UPS Shipments Swell in Amazon Era

[Stay on top of transportation news: Get TTNews in your inbox.]

Not that long ago, Wall Street fretted that tradition-bound United Parcel Service Inc. would lag nimble FedEx Corp., with its fully automated package-sorting hubs, in the race to cash in from surging shipments tied to e-commerce.

It hasn’t turned out that way.

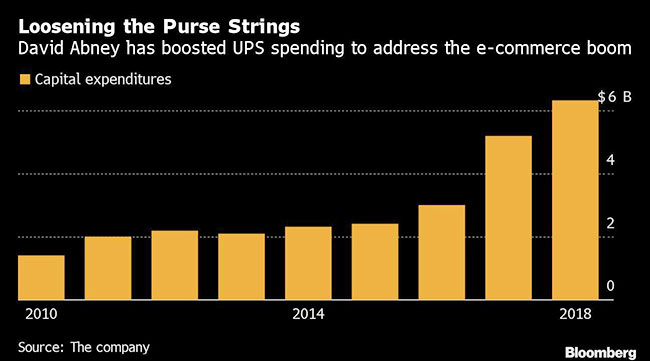

A $20 billion investment spree detailed by UPS CEO David Abney last year, a plan that initially rattled Wall Street, is bearing fruit. Profit margins are improving even as 112-year-old Big Brown copes with swelling volume from voracious online shoppers, who are typically less lucrative to serve than business customers.

“We’re on a real solid trajectory, and I think we’re going to get the benefits of transformation for many years to come,” Abney said in a recent interview at his Atlanta office.

UPS CEO David Abney (Dustin Chambers/Bloomberg News)

While FedEx was slow to embrace the lower-profit e-commerce business, Abney pounced on it, even showing he was willing to live with frenemy Amazon.com as a major customer. Both couriers are managing through a time of upheaval in their business, and their fortunes could shift over time. But for now, the upper hand belongs to Abney, the rural Mississippi student who worked himself up the ranks at UPS from a part-time job loading packages.

Shares of UPS were outperforming its rival’s this year even before FedEx warned this week that a trade war and broad, global economic slowdown are tanking package demand — a view that UPS pointedly said it didn’t share. And Abney said UPS is on track to meet the target he set last year of boosting annual profit by $1.20 a share in 2022.

A little more than two years into his tenure as CEO, Abney first broached to investors what has become the company’s most sweeping top-to-bottom overhaul in decades. UPS needs to “change drastically,” he said in the interview, to confront the changes in retail shipments and the squeeze those residential packages put on profit margins.

WANT MORE NEWS? Listen to today's Daily Briefing

UPS needed to spend heavily to improve efficiency at facilities that had become outdated after 15 years of low investment. He realized he needed to hire executives from outside UPS’ ranks to bring fresh thinking on how to deal with the disruption wrought by Amazon. The internet retailer is one of UPS’ biggest customers as well as a potential competitor, since it’s building out its own delivery network.

“It’s about time somebody shook things up,” said Cowen & Co. analyst Helane Becker. “He is just trying to get UPS to the next level and figure out how he competes globally and with a customer who is also increasingly becoming a competitor.”

Investors balked at the price tag of Abney’s three-year plan and sent UPS shares reeling last year. Signs of success — one of the smoothest peak seasons ever last year and an increase in operating profit in the second quarter for the first time in two years — have helped the stock rebound closer to its record-high in early 2018.

Next month will be pivotal, as investors pore through third-quarter results to see if the courier known for its trademark brown delivery vans can maintain the momentum.

Abney more than doubled annual investment to modernize sorting hubs and add new aircraft. He rammed through a union contract that allowed UPS to hire weekend drivers at new lower pay rates. He also offered early retirement for executives who didn’t get behind his transformation plan and broke a UPS taboo by putting outsiders in the C suite.

Each of those moves carries risks.

Amazon’s homegrown parcel business still threatens to steal volume and undercut shipping prices. It also isn’t clear that automation and new aircraft can help reverse the drag on UPS’ profit margins, said David Ross, an analyst at Stifel Nicolaus & Co. Efforts by the courier to spur growth from small businesses and the health care industry are helpful, but “don’t move the needle that much” for a company with $70 billion in annual sales, he said.

“Either they can solve that with pricing, or they can solve that with operational efficiencies, but it’s going to be a challenge,” Ross said. “They haven’t been meeting that challenge because we’ve seen margins go the other way.”

Abney’s decisions to place four outsiders on the 12-person leadership committee and shed longtime executives through early retirement have employees on edge, said Glenn Gooding, president of shipping consulting firm IDrive Logistics, who worked at UPS for 21 years.

A new five-year contract that was barely ratified last year still rankles some union members, in part because it creates a new class of drivers for weekends who earn less than existing drivers. Still, UPS drivers are the best compensated in the industry.

“It’s a big cultural change,” Gooding said. “It’s very disruptive and is impacting morale.”

Analysts mostly are optimistic about third-quarter results, though, predicting that profit will rise to $2.06 a share, up from $1.82 a year earlier. Year-to-date, the company’s stock was up 24% through Sept. 18, outpacing a 6.5% decline for FedEx and a 20% increase for the S&P 500 Index over the same span.

Abney, a UPS lifer, may seem an unlikely change agent. He joined the company while in college as a 19-year-old package loader and later delivered parcels. Yet UPS has thrived through other shocks, he said, such as when paper logs were replaced with “hand held” computers so large that some drivers joked they were best used for fending off aggressive dogs.

“Our future is not going to be as positive as our past if we’re not willing to do what the company has done in the past, which is change — and change drastically,” he said.

Abney said UPS is ready for the shift at Amazon, which is leasing air freighters, lining up drivers to make home deliveries and building a high-tech shipping network. Analysts estimate that the e-commerce giant represents almost 10% of UPS sales — business that could become less profitable if Amazon grabs the most lucrative routes for itself. FedEx canceled domestic contracts with Amazon.

“We have chosen to work with them,” Abney said. “As long as it’s mutually beneficial, then that’s what we’ll do. If it no longer becomes mutually beneficial, we’ll make those changes appropriately.”

Abney also touts UPS’ innovation in response to the explosive growth of online commerce, such as matching small businesses with empty warehouse space or helping retailers use their stores as delivery centers for online purchases.

“What you can’t do is put your head in the sand and say that e-commerce isn’t real,” Abney said. “E-commerce, I believe — along with emerging markets — is probably the greatest commercial opportunity that many of us are ever going to see because it is just changing the world.”

In a telling example of how Abney is trying to thread new ideas with tradition, the CEO plans to ring a brass bell outside of his office when UPS gets the green light from authorities to operate drones like an airline. The company plans to make deliveries first for health care customers and then expand from there, he said.

The 18-inch-tall bell, which for decades has been rung after significant milestones, has sat silent since after UPS acquired Coyote Logistics in 2015. Abney said he’s eager to ring in that change when regulators loosen restrictions for UPS to fly delivery drones — approval that Abney expects to receive “quickly.”

“I do admit when I pull the bell, I feel a little pressure,” he said. “You can’t have just a little clang. You’ve got to have a clear ring.”

UPS ranks No. 1 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.