Special to Transport Topics

Some Fleets Turn to Cameras to Help Mitigate Rising Insurance Costs

[Stay on top of transportation news: Get TTNews in your inbox.]

Many trucking companies have installed cameras in their vehicles as a way to coach drivers and avoid protracted litigation, but onboard video also can help address rising insurance costs in the transportation industry.

Most insurance companies, for their part, are in favor of their trucking clients deploying video telematics. Theoretically, the existence of onboard cameras should lower premiums, particularly if the recorded event in question exonerates the driver. But whether that actually translates into discounted insurance premiums is another question. In the long run, such insurance breaks will likely occur as insurance companies analyze the data and determine if fleets are utilizing the technology to effectively train drivers.

Meanwhile, nuclear verdicts and expensive settlements in trucking litigation have skyrocketed — a key factor driving up insurance costs.

“These types of settlements are driving our trucking companies out of business, driving insurance rates to levels we’ve never seen in the last decade,” said Jim Angel, vice president of video intelligence solutions at Trimble, which offers an onboard camera system primarily for Class 8 fleets.

Onboard video, however, can provide fleets with liability protection, suppliers said.

A SmartDrive SR4 recorder in and Oakley truck cab. (SmartDrive)

“More often than not, the truck driver is exonerated,” said Jason Palmer, chief operating officer at SmartDrive, which supplies a wide range of video-based safety systems. “It’s really there to protect the driver, and even if they are at fault, they’d want to know about it right away.”

Passenger car drivers are principally at fault in 70% to 75% of fatal car-truck crashes, according to a 2013 report by American Trucking Associations.

“If you take advantage of the odds of truck drivers only being at fault a small minority of the time, then having the right tools is absolutely key,” Angel said.

He said this can translate to lower insurance deductibles because companies are able to win the majority of litigation battles and not pay out as many false claims as they had in the past.

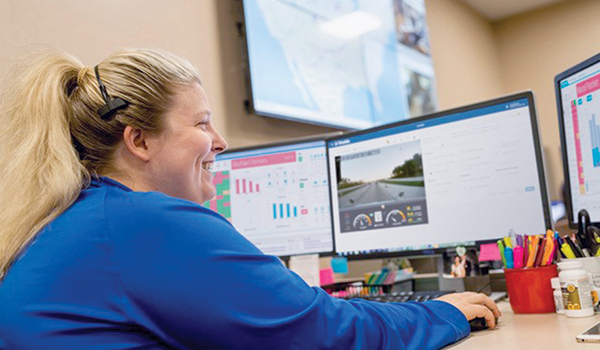

A back-office employee reviews a video recording from a forward-facing camera. (Trimble)

Onboard cameras have become much more common in trucks, almost an expectation. If a collision between a truck driver and passenger vehicle results in litigation, fleets that have not implemented video systems then have to defend that decision, Palmer said.

“Paying for claims and damages that are the fault of the trucker is not really the issue. No one is trying to dodge legitimate liability, but we’re trying to isolate that legitimate liability as compared to frivolous litigations, claims that have no foundation, and the camera certainly helps us to do that,” added Bob Fuller, agency president of AssuredPartners/Fleet Risk Management, an insurance company focused on the transportation industry.

Two years ago, KKW Trucking, headquartered in Pomona, Calif., installed forward-facing cameras in its 400-truck fleet, primarily because of the litigious environment in the trucking industry.

“We wanted to capture what really occurred. From our perspective, we’re going to mitigate liability in many cases completely where we captured an accurate account of an event that was not absolutely 100% our fault, and the other piece is, if we did have some fault, we want to be able to have an accurate account of what occurred and be able to address it as quickly and as cost efficiently as possible,” said Brandon Krueger, senior director of IT and fleet services.

“While our insurance company was happy for us to have it because they recognized the potential help for liability circumstances, it really never produced a premium discount or subsidy of any kind for us,” he added.

Still, Krueger said the cameras already have helped mitigate claims.

“We feel it has been worth the investment,” he said. “In most cases, it has proven that we were not at fault.”

Kevin Parker, a fleet manager at Dana Cos., said his company started installing video systems last fall. The technology is still new, though, so it has not had an impact on insurance premiums yet.

“Because we’re still providing them with evidence, they want to see a curve in chargeable claims. I don’t expect anything to change with our insurance until it is time to review premiums,” he said.

Feldstein

Lytx, another supplier of onboard cameras and video-based safety systems, has been working with insurance companies for a decade, said Eliot Feldstein, senior vice president for corporate development.

“They have realized early on that once they write a liability policy for a trucking company, it’s in their economic interest to make sure the trucking companies have the lowest collisions and the best performance they can,” Feldstein said.

In his experience, insurance companies will generally give discounts on premiums to those fleets that have installed Lytx systems.

“A safer fleet with a better track record gets better insurance pricing. They’re a better risk when they go out and look for insurance, and we are able to formalize that with a variety of insurance companies,” Feldstein said.

