Tonnage Remains Solid, Takes Breather in March

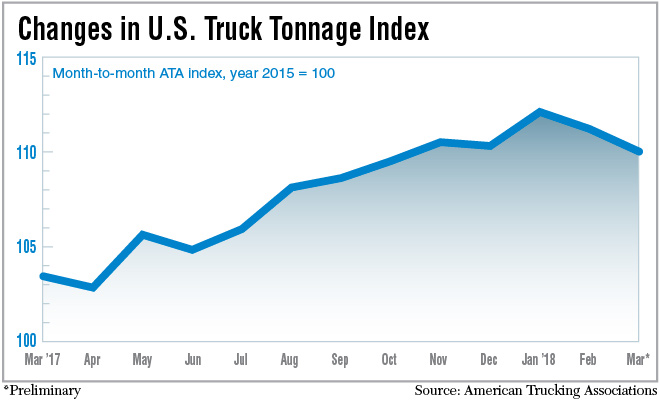

Truck tonnage rose 6.3% in March compared with the same period a year ago, according to American Trucking Associations’ monthly for-hire truck tonnage index.

In the first quarter, the tonnage index rose 7.4% compared with the year-ago period. It increased 0.9% from the fourth quarter of last year.

On a sequential basis, the index declined 1.1% from February 2018 while February was revised to 111.2, down 0.8% from January’s value.

“Despite a softer March and February, truck freight tonnage remains solid as exhibited in the year-over-year increase of 6.3%,” ATA Chief Economist Bob Costello said. “While I expect the pace of growth to continue moderating in the months ahead … the levels of freight will remain good going forward.”

Costello

ATA also tracks a not-seasonally adjusted index, representing the change in tonnage actually hauled by fleets before any adjustment. That index equaled 114.6 in March, a rise of nearly 13% from February. ATA calculates its tonnage indexes based on surveys from its membership.

The continuing rise in tonnage brought a corresponding increase in demand for trucks as evidenced by the 38% jump in activity in DAT Solution’s spot truckload freight availability market in March, said Mark Montague, senior pricing analyst with DAT. Brokers and shippers use the availability market to post their freight loads as they seek trucks.

“This is not scientific, but it’s an indicator of barometric pressure in the market,” Montague said. “This is shippers with freight to move posting again and again [on the DAT load board] to get trucks.”

DAT reported flatbed truck rates rose to a record $2.53 a mile as a national average, 50 cents higher year-over-year. Much of flatbed business is carrying construction or oil field service equipment, hence much of the activity can be tracked in lanes through Texas with its massive natural gas fields.

Montague said warmer weather will mean more construction along with busy farmers bidding up rates for refrigerated trucks as they seek to get seasonal produce to market.

“It should be a wild ride in the second quarter,” he said. “We will continue to see higher rates throughout this year. In the second, half e-commerce will build demand for trucks.”

Continued domestic business growth also was shown in the Cass Freight Index Report for March. St. Louis-based Cass Information Systems breaks the index into two channels, shipments volume and freight shipment expenditures. Cass processes more than $25 billion in annual freight payables.

The shipments volume index in March grew year-over-year nearly 12%, a “percentage increase usually only attained when emerging from a recession, not when competing against already strong statistics,” according to Donald Broughton, founder of equity research firm Broughton Capital and an analyst and commentator for the Cass Indexes.

The expenditures index grew close to 16% in March, “a signal that capacity is tight, demand is strong and shippers are willing to pay up for services to get goods picked up and delivered,” Broughton reports.

National economic indicators for March showed an economy that was going strong.

The Institute for Supply Management found that economic activity in the manufacturing sector grew in March, though at a slower pace than in February. Its manufacturing index registered at a value of 59.3, with any reading above 50 indicating that the manufacturing economy is generally expanding.

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly reported that March housing starts were at a seasonally adjusted annual rate of 1,319,000, nearly 2% higher than the February rate and almost 11% higher than the rate seen in March 2017.

The Census reported March retail sales of $494.6 billion, an increase of 0.6% from February and 4.5% higher than March a year ago. Sales in the first quarter were up 4.1% from the same period in 2017.