Trump Tariff on Mexican Oil Could Hit Gulf Refiners

U.S. oil refiners could get hit if crude is included in President Donald Trump’s threatened 5% tariff on Mexican goods, although the effect may be tempered by their growing fuel exports.

Trump announced the tariff in a Twitter post May 30 without giving details. Mexico accounts for about 10% of U.S. oil imports, with sophisticated refineries along the Gulf Coast geared to turn Mexico’s sludgy Maya crude into gasoline and diesel.

Typically, refineries located in so-called foreign trade zones — including many Gulf Coast facilities — are exempted from duties on crude used to make fuels and other finished products that will be exported, as well as certain raw feedstocks sold domestically. As a result, the impact largely depends on how much of a plant’s output is destined for foreign markets.

A 5% tariff would add about $3 a barrel to the cost of Maya, which was worth about $58 on May 31, according to data compiled by Bloomberg. The profit margin for using Maya to make fuels is $6.86 a barrel, according to Oil Analytics data, so the increase in crude cost could slash that almost in half.

West Texas Intermediate, the U.S. benchmark, dropped 4% on the New York Mercantile Exchange. Trump’s tweet also rattled U.S. equities, with the Dow Jones Industrial Average sinking deeper into its longest streak of weekly losses since 2011.

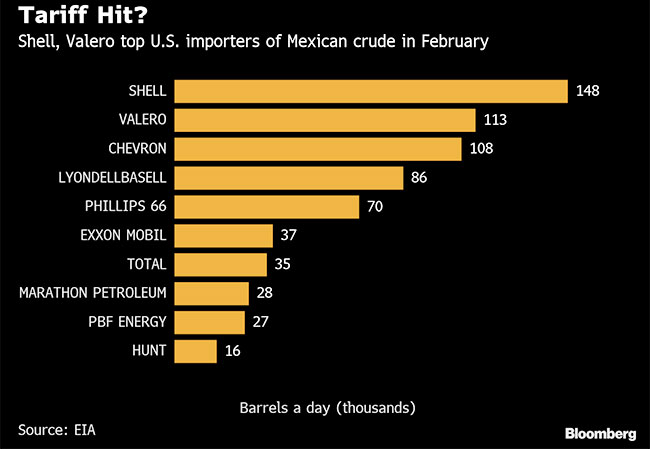

Royal Dutch Shell’s Deer Park plant in Texas, which is a joint venture with Mexico’s state oil company Petroleos Mexicanos, was the biggest importer of Mexican crude, bringing in 148,000 barrels a day in February, according to data from the Energy Information Administration. Much of its fuel is exported back to Mexico.

American companies Valero Energy Corp. and Chevron Corp. are the next-biggest purchasers, bringing in more than 200,000 barrels a day combined.

“At the moment the gas cracks look favorable for the refiners” in the U.S. Gulf, said Wood MacKenzie analyst Ixchel Castro in Mexico City. “But an increase in the price of Maya would affect the margins of those who already have the oil contracted and other producers will try to take advantage to place their heavy crudes at a more competitive price.”

There is some maneuver room for Pemex to send oil to Asia, but Mexico’s “contractual commitments limit this flexibility,” she added.

The proposed tariffs come at a time when the international market for heavy crude is tightening amid sanctions on Venezuela and Iran, ‘‘making it difficult for investors to ascribe value to widening crude quality differentials,’’ Cowen Inc. analysts led by Jason Gabelman wrote in a note to clients. The impact of the tariffs on refiners will start to show up in third-quarter earnings, the analysts said.

‘‘PBF Energy Inc. and Valero are most exposed to these impacts, while Phillips 66 and Marathon Petroleum Corp.’s exposure is less pronounced due to their more diversified nature,’’ the analysts said.

Valero’s shares dropped as much as 4.7% in New York, and PBF fell as much as 6.1%.

“Imposing tariffs on Mexican products, particularly crude oil, could raise energy prices for U.S. consumers, disadvantage the U.S. refining industry and jeopardize passage of USMCA — all bad outcomes,” American Fuel and Petrochemical Manufacturers President and CEO Chet Thompson said in a statement. “We thus urge the president not to pursue energy tariffs against one of our most important trading partners.”