He added that some insurers will even subsidize the cost of his company’s system, shouldering the load because they know that video evidence can be very impactful. And it’s not just about price, but having insight to deliver services better, along with helping to adjudicate and settle claims more quickly. But fleets have to utilize the data they obtain from a telematics system in a meaningful way in order for everyone to reap the benefits.

A driver-coach incorporates video captured by the Lytx system into a training session. (Lytx)

The ability to address unsafe driving behaviors is undoubtedly important for all parties. Not only are drivers involved in collisions being exonerated more often than not, but it creates opportunities for coaching; this is what insurance companies want to see.

“It makes drivers more conscientious of driving skills when they realize the potential for what they’re doing to be recorded. It can be a great training tool if it is implemented properly,” Fuller said.

“The telematics will allow an intervention on an unsafe behavior much earlier, which translates into lower insurance costs and a more efficient operation,” he added.

Many companies proactively integrate the data into formal safety programs.

“We have a SmartDrive-managed service team of highly trained driving analysts that objectively review and score driving events, which are incorporated into a driving performance profile,” Palmer said. “This is an essential component of the SmartDrive safety program that typically results in 50% to 70% reduction in collisions, which is a significant portion of cost savings.”

Host Seth Clevenger speaks with Mike Perkins and Derrick Loo, test drivers at Peloton Technology, one of the companies at the forefront of developing truck platooning systems. Hear a snippet, above, and get the full program by going to RoadSigns.TTNews.com.

Parker plans to extract videos from the dash cams for training purposes in the company’s school for new hires.

“We’re using recent material that was defensible, and in a couple of cases showing where our driver made poor decisions; we can use that to educate new drivers,” he said.

Todd Reiser, vice president at risk management firm Lockton Cos., said insurance providers want to know that the client is utilizing the data to train drivers.

“That the camera footage and data is being reviewed and utilized and being part of the training process on an ongoing basis is the most important thing insurance companies want to see,” he said.

KKW’s Krueger agreed.

“If you’re seeing these events you wouldn’t otherwise see that create coachable events — you’re coaching against risky behavior — that will theoretically result in lower events per miles driven, and it’s that claims experience the insurance company is looking for and what they’re basing their premiums on,” he said.

Grant

Insurance firm Sentry has an affiliation with one of the large camera providers, said Dan Grant, corporate director of safety services.

“We’ve been actively promoting the video telematics as a solution to basically improve the drivers that are behind the wheel. That is what the technology is for — capturing observed behaviors of drivers, and then have some type of intervention with the driver,” Grant said.

Still, his company does not directly align a premium discount with cameras.

“We like to see companies that are actively administering a good safety program based around the cameras, so just having cameras doesn’t indicate it’s a better risk. We need to see how well they’re performing. Are they holding drivers accountable? Do they have training? We’re trying to gather as much information as we can, which builds into the overall risk picture and the underwriting of that particular account,” Grant said.

In fact, his company conducted an internal study to determine if fleets that installed video telematics perform better.

“We found there was a measurable reduction in claim frequency for the group that had video telematics, a benefit to us as their carrier, reporting less claims and having less severe claims, but also a benefit to the company as well,” Grant said.

Another benefit, said Fuller, is the ability to process claims quickly and efficiently rather than slogging through litigation.

“If it is the trucking company’s fault, we want to pay the claim. And if not, which we find to be the case so often with the video available, we want to get that out and get that to the plaintiff’s attorney and shut this litigation down as quickly as possible,” he said.

Trimble’s Angel added that video analytics give the carrier a snapshot into predicting risk by looking at all the data, including overall driving performance. He said insurance companies love having the data available and that it gives them an opportunity to process claims more quickly.

Angel

“But what you don’t hear them talking about is the dollar amount that has been reduced in total amount of claims. I’d like to see more of an active role played by insurance companies and providing larger discounts to trucking companies,” Angel said.

Video intelligence is almost always viewed favorably by the insurance carrier, with some insurance companies even subsidizing or supplementing the cost of deploying the technology. There are usually expectations with shared cost programs, with performance indicators that they have to meet.

Sentry had a subsidy program but moved away from it, though Grant said it is still a very common practice in the trucking insurance space.

“Some will underwrite the cost, typically the cost of monitoring but sometimes the cost of purchasing the units, though generally it’s an underwriting consideration, not an enumerated discount,” Fleet Risk Management’s Fuller said.

Grant said that while a video program is not required, it is indeed a plus.

“That shows us that the company is being proactive from a risk management standpoint. It’s an underwriting consideration — we’ll look at it as part of the overall profile for a particular trucking company. If they’re having good experience with the program, it will reduce their loss frequency and will make it more likely to see lower rates than companies that don’t have that,” he said.

Adopting video telematics may not drive down the cost of insurance at the outset, but is likely to happen after the system has been in place, and the insurance companies see that the fleets are utilizing the data to coach drivers.

“Most are going to wait for the reduction in claims that we believe will follow implementation of the cameras to show up in the loss history for the carrier. If we see improvement in the loss history, that will drive down cost of insurance,” Fuller said.

Want more news? Listen to today's daily briefing: