Guest Contributor

Trailer Rental/Lease Study Examines the Reach of Technology Solutions

[Stay on top of transportation news: Get TTNews in your inbox.]

My father’s workshop was a total disaster. I often used a tool in his workshop, only to put it somewhere in the mess. And like clockwork, my father would bellow, “Where is my ____?” To me, the workshop looked a mess, but to my father, everything was nice and organized.

In business, we hear that same cry as a result of a container being lost overboard on a ship, a train wrecked or derailed, or a plane getting diverted due to weather.

Specifically in trucking, it’s the result of drivers running out of hours-of-service, trucks breaking down on the road, trailers getting lost in a yard, or packages getting delivered to the wrong place. Many of these examples may be considered — like my father’s workshop — a mess. However, when we scream, “Where is my ____?” the word in the blank space is usually … “technology?”

Menig

The recent Transport Topics webinar, “Trailer Optimization in a Reopening Economy,” highlighted some of the challenges in our industry and how trailers are playing a more significant role today and tomorrow. Trailer utilization is near its peak, trailer production is maxed out, chips and steel are in short supply. Costs for lumber and steel are rising and fleets are seeing cost increases put through to them, even as they are forced to wait more than six months to get half their order. The shortages of drivers and technicians put further strain on the efficiency of fleet operations.

This creates a demand for better utilization and optimization of existing trailers to keep them moving rather than sitting waiting while loaded or going unused. In turn, it begets the need for technological solutions that provide actionable data and information. Some fleets are turning to third parties to provide the manpower to monitor, analyze and decide when to move a trailer, where to move it, when to have it maintained.

Q3 Calibrate Stories

►Investing in Seat Technology

►Shops Improve Efficiency, Productivity

►Frequent Overhead Maintenance: Worth the Trouble?

►Volvo, Bendix Team Up on Safety, Training

►Freeze: Introducing Calibrate

Over the last year, ATA’s Technology & Maintenance Council — through its S.7 Trailers, Bodies & Material Handling Study Group — has taken the lead investigating the technology available for the next generation trailer. S.7 has hosted many presentations by brake suppliers, telematics companies, trailer logistics purveyors, trailer lamp and harness suppliers and more, which have provided a significant view of the “technology push” aspect of the future — with some understanding of the industry drivers for new technology.

Often, the best way to determine an answer to a problem or challenge is to ASK, or “Always Seek Knowledge.” The best person or persons to ask are your customers. Unfortunately, the trucking industry has hundreds of thousands of companies, making that a daunting task. To size the task more appropriately, TMC recently commissioned a study of the major trailer rental/leasing companies and their opinions of the issues and the technological solutions. These fleets account for roughly 10% of all trailers used, are a manageable number of companies to interview, and have inputs coming from thousands of fleets, both technologically leading and those that are more reluctant. Thus, they represent a good way to begin to assess the technologies and their benefits.

The TMC-funded study was performed by Business Accelerants and WillGo Transportation Consulting, which formed the eSMARTT collaboration to research the topic. The end result of the study was TMC IR-2021-1: North American Trailer Rental/Lease Company Survey Report — Next Generation Trailer Expectations. The council introduced the findings of this first TMC Market Intelligence Series report at its June 30 webinar earlier this year.

Such research can be challenging, because customers may know what they want, but not what they need. As the alleged quote from Henry Ford said, “If I had asked people what they wanted, they would have said a faster horse.” It often takes years for the “technology push of suppliers” to successfully meet the “pull of fleet needs” that properly balances the two to achieve enhanced safety, maintainability and readiness through technology.

The latest in technology often has numbers associated with it. Industry 4.0 promises to help us find and track everything in our factories and assure proper processing, assembly and quality. 5G promises to give us this information more quickly than ever before. AV 4.0 from the U.S. Department of Transportation envisions a future where unmanned ground vehicles, air drones and anthropomorphic robots deliver packages to our doors.

If not a number, then an acronym defines the future technology.

The Gartner Organization

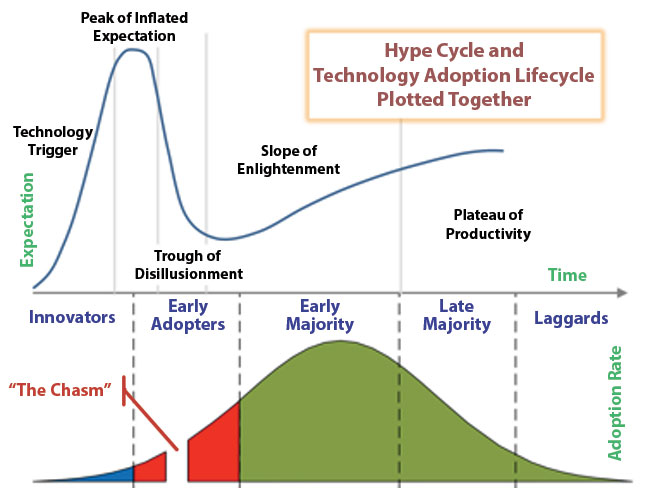

Which of these technologies will make the grade and crest the early majority hill?

- Trailer global positioning system (GPS)

- 3G/4G/5G telecommunications

- Variable frequency tracking/location updates

- Geofencing

- Door open/closed

- Loaded/empty status

- Interior temperature/humidity

- Power source

- Reefer/heater monitoring

- Tire pressure management

- Liftgate monitoring

- Wheel end and brake monitoring

- Backup and/or proximity sensors/cameras

- Onboard trailer weigh scales

- Light and/or electrical gateway hubs

Augmented reality (AR) will let us see things in 3D remotely, helping to alleviate the shortage of technicians.

VR or virtual reality will encase us in new worlds to learn and experience things as if we are there.

Advanced driver assistance systems (ADAS) will give drivers a clearer picture of their surroundings and aid them in avoiding accidents that delay shipments and increase transportation costs.

We need lithium iron phosphate (LiFePO4) or any of a number of chemical acronyms to eliminate the CO2 and NOx and more in the atmosphere.

AI for artificial intelligence, ML for machine learning, IoT for Internet of Things, IIoT for Industrial Internet of Things, CAN for controller area network, and USB for universal serial bus are more of the new language of technology.

Then, we can combine acronyms and numbers such as CCS2 for combo charging standard 2, BT 5.0 for Bluetooth version 5, V2X for communications between vehicles and everything/anything, 3PL for third-party logistics.

Technology is often hyped by its inventors and the press as the answer to the “Where’s my ____?” screams of the fleets, their customers, and their customers, until you reach the final consumer. Some technologies appear to take off, others lose their glow. Some can never get past those few companies that are the innovators in our industry and appeal to the much larger audience of fleets. Historically, it takes 2-3 decades for a technology to move from first prototypes to high penetration in new production. Examples include anti-lock brakes, electronic engines, automated mechanical transmissions, electronic logging devices, forward-facing cameras and ADAS.

TMC IR-2021-1 provides an analysis of smart trailer technologies currently employed by North American trailer rental/lease companies. Twelve of the top 15 companies in North America responded to the written survey and each participated in a follow-up 60-minute video conference. While dry vans represent the largest percentage, reefers/heaters, flatbeds, container chassis and other types are included. The 17-page, in-depth written survey was distributed and collected in February and early March 2021 and focused on several key areas of smart trailer technology adoption, including:

- Current technologies offered to customers

- Brands of smart products selected and offered

- Experience with those products and their performance reliability

- Rental customer demand and feedback

- Field operations issues and challenges

- Decision drivers on future smart trailer offerings

The full report is available at atabusinesssolutions.com.

TMC is looking forward to continuing its research in this area later this year with an in-depth look at the refrigerated trailer segment.

Paul Menig, CEO at Business Accelerants, is an MIT electrical/electronics engineer with many decades of service and contribution to the transportation industry in various capacities. Menig currently chairs two TMC task forces studying future trailer design and integration issues.

Want more news? Listen to today's daily briefing below or go here for more info: