Bloomberg News

Target Tempers Strong Q4 With Cautious Forecast

[Stay on top of transportation news: Get TTNews in your inbox.]

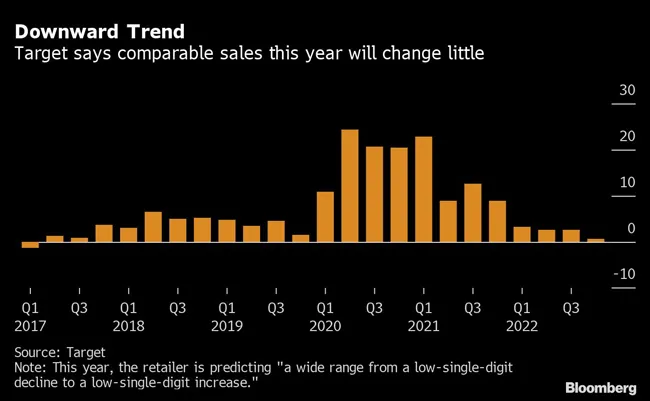

Target Corp. turned in a strong fourth-quarter performance but offered a cautious financial forecast for this year as the retailer contends with shaky demand for discretionary goods.

Adjusted earnings will rise to no more than $8.75 a share in the current fiscal year, the company said in a statement Feb. 28 as it reported financial results. That’s 50 cents lower than the average of analyst estimates compiled by Bloomberg. Target turned a profit of $1.89 a share in the fourth quarter, handily exceeding the $1.48 predicted by Wall Street, and resolved an inventory surge that marred results earlier in the year.

The muted outlook combined with strong recent results echoed the message from Walmart Inc.’s earnings report last week, as U.S. retailers contend with a cloudy sales picture and an uncertain economic backdrop. While Target continues to attract customer traffic, the company faces a long road ahead in its push to rebuild profits after a bonanza early on in the pandemic, when homebound shoppers snapped up household furnishings, appliances and electronics.

“We’re planning our business cautiously in the near term to ensure we remain agile and responsive to the current operating environment,” CEO Brian Cornell said in the statement. “As we plan for the year ahead, we will continue to make robust capital investments and pursue efficiency opportunities in support of our long-term growth.”

The shares rose 2.5% at 9:33 a.m. in New York trading. Target climbed 12% this year through Feb. 27, in line with the gain in an S&P index of U.S. consumer-discretionary companies. The shares plunged 36% last year, Target’s worst annual decline since at least 1981.

Fourth-quarter revenue climbed 1.3% to $31.4 billion, surpassing Wall Street’s projections by almost $1 billion.

In another sign of strength, the Minneapolis-based retailer posted a comparable-sales gain of 0.7%, while analysts had projected a decline of 1.7%. Inventory fell 2.9% to $13.5 billion, a welcome relief after a jump of more than 40% early last year as demand weakened and unwanted merchandise piled up.

Surging inventory forced discounts and reduced profit margins earlier in the year. In the fourth quarter, Target’s stockpile of discretionary merchandise — the epicenter of last year’s woes — fell about 13%.

During last year as a whole, Target said it gained market share in all five of its merchandise categories.

Cornell and other company leaders were scheduled to make a series of presentations to analysts and investors in New York at 9 a.m. on Feb. 28.

Host Mike Freeze speaks with Online Transport's Randy Obermeyer about diagnostics. Hear the program above and at RoadSigns.TTNews.com.

At a similar event a year ago, the company predicted that operating income would reach 8% of revenue in the fiscal year ending in early 2023. The actual operating margin turned out to be 3.5%. Target is predicting a gain in operating income of more than $1 billion this year, which would lift the total to at least $4.8 billion. That implies a margin of a little more than 4% based on analysts’ sales estimates.

Over the next three years, Target said its operating margin would reach and then exceed its pre-pandemic rate of 6%. Indeed, the company said it could attain that level as soon as the fiscal year that ends in early 2025, “depending on the speed of recovery for the economy and consumer demand.”

Target’s outlook was “better than feared,” Rupesh Parikh, an analyst at Oppenheimer & Co., said in a note to clients.

“We believe the elements are clearly now in place for a multiyear profit recovery,” he said.

Want more news? Listen to today's daily briefing below or go here for more info: