AI, Edge Computing Are Shaping the Future of Fleet Telematics

[Stay on top of transportation news: Get TTNews in your inbox.]

With modern trucks and in-cab technology now generating vast amounts of data, fleet telematics providers are beginning to harness artificial intelligence to transform that information into valuable business insights so trucking fleets can become more efficient and productive.

Industry technology vendors envision AI unlocking new ways to automate mundane tasks, support better business decisions, improve driver satisfaction and enhance safety and regulatory compliance.

“Much of what drives a trucking operation today is highly dependent on human-to-human interaction — for example, a dispatcher to driver and vice versa,” said Grant Gardner, a senior vice president at Solera, the parent of Omnitracs, Spireon, SmartDrive and several other transportation technology brands.

With AI coming front and center, telematics will begin to automate some share of day-to-day operations, Gardner said. “This will enable operators and staff to focus less on administrative tasks and more on predictive risk management.”

Fleet management and telematics technology continue to move toward a more intuitive and user-friendly experience for the driver, with the ultimate goal being that very little or no training is required for use, said Paul Cardosi, sector vice president of global mobility at Trimble.

He also anticipates additional use of voice commands, biometrics and heads-up displays, “all in the name of maintaining security, simplifying the experience for the driver and keeping the driver focused on the road and not an [electronic logging device].”

Telematics systems also could monitor driver health on the road, promote a healthy lifestyle and issue alerts when drivers have a medical issue, Cardosi added.

AI data analysis could even detect a possible change in a driver’s mindset or attitude, some technology vendors said.

DeLarochelliere

“I believe this year is the year we’ll see an impact of AI on the bottom line of trucking companies,” said Isaac Instruments CEO and co-founder Jacques DeLarochelliere.

Drivers’ general well-being is one area where AI can make a difference in an industry that has long struggled with driver recruiting and high turnover rates.

“We want to know if the driver is unhappy, frustrated, dissatisfied,” DeLarochelliere said.

Clues to a driver’s state can be gleaned by analyzing data showing the ups and downs he or she encounters, such as traffic conditions, road construction, wait time, hours-of-service limitations, mileage for the week and resulting paycheck.

Telematics data also shows how a driver responds to dispatch, and how long it takes a driver to respond, DeLarochelliere said.

“With all of this data crunched together … we’re in a position to say, ‘This man or this woman is likely to leave the job,’ ” DeLarochelliere said. “You and I could do a big analysis of one driver, sit down and crunch the information and maybe come to some sort of conclusion that would be close to that. But we would not be able to do it in real time, all the time, on all the drivers, and have the conclusion quick enough to go make an intervention.”

Franchetti

The expansion of AI will create a greater emphasis on data management, said Stephen Franchetti, chief information officer at Samsara.

“There’s no denying that AI will continue to increase efficiency, accuracy and overall business agility in 2024,” he said. “With this, we’ll start to see an increased need for a robust foundation of reliable and well-governed enterprise data.”

The quality and accessibility of enterprise data can affect a fleet’s ability to assess large data sets in real time, stay competitive, eliminate bias and allow time for innovation, he said.

Eliminating bias requires accurate, comprehensive data. If an AI model for predictive maintenance is trained on comprehensive data that includes a wide range of vehicle types, operating conditions and maintenance histories, it is more likely to accurately predict maintenance needs across the entire fleet, Franchetti explained.

Akinyemi Koyi, president of ERoad’s North American business, said AI can enable predictive analytics covering a range of fleet management issues, including “foreseeing maintenance needs, suggesting personalized driver training programs and adapting routes in real time,” all of which can result in cost reductions, heightened operational efficiency, “and an elevated standard of safety across fleet operations.”

Zonar Systems CEO Michael Gould said his company is working on a way to evaluate tire treads with “computer vision” — using AI to process digital images and videos and extract information for fleet decision-making.

More Connected Fleet Operations

The industrywide implementation of ELDs starting in late 2017 triggered fleet adoption of “holistic vehicle telematics frameworks” that bundle regulatory compliance tools, GPS tracking, fleet management solutions, vehicle diagnostics, safety and risk management and last-mile route optimization, Solera’s Gardner said.

The ability to ingest and analyze that vehicle data will be enhanced using AI, leading to opportunities for equipment optimization, he said.

Telematics providers will be able to provide “predictive and prescriptive business intelligence” through analysis of historical data, such as a specific tractor make, model and year with a history of mechanical failures at specific mileage points, Gardner said.

Cardosi

Trimble envisions telematics and fleet management technology as part of a “broader connected transportation ecosystem — where the majority of heavy-duty trucks in North America are connected in real time to a central platform,” Cardosi said.

He offered as an example Trimble’s Transportation Cloud. A central platform will enable “continuous, real-time position updates and communication on a wide range of parameters — including truck stop parking, weather updates and terminal dwell times with the goal of further promoting safety, compliance and efficiency for fleets,” Cardosi said.

The sheer amount of trucking telematics data continues to expand.

White

Telematics provider Geotab connects 4.1 million vehicles today, compared with about 460,000 just seven years ago, said Stephen White, Geotab’s associate vice president of enterprise sales.

“We’re collecting a little over 60 billion data points a day,” he said. At the same time, “consumption” — data collection and analysis — is rising dramatically among some fleets, “especially the mega fleets,” White said.

Some trucking companies are “running on the data they’re able to consume, digest and analyze from Geotab,” White said.

When technology companies began offering data storage and processing “in the cloud” — on remote servers rather than on-premises data centers — some fleets were wary. They expressed concern that they were relinquishing control of proprietary data. That concern persists today, White said, adding that privacy “comes up a lot.”

Geotab’s open platform allows fleet users to download data into their own cloud or hard drives, and a small, growing number do, because they want to archive historical data or analyze it for results they consider proprietary, White said.

The Growth of Edge Computing

Telematics companies said “edge computing” — the shift of computing and data processing away from the back office toward the truck — has the potential to offer faster, more consistent data processing and in turn support operational decisions and decrease some costs.

Koyi

Edge computing also minimizes disruptions due to cellular connectivity, “quickens resolution [of] in-field challenges and eliminates the need for constant cloud communication — resulting in quicker data processing,” Solera’s Gardner said.

Edge computing also has the potential to reduce communication costs through lower data transfer fees, Gardner added.

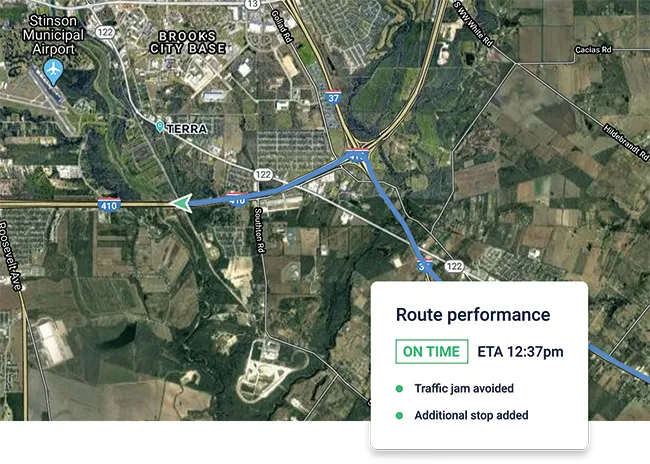

Dynamic decision-making can happen midtrip with advanced edge computing, Trimble’s Cardosi said.

For example, a fleet could make an almost instant decision to reroute a truck to a new pickup based on real-time information on dwell time, Cardosi said. With Trimble’s in-cab technology, the process would engage computing power on the mobile gateway and tablet in the truck and would be less reliant on latent communication from the back office, he noted.

With a focus on real-time data analysis and feedback to drivers, edge computing can address issues related to latency, ERoad’s Koyi said. It can also facilitate trucking’s integration with the internet of things, or IoT, Koyi said, “fostering an interconnected and intelligent ecosystem.”

The Future of Telematics Hardware

Telematics vendors’ enthusiasm for the hardware side of the business varies from one company to the next.

Zonar’s Gould said his company continues to see a strong market for the telematics control units it installs in customers’ vehicles.

Others envision a shift toward more telematics hardware built into the vehicle by truck manufacturers.

“Telematics companies are software companies. We wish the hardware was part of the truck,” DeLarochelliere of Isaac Instruments said.

Some technology vendors envision more telematics hardware and onboard cameras being built into trucks in the years ahead. (Isaac Instruments)

The same is true of camera systems, he added. Isaac Instruments last fall announced an enhanced version of Isaac InView, its video camera and data recording system that includes a road-facing and optional side- and driver-facing cameras.

Still, DeLarochelliere said he hoped that truck makers eventually will replace side mirrors with camera systems.

“I see cameras provided by the truck OEMs” that connect to telematics systems, he said.

Koyi of ERoad said truck makers “are pivotal” to integrating more video cameras directly into trucks.

“This aligns with the broader trend of embedding advanced technologies within vehicles,” he observed.

Trimble’s Video Intelligence technology currently leverages AI to monitor and alert at-risk driving behaviors, “but we believe that this will continue to advance, with more sophisticated alerting and deeper analysis of driving behaviors, ultimately leading to safer driving and better accident risk predictions,” Cardosi said.

Asked whether traditional fixed-mount displays will cede the in-cab space to a combination of driver mobile devices and factory-installed displays, some telematics vendors answered in the affirmative while citing hurdles for truck OEMs.

Johnson

“Eventually we’ll get to that point,” said Gary Johnson, head of safety and compliance at Motive.

For today’s telematics systems, “the sophistication of the design and the ease of user experience took years to develop, years to design,” he emphasized.

Motive and other vendors already “work a lot with the OEMs to better provide streamlined processes,” Johnson pointed out. More of that kind of partnership would be needed, he said.

Cardosi said Trimble envisions a hybrid model that combines an in-cab tablet, mobile device and the factory-installed display, “with none of these interfaces necessarily having dominance over one another.”

Factory-installed displays can enable the driver to interact with the software through controls on the steering wheel. Meanwhile, detachable in-cab tablets enable automation and data capture outside the truck and in the yard for electronic vehicle inspections. And drivers can use companion apps on their mobile devices for a variety of functions.

Electric Vehicle Telematics

As electric-powered vehicles begin to enter the transportation industry, telematics systems will play a part in those rollouts, vendors said.

Fleets can improve route planning by analyzing data, such as vehicle location, traffic and weather conditions. (Samsara)

Philip van der Wilt, Samsara’s vice president for Europe, the Middle East and Africa, said fleets will continue to be challenged by uncertainty surrounding electrification and the need to “double down” on fuel efficiency.

van der Wilt

“Businesses are waking up to the fact that it’s not petrol, diesel or electricity that powers fleets — it’s data,” Van der Wilt said. “Organizations that have already invested in connected data platforms are better able to identify which routes, vehicles and tasks are best suited to the electrification of their fleets.”

Trimble expects to see additional data points such as electric vehicle monitoring based on charge, weight of load and ambient temperature, as well as charging locations along the route, Cardosi said.

Zonar’s Gould noted that the performance characteristics of electric trucks differ from those of diesel-powered vehicles.

“There is a different set of data that we capture from EVs that is required in order to give insights to that operator about what’s happening,” he said.

He added that fleets will have, “for a long time,” some internal combustion trucks and some EVs, as well as trucks built by more than one manufacturer.

“The telematics community has to be conscious of that and be able to provide value [for] heterogeneous fleets,” Gould said. “Part of the value proposition of a company like ours is aggregating data from various brands and making sense of that for a fleet operator.”

Want more news? Listen to today's daily briefing below or go here for more info: