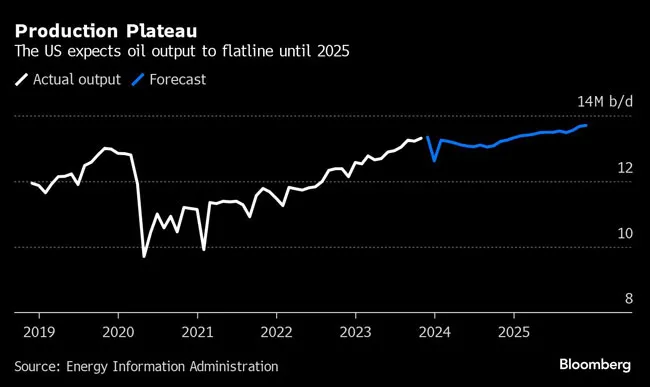

US Oil Output Expected to Flatline Until 2025

[Stay on top of transportation news: Get TTNews in your inbox.]

The U.S. sees oil production flatlining for most of this year before reaching a new record in early 2025. That would ease concerns about a supply glut that has weighed on prices.

Shut-ins from frigid weather caused output to drop to 12.6 million barrels a day in January from a record 13.3 million-barrel clip in December, the U.S. Energy Information Administration said in a forecast Feb. 6. Production will rebound to just shy of record levels this month before decreasing slightly for the rest of the year, and won’t reach a new high until next February, the agency said.

Lower output from the U.S. at a time when OPEC and its allies are reining in their own exports could support global crude prices, which are down more than 20% from last year’s highs. The EIA continues to expect a global supply deficit of about 120,000 barrels a day in 2024.

But the agency’s forecast stands in contrast to that of the International Energy Agency, which sees continued supply growth from the U.S., Canada, Brazil and Guyana contributing to a global surplus of 500,000 barrels a day.

To be sure, the pace of U.S. production growth in 2023 surprised some forecasters, with record supplies from the Americas dampening the impact of OPEC+ cuts later in the year.

The EIA lowered its forecast for U.S. oil demand this year to 20.39 million barrels a day, down from a previous estimate of 20.45 million barrels a day. The forecast for U.S. jet fuel demand was revised lower by about 1.8% to 1.68 million barrels a day.

Want more news? Listen to today's daily briefing below or go here for more info: