Tonnage Robust as Demand for Trucks Grows

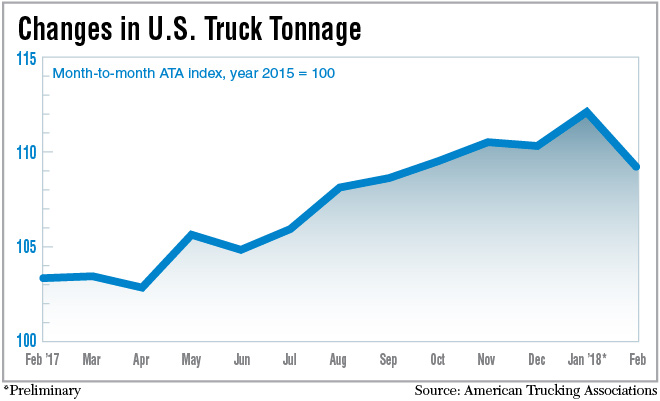

Truck tonnage in February was up nearly 6% compared with February 2017, according to American Trucking Associations’ monthly for-hire truck tonnage index. Tonnage is up 7.1% year-to-date, compared with the same two months in 2017.

For all of last year, the index increased 3.8% over 2016. On a sequential basis, the index in February declined 2.6% from January.

“Despite a softer February than January, freight remains robust as exhibited in the year-over-year increase,” ATA Chief Economist Bob Costello said. “The drivers of truck freight – personal consumption, factory output and construction – are good, plus the inventory cycle is in favor of motor carriers, so I expect freight tonnage to grow at a decent pace in the months ahead.”

The not seasonally adjusted index, which represents the change in tonnage actually hauled by fleets before any seasonal adjustment, equaled 99.7 in February, down about 7% from January. ATA calculates its tonnage indexes based on surveys of its membership.

In other industry measures, the Truckstop.com Market Demand Index (a measurement of the ratio between trucks and freight on the spot market) is at 53.3, indicating an extraordinarily powerful demand for trucks by shippers. A number less than 20 denotes a market that favors shippers, while a number over 20 equals a truckers market.

Noel Perry, chief economist with Truckstop.com, said the index, which is set weekly, hit a record 55.5 at the beginning of January. The last all-time high was in 2014 at 33.1, the last time demand for trucks was so strong due to a series of weather events.

“The high value says that trucks have all the loads they can handle. We are at a point where some loads are not moving when the customer wants them to because they can’t find a truck,” Perry said. “That can lead to spoilage and other problems. We could see a supply chain failure in some places.”

The demand for trucks could get higher if police crack down in April when enforcement of the electronic logging device mandate goes into effect and takes more trucks off the roads, he said.

“There’s no evidence of spare capacity to handle additional tonnage,” Perry said.

Truckstop.com is a load board and financial services provider based in New Plymouth, Idaho.

The FTR Trucking Conditions Index for February was forecast at 11.49, up slightly from January but more than double its 5.11 value in February 2017. The index measures the health of the trucking industry with a value of 0 indicating a neutral market.

“Everything in the market is heating up as we head into the spring freight season. We see this continuing for the next couple of quarters,” said Jonathan Starks, chief operating officer with FTR Transportation Intelligence in Bloomington, Ind. “[Demand for] refrigerated trucks is starting to pick up. Flatbed demand has been strong all winter.”

Indeed, demand for trucks across all segments has been strong since last summer. The FTR measure of truck utilization, or capacity, has been running at 99.6% or higher since July 2017 and at 100% for the past four months.

“This capacity could last through the third quarter of 2018,” Starks said. “Essentially, the market is running as much freight as it can.”

This activity puts upside pressure on contract rates, which are growing at a double-digit rate, he said.

Broader economic indicators generally were higher in February.

Manufacturing was in overdrive in February, according to the Manufacturing Report on Business from the Institute for Supply Management. Its index hit 60.8%, its highest level since 2004. A reading above 50 indicates manufacturing is on the rise. February marked the 18th consecutive month the index has indicated growth.

Industrial production rose 1.1% in February after a 0.3% decline in January, according to the Federal Reserve. Manufacturing production increased 1.2%, and mining output rose 4.3%, primarily due to growth in oil and gas extraction.

The Census Bureau reported housing faltered last month with new home construction moving at a seasonally adjusted rate of 1,236,000, a 7% decline from January and 4% lower than the rate seen in February 2017.

Retail sales came in at $492 billion, a 4% rise from February a year ago but down 0.1% from January, according to the Census Bureau.