Bloomberg News

Tesla Stock Has Never Been This Cheap — And It Could Still Drop Further

[Stay on top of transportation news: Get TTNews in your inbox.]

Tesla Inc. shares are trading at their cheapest ever by at least one measure as the electric vehicle giant grapples with an array of challenges, from waning demand in China to investor concern over billionaire CEO Elon Musk’s priorities.

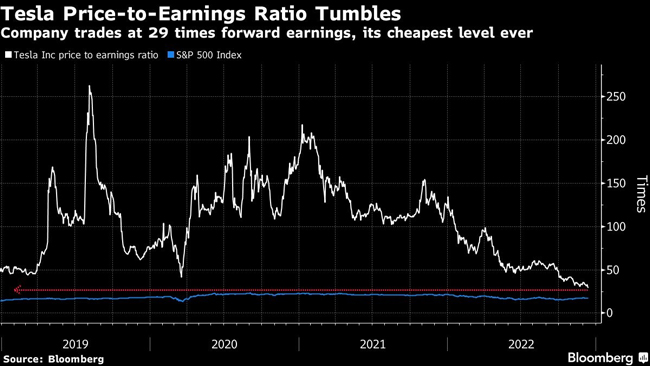

The stock is now trading at 29 times projected earnings, according to data compiled by Bloomberg. While that’s still well above the S&P 500 Index’s 17 times forecast earnings, it’s the lowest since the company went public in 2010. The company’s market value fell below $500 billion for the first time since November 2020 on Dec. 13.

The automaker’s shares face stiff headwinds heading into the new year, market watchers say. Demand in China isn’t meeting expectations, forcing the company to scale back production and slow hiring. What’s more, shareholders are growing increasingly wary that Musk’s takeover of Twitter Inc. is proving a liability for Tesla by limiting his involvement in the company.

“My biggest concern is the slowdown they’re seeing in China,” said Matt Maley, chief market strategist at Miller Tabak + Co., adding that “as long as Elon Musk is spending a lot of time with Twitter, it’s going to keep a lid on the stock.”

Bloomberg reported Dec. 9 that Tesla plans to suspend output in stages at its Shanghai electric car factory from the end of the month until as long as early January, amid production line upgrades and slowing consumer demand.

Meanwhile, Twitter is more than just a distraction. Musk’s bankers are considering replacing some of the high-interest debt he layered on Twitter with new margin loans backed by Tesla, people with knowledge of the matter told Bloomberg.

Tesla shares slumped as much as 5.8% to $158.03 on Dec. 13, touching a fresh two-year low and weighing on fellow EV stocks like Rivian Automotive Inc. and Lucid Group Inc.

“Between the issues with Twitter and the slowdown in demand, Tesla could fall as low as $150 before it becomes attractive to most investors,” Maley said.

— With assistance from Boris Korby.

Want more news? Listen to today's daily briefing below or go here for more info